In addition to the above solution, in response to voters in some provinces and cities regarding this issue last week, the SBV stated that it has directed its local branches to coordinate with relevant authorities to enhance monitoring, inspection, and supervision of gold business activities. They are also required to ensure that credit institutions and enterprises licensed for gold bullion trading comply with legal provisions on gold trading and adhere to invoice and voucher regulations as stipulated by law.

Furthermore, the SBV has requested the Ministry of Public Security, the Ministry of Industry and Trade, and the Ministry of Finance to strengthen inspection, supervision, and monitoring. They will also strictly handle violations such as gold smuggling across borders, market manipulation, and profiteering, which cause instability in the gold market. Close coordination with management agencies and media outlets is also emphasized to ensure timely communication and sharing of information regarding policies and management directions.

With the synchronous solutions implemented by the SBV and the effective coordination of relevant agencies, the gap between domestic SJC gold bar prices and international gold prices has narrowed significantly. As of September 7, 2024, according to Kitco, the spot price of gold was $2,496.12 per ounce, a decrease of $20.71 per ounce from the previous session. When converted at the current exchange rate of Vietcombank, the price of SJC gold bars was only about VND 5.3 million higher than the international gold price, a much lower difference compared to the middle of the year when the gap reached nearly VND 20 million per tael.

It is also encouraging that, despite the global gold price surge to unprecedented levels of over $2,500 per ounce, the domestic gold market remained stable, without the previous rush to buy gold.

Industry experts attribute the calm in the domestic gold market, despite global gold price fluctuations, to the SBV’s resolute management. They particularly highlight the clear and strong measures taken by the SBV, including gold sales to four state-owned commercial banks and SJC, which stabilized the domestic gold market and prevented prices from following the upward trend of world gold prices. This has strengthened the confidence of enterprises and people in the management policies of the authorities. In fact, investors have also become more cautious about this investment channel, which inherently carries high risks.

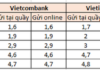

Delving deeper into the risks associated with gold investment, finance expert Phan Dũng Khánh points out that when purchasing gold, buyers immediately incur a loss of about VND 2 million per tael due to the buy-sell spread, and this loss can sometimes be higher. The money invested in gold is considered dead capital as it does not generate returns. Investors can only wait for the price to rise to make a profit, but in terms of short and medium-term investment probabilities, the chances of earning higher returns than bank deposits are not significant. Considering gold investment for the long term, a horizon of at least three years may be worth examining.

“In my opinion,” Mr. Khanh advises, “gold buyers at this time are likely to be more concerned about the significant potential for losses. If an investment causes anxiety about losses and the probability of high profits is low, depositing money in a bank is a safer option with a predetermined interest rate.”

From a management perspective, the SBV stated that to ensure the goal of stabilizing the gold market, in the coming time, it will continue to implement necessary measures in accordance with regulations to control the gap between domestic and world gold prices at an appropriate level as directed by the competent authorities. The SBV will also continue to coordinate with relevant ministries and branches to vigorously inspect and supervise the gold market, gold business activities, and gold bar distribution and trading outlets.

“In the coming time, the SBV will organize a summary and propose an early amendment of Decree 24/2012, including content on gold bar production management, to perfect the legal framework for gold business management. This will ensure adherence to the guidelines and policies of the Party and the Government’s and Prime Minister’s directions on gold market management, while also taking into account practical situations and selectively learning from international experiences, especially from countries with similar business environments and political regimes,” the SBV added.

The Commodities Rundown: Oil, Copper, Aluminum, Steel, and Rubber Rally, While Gold Holds Steady

As of the market close on September 9th, commodities were mostly on the rise, with oil, copper, aluminum, steel, rubber, and coffee futures all posting gains. Gold prices held steady, while natural gas in the US fell.