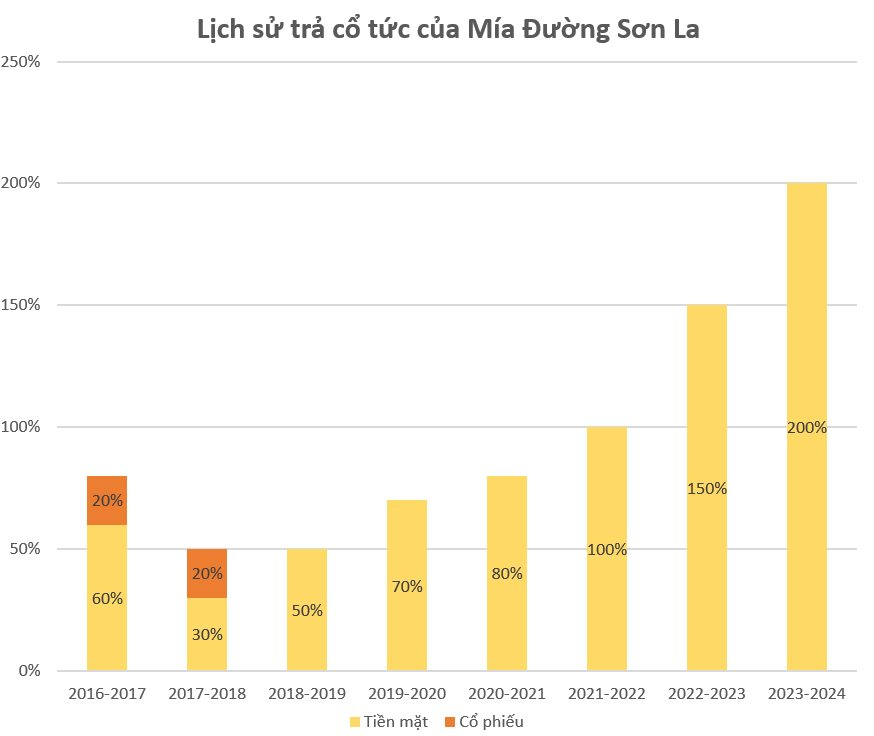

Son La Sugar Joint Stock Company (stock code: SLS) announced the minutes of the Annual General Meeting for the 2023-2024 fiscal year, with shareholders approving a dividend of 200% in cash for the previous fiscal year. As such, the company will pay out nearly VND 196 billion in dividends.

Previously, the company’s Board of Directors proposed a dividend of 100% in cash. However, after discussions, Son La Sugar increased the dividend to 200%.

Son La Sugar is still known for its high dividend payouts on the stock exchange. In the last three fiscal years, the company has consistently paid dividends above 100%. In the 2023-2024 fiscal year, the company also paid a record-high dividend in its operating history.

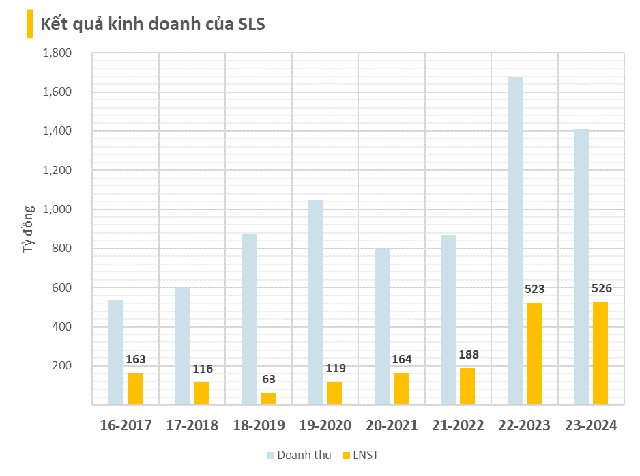

For the 2023-2024 fiscal year, Son La Sugar recorded consolidated revenue of VND 1,412 billion, a 16% decrease compared to the previous year. Net profit after tax was VND 526 billion, a slight increase from the previous year (VND 523 billion). This is also the highest profit for the company since its listing and is the basis for Son La Sugar’s high dividend payout.

In the 2023 – 2024 fiscal year, Son La Sugar set a target of VND 1,046 billion in revenue and VND 137 billion in after-tax profit, a decrease of 39% and nearly 74%, respectively, compared to the previous year. Thus, the company exceeded its annual profit target by 284%.

Notably, the company recorded an earnings per share (EPS) of VND 53,745 for the entire previous fiscal year, one of the highest on the Vietnamese stock market. The price-to-earnings ratio (P/E) stood at 3.5 times.

Regarding the business plan for the 2024-2025 fiscal year, the company set a modest target of nearly VND 1,100 billion in revenue and VND 150 billion in after-tax profit. These targets represent a 22% and 72% decrease, respectively, compared to the previous year’s performance.

The company’s Board of Directors attributed the lower targets to various challenges faced in 2024, including the global and domestic economic recovery still being fragile, weak purchasing power, and the impact of climate change, droughts, and floods in Son La province, which affected the company’s sugar cane production.

“Dragonfruit’s American Dream: How Vietnamese Pitahaya Receives its US ‘Visa’, Sending Export Giant’s Stocks Soaring.”

Investors who purchase this stock on or before September 10th will not be entitled to the 10% stock dividend.