Rebound After a Dark Tuesday

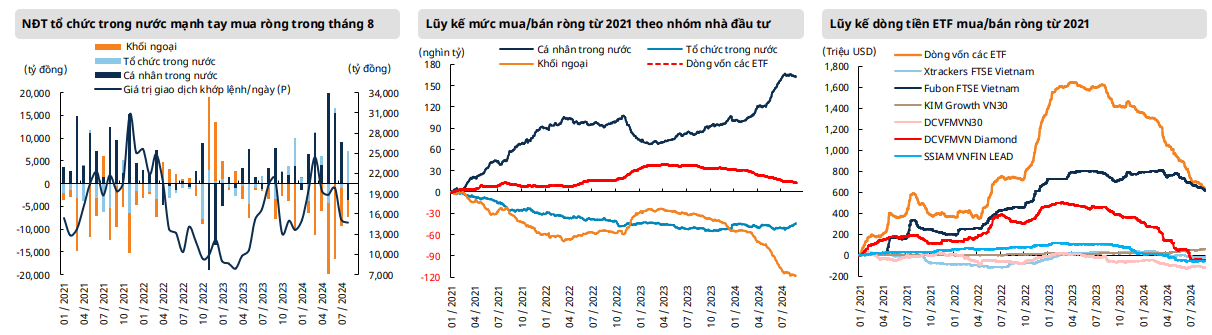

The Vietnamese stock market rebounded after a dark Tuesday on 05/08, with the recovery somewhat in line with the overall global market trends. At the end of August, the VN-Index closed at 1,283.87, an increase of over 32 points compared to the end of July, especially with a consecutive 3-week gaining streak.

Source: MAS September 2024 Macro and Strategic Report

|

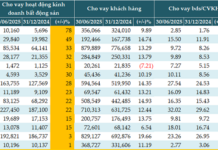

It is noteworthy that investor caution may not have improved significantly in August, with the average matched transaction value continuing to decrease by 3% from the low base in July. It recorded the lowest level since December 2023, with over 14.7 thousand billion VND per session.

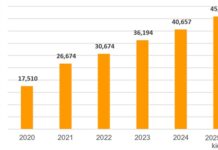

From another perspective, ETFs witnessed net outflows for the 10th consecutive month, with a total net outflow of 62 million USD in August. This brought the net outflow since the beginning of the year to 724 million USD as of August 30. However, this was also the lowest net outflow since March 2024.

Source: MAS September 2024 Macro and Strategic Report

|

Cautious About the Turning Point in Monetary Policy

As we move into September and look ahead to the remaining months of 2024, MAS believes that the market will continue to receive mixed news regarding the overall growth prospects of major economies in the region and specifically for Vietnam.

The market will continue to seek new narratives to drive growth as the story of an upgrade may once again be delayed in the FTSE’s September 2024 evaluation report. The final drafts of amendments to laws related to securities trading and brokerage to meet the remaining criteria for the upgrade have just been approved and are pending the National Assembly session in October.

With the current timeline for amendments, the most promising expectation for an upgrade evaluation is September 2025. This is considering that the implementation and actual operation will require time for verification, making necessary changes to assess the effectiveness of policy changes, and applying the new trading system.

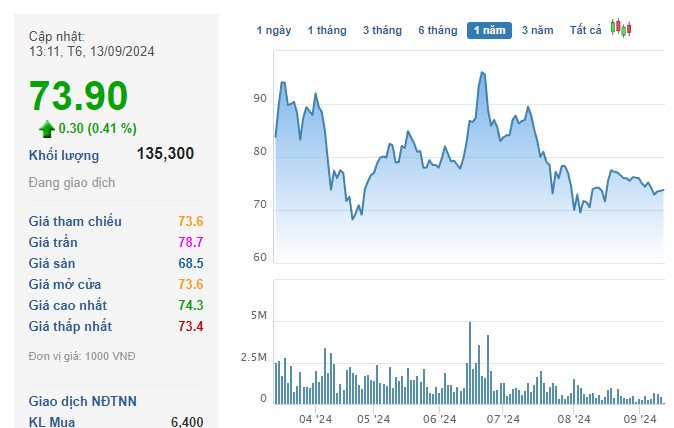

On the other hand, the lack of clear growth drivers and the not-so-optimistic performance of many large-cap stocks may cause the market to experience unexpected volatile sessions more frequently, as seen in the past six months with mostly sideways trading within a large range of 1,200 – 1,280 points.

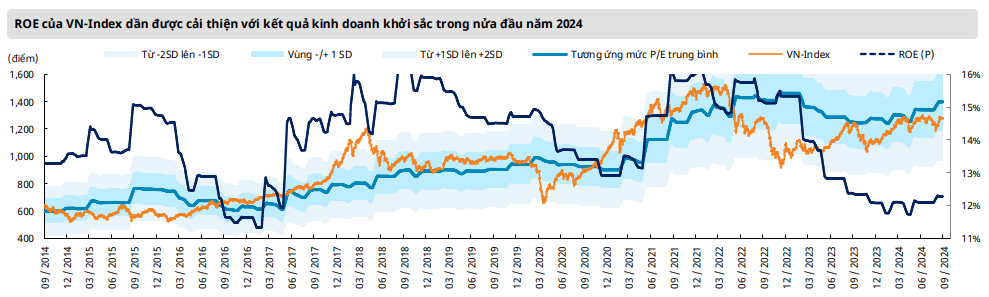

In the medium to long term, MAS believes that there is insufficient data to conclude that the market will soon enter a trend reversal phase, and the VN-Index is likely to continue aiming for the psychological milestone of 1,300 points. This is because the VN-Index‘s P/E ratio remains relatively attractive when trading below the 10-year average. However, fluctuations may occur when profit-taking sentiment increases as the VN-Index surpasses the psychological resistance level, and this trend could continue until it successfully conquers the 1,330-point mark.

Nevertheless, MAS also believes that short-term risks remain as the VN-Index tends to return to equilibrium after a 3-week gaining streak and head towards the support range of 1,240 – 1,250 points.

Source: MAS September 2024 Macro and Strategic Report

|