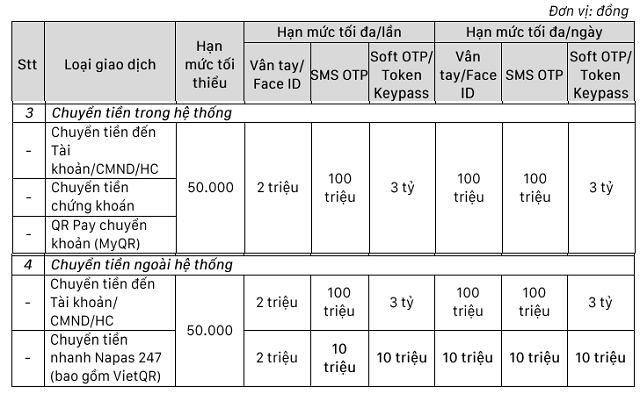

These limits apply to all over-the-counter and SCB eBanking channel transactions.

For instant money transfer transactions using fingerprint/Face ID authentication, customers can transfer up to 2 million VND per transaction and a maximum of 10 million VND per day.

For instant money transfer transactions authenticated via SMS OTP, Soft OTP/Token Keypass, the limit is a maximum of 10 million VND per transaction and a maximum of 10 million VND per day.

Source: SCB

|

Previously, on August 15, 2024, SCB adjusted the transaction limit for Napas 247 instant money transfers from a maximum of 200 million VND per transaction/day/customer to 100 million VND per day/customer, and on August 23, 2024, it was further reduced to 50 million VND per transaction/customer.

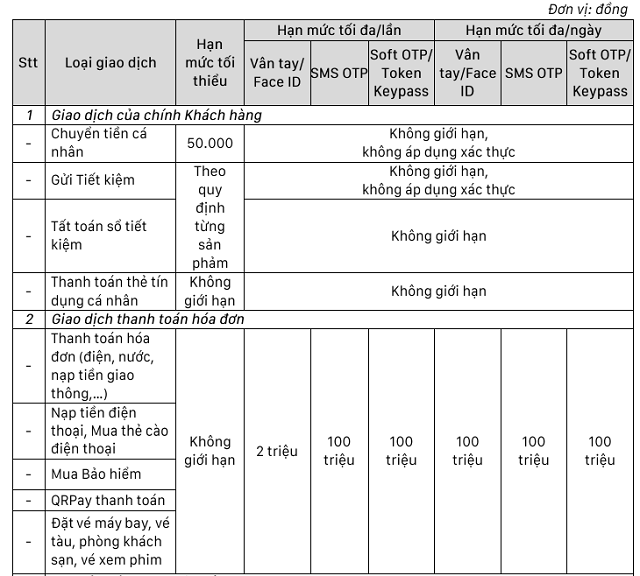

For other transactions, the limits remain unchanged. These include intra-system money transfers with limits of up to 2 million VND per transaction and 100 million VND per day for fingerprint/Face ID authentication; 100 million VND per transaction/day for SMS OTP; and 3 billion VND per transaction/day for Soft OTP/Token Keypass.

The transaction limit for bill payments for SCB individual customers is 100 million VND per day. These payment transactions include utility bill payments, mobile phone top-ups, insurance purchases, QRPay payments, and flight bookings, among others.

Source: SCB

|

In parallel, SCB has been consistently terminating the operations of its transaction offices since it came under special control at the end of 2022. According to statistics from the Vietnam Bank Association (VNBA), from June 2023 to the present, SCB has ceased the activities of 120 transaction offices in provinces and cities, including 64 in Ho Chi Minh City and 56 in other provinces and cities.

Most recently, in Ho Chi Minh City (all from August 30, 2024), SCB closed: District 9 Transaction Office – Dong Sai Gon Branch; Ly Thai To Transaction Office – Cong Quynh Branch; Pham Hung Transaction Office – Cho Lon Branch; Binh Chanh Transaction Office – Cho Lon Branch.

In other provinces and cities (on August 30 and 31, 2024): SCB closed Ham Nghi Transaction Office – Da Nang Branch; Son Tra Transaction Office – Da Nang Branch; Vu Trong Phung Transaction Office – Cau Giay Branch; Hoan Kiem Transaction Office – Thang Long Branch; An Phu Transaction Office – Can Tho Branch; Le Trong Tan Transaction Office – Hanoi Branch; Tay Son Transaction Office – Hanoi Branch; Nguyen Trai Transaction – Hanoi Branch; and Le Chan Transaction Office – Hai Phong Branch.

SCB affirms that the termination of the above-mentioned transaction offices does not affect the operations of the Bank. All rights and transactions of customers are guaranteed to be fully performed at other transaction offices of SCB.

The Ultimate Guide to Securely Sending Money for Your Child’s Education Abroad

As of February 17, 2024, Vietnam leads Southeast Asia in the number of international students, with a total of 137,022, according to the latest statistics from the UNESCO Institute. This has resulted in a growing need for parents to send money overseas. Banks have always been the go-to option for parents, providing a trusted and efficient way to transfer funds internationally.

The Perils of Phone Scams: A Vietnamese Student’s Harrowing Tale of Almost Losing $370,000

A young student’s dreams of studying abroad were almost shattered by a cunning scammer. Thanks to the timely intervention of the police, he was spared from losing his entire tuition fee for his studies in the UK. This story serves as a stark reminder of the dangers that lurk in the shadows of our digital world.