The concept of green banking is integral to sustainable development, and Vietnamese banks are increasingly embracing ESG (Environmental, Social, and Governance) principles, with a particular focus on green initiatives. In this regard, we interviewed experts from RMIT University Vietnam to gain insights into the global and local landscape of green banking.

A Global Perspective on Green Banking and Its Measurement

Interviewer: Can you provide an overview of the current trends in ESG globally?

Dr. Pham Nguyen Anh Huy, Senior Lecturer in Finance, School of Business, RMIT University Vietnam: ESG has evolved from a niche concept to a mainstream requirement for companies of all sizes. Most large corporations worldwide have reported on ESG, and small and medium-sized enterprises are also making relevant disclosures. In Europe, the Corporate Sustainability Reporting Directive (CSRD) will enforce stricter climate-related disclosure requirements from 2024. This shift towards mandatory compliance is expected to reshape business strategies, encouraging companies to integrate ESG factors into their core operations rather than treating them as peripheral issues.

Countries in Asia, such as South Korea, India, and China, are also mandating ESG disclosures for listed companies. However, as ESG activities gain traction, companies must navigate challenges, including allegations of “greenwashing,” where they exaggerate or misrepresent their sustainability efforts. With increased ESG scrutiny, organizations must ensure their ESG statements are substantiated by tangible actions and transparent reporting.

Interviewer: Green banking is a component of ESG. How are banks globally implementing green banking, and are there specific metrics to measure it?

Dr. Dao Le Trang Anh – Lecturer in Finance, School of Business, RMIT University Vietnam: According to the International Finance Corporation (IFC), green banking involves “combining the reduction of a bank’s direct environmental impact with environmental and social risk management in decision-making, while supporting environmentally and socially beneficial enterprises and industries.”

Banks worldwide are implementing green banking through a range of specific measures. Firstly, they are committing to carbon emission reduction and supporting environmentally friendly projects. This includes adopting renewable energy, undergoing green revolutions within their operations, and encouraging and financing enterprises in clean technology, renewable energy, and sustainable projects. Additionally, some banks are engaging in international cooperation programs to promote higher environmental and social standards in the financial sector. Notable examples of green banks globally include the New York Green Bank, DC Green Bank (USA), Industrial and Commercial Bank of China (ICBC), and Mizuho Bank (Japan), among others.

In terms of measurement, green banks typically assess their performance based on ESG standards, including carbon emission measurements, the utilization of renewable energy, and the proportion of sustainable projects they finance. Furthermore, international standards such as those set by the Sustainable Banking Network (https://www.sbfnetwork.org/), with IFC as the secretariat and knowledge advisory partner, are also commonly used to gauge the effectiveness of green banking.

Vietnam has made significant strides

Dr. Dao Le Trang Anh

What is your assessment of the current state of green banking in Vietnam?

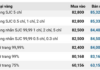

Dr. Dao Le Trang Anh: Green banking in Vietnam has made notable progress, with a significant milestone being the issuance of Decision No. 1658/QD-TTg by the Prime Minister on October 1, 2021, approving the National Green Growth Strategy for 2021-2030. This decision has opened up opportunities for the development of the green capital market. Vietnamese banks have also formulated specific strategies to promote green banking. As of March 31, 2024, 47 credit institutions have engaged in green credit activities, with a total outstanding balance of nearly VND 637 trillion, accounting for approximately 4.5% of the economy’s total outstanding credit. This funding is primarily directed towards renewable energy sectors (nearly 45%) and green agriculture (nearly 30%).

However, several challenges persist in Vietnam’s green banking landscape. Specifically, businesses and financial institutions face obstacles in identifying and evaluating green projects due to the lack of a clear classification system. Moreover, the cost of issuing green financial products remains higher than that of traditional products, while incentives are not yet well-defined. Long-term capital, crucial for large-scale energy transition and clean technology projects, is also difficult to access. Notably, the lack of experience in developing green projects is a significant challenge that needs to be addressed. Therefore, the banking system requires robust reforms, from developing specific green credit products to enhancing long-term capital sources, to meet the financial needs of green projects and foster sustainable development.

When it comes to green banking, the focus in Vietnam has primarily been on environmental protection and providing credit for green projects. However, a strong push towards digital banking/digitization is also a form of “greening.” What are your thoughts on this?

Dr. Dao Le Trang Anh: In my view, digital banking and digitization play a crucial role in promoting green banking. Digitization significantly reduces the use of physical resources, such as paper, and saves energy by minimizing the need for travel and physical transactions. Services like electronic payments, online credit, and digital account opening not only enhance the efficiency of banking operations but also benefit users by saving time, reducing costs, and lowering carbon emissions. Furthermore, they facilitate the widespread adoption of green financial services. Thus, digital banking is not just a technological solution for modernizing the banking system but also a powerful tool in building and advancing sustainable development.

Benefits for Vietnamese Banks Embracing Green Banking

What should Vietnamese banks focus on to become truly green banks?

Dr. Pham Nguyen Anh Huy: Vietnamese banks should concentrate on developing green credit products and providing financial support for environmentally friendly projects in areas like renewable energy, energy-efficient construction, and sustainable production. This will not only reduce environmental impact but also create new business opportunities for banks.

Dr. Pham Nguyen Anh Huy

As mentioned earlier, 47 credit institutions are engaged in green credit activities, accounting for only about 4.5% of the total outstanding credit in the economy. Therefore, there is significant potential for growth in green credit in Vietnam.

Additionally, banks should implement internal greening measures, such as establishing paperless offices, utilizing energy-efficient technologies, and reducing carbon emissions. The adoption of digital technologies in transactions also helps reduce resource consumption and improve operational efficiency.

How will green banking benefit the development of individual banks and the Vietnamese banking system as a whole in the future?

Dr. Pham Nguyen Anh Huy: Green banking enables banks to embrace sustainable development by financing environmentally friendly projects. This not only supports a green economy but also creates new opportunities for banks to expand their green product and service portfolios.

Moreover, green banking enhances banks’ brand image. By committing to green banking practices, banks can elevate their image and reputation among customers and the community. Green banks can attract environmentally conscious customers, thereby increasing their customer base and revenue.

Green banking also encourages banks to adopt new technologies and improve work processes, leading to enhanced operational efficiency and cost reduction. Additionally, the transition to digital banking services and the reduction of paper usage contribute to more efficient and sustainable banking operations.

We appreciate the insights provided by the experts!

Better Choice Awards 2024

The Better Choice Awards recognize and celebrate innovation that delivers tangible benefits to consumers. It is organized by the National Innovation Center in collaboration with VCCorp JSC, under the guidance of the Ministry of Planning and Investment. The awards comprise three main categories: Smart Choice Awards, Car Choice Awards, and Innovative Choice Awards.

In 2024, the Innovative Choice Awards expanded to include Smart Home, Fashion, Transportation Services, and, notably, Finance and Banking. The award criteria were developed in collaboration with PwC Vietnam.

Nominations are now open through the website: https://betterchoice.vn/. The official announcement and voting will commence on September 9, 2024, following a press conference at the headquarters of the Ministry of Planning and Investment, 6B Hoang Dieu.

The Future of Hanoi’s Land Subdivision: 50m2 Minimum Lot Size and Its Implications

The proposed increase in the minimum land parcel size to 50sqm in Hanoi is a contentious issue. While experts argue that it will curb the rampant practice of land subdivision and sale, it is crucial to thoroughly consider the potential impact on the citizens. This decision has far-reaching consequences, and a delicate balance must be struck to ensure the well-being of all stakeholders involved.