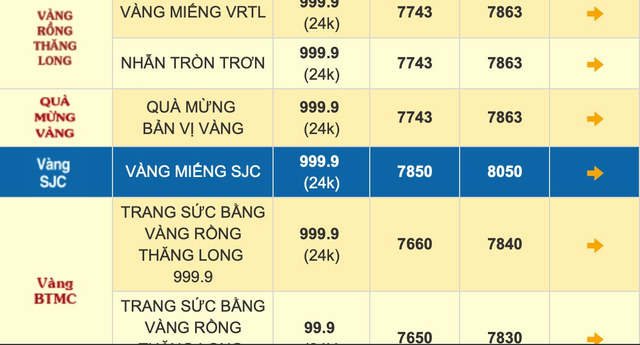

Gold bar and gold jewelry prices remain stable, with gold bars listed at 78.5 million VND per tael for buyers and 80.5 million VND per tael for sellers.

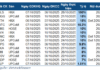

There were no significant changes in gold ring prices today, with selling prices averaging 78.6 million VND per tael. Meanwhile, buying prices varied by about 150,000 VND per tael among brands, ranging from 77.2 to 77.45 million VND per tael.

Specifically, SJC Company is listing gold ring prices at 77.3-78.6 million VND per tael. DOJI Group is offering 77.45-78.6 million VND per tael. Bao Tin Minh Chau’s prices are 77.43-78.63 million VND per tael, unchanged from yesterday. PNJ, on the other hand, decreased their prices by 200,000 VND per tael compared to the previous day, now listing at 77.2-78.4 million VND per tael.

In the international market, the spot gold price dropped sharply, falling below the 2,500 USD/ounce mark. As of 9:30 am, gold was trading at 2,498 USD/ounce, equivalent to about 75 million VND per tael when converted at the current VND/USD exchange rate, excluding taxes and fees.

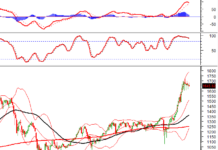

The precious metal is currently trading within a narrow range, fluctuating between the support level of 2,500 USD and the resistance level of 2,560 USD. This consolidation phase is particularly notable, as the 2,560 USD mark is a significant barrier to the next upward movement.

Recent economic data has played a crucial role in shaping the behavior of the gold market. The latest non-farm payroll report from the US Labor Department, a key indicator closely monitored by the Federal Reserve (Fed), fell short of expectations. While economists had predicted an addition of 160,000 new jobs in August, the actual number turned out to be 142,000. This holds significant implications for monetary policy decisions.

The unemployment rate slightly decreased from 4.3% to 4.2%, but it remains high compared to the 3.8% rate recorded a year ago. The total number of unemployed individuals has increased from 6.3 million to 7.1 million in the past year, indicating ongoing challenges in the US labor market.

The labor market data, coupled with the recent Consumer Price Index (CPI) report showing inflation at its lowest level in three years, have bolstered expectations of an imminent Fed rate cut. This expectation was further fueled by Fed Chairman Jerome Powell’s statement at Jackson Hole on August 24, where he noted that “it’s time for policy to go back to its longer-run settings.” The anticipation of a rate cut has supported gold’s record high of 2,560 USD/ounce on August 16. Now, the precious metal awaits new catalysts or favorable economic data to break out of the 2,500-2,560 USD range.

The Golden Opportunity: Unveiling the Latest SJC Gold Prices and Beyond

The morning of September 6th saw SJC gold prices remain static from the previous day, with buy and sell rates fixed at 78.5 and 80.5 million VND per tael, respectively.