The People’s Committee of Hanoi has issued Decision No. 56/2024/QD-UBND on regulations regarding compensation, support, and resettlement in cases of land revocation by the state in the city. The decision takes effect on September 20, 2024.

According to the decision, for agricultural land, the compensation rate for remaining investment costs is VND 50,000/m2 for paddy land and VND 35,000/m2 for land with long-term crops. The maximum compensation for each land user does not exceed VND 250 million. For non-agricultural land, the compensation rate is VND 35,000/m2.

It is known that the land price list in Hanoi in 2024 was amended and supplemented in Decision No. 20/2023/QD-UBND.

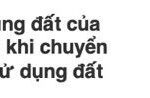

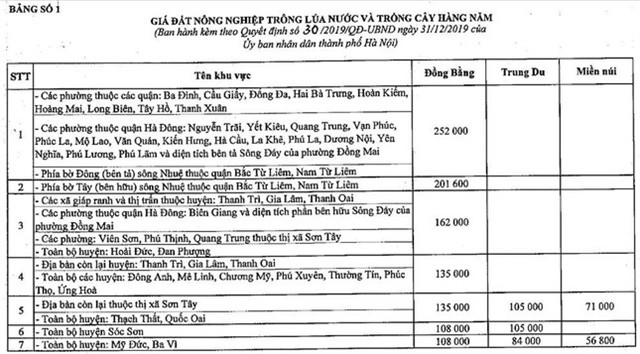

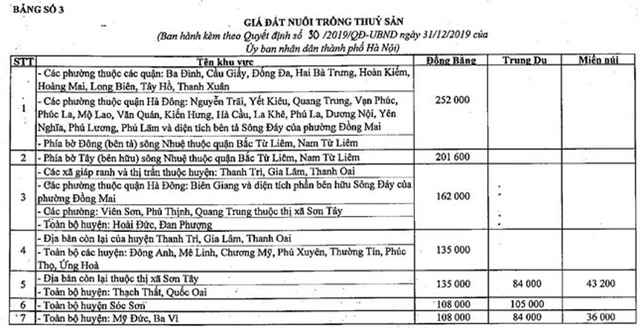

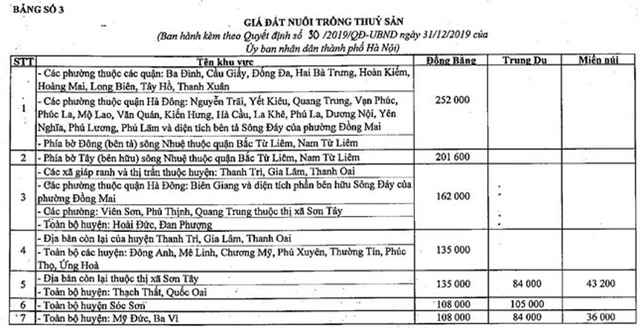

Accordingly, the land price frame for agricultural land in Hanoi is applied as follows:

– The price of agricultural land for growing paddy and other annual crops, land for growing long-term trees, land for aquaculture, production forests, protection forests, and special-use forests in communes belonging to districts is determined based on the purpose of land use at the time of allocation or lease and is divided by region and by area (delta, midland, and mountainous areas) as specified in Tables 1, 2, 3, 4, and the Appendix on commune classification.

– The price of agricultural land within the residential area of a township, the residential area of a rural commune whose boundary has been determined according to the approved planning (in case there is no approved planning, it shall be determined according to the boundary of the outermost land plot with a house in the residential area) shall be higher but not more than 50% of the corresponding agricultural land price specified in Tables 1, 2, 3, 4, and the Appendix on commune classification.

– The price of other agricultural land (including land in suburban communes used for building greenhouses and other types of houses for cultivation, even in non-direct cultivation forms on land; building livestock farms for cattle, poultry, and other animals permitted by law; land for cultivation, animal husbandry, and aquaculture for learning, research, and experimental purposes; land for seedling and seed production, and land for growing flowers and ornamental plants) shall be equal to the price of agricultural land for long-term crops in the same area and region as specified in Table 2 and the Appendix on commune classification.

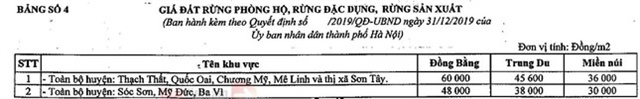

Below are the detailed tables of agricultural land prices:

Price of agricultural land for growing paddy and other annual crops. |

Price of agricultural land for growing long-term trees. |

Price of agricultural land for aquaculture. |

Price of land for protection forests, special-use forests, and production forests. Source: Ministry of Natural Resources and Environment. |

Ninh Phan

What is the Minimum Lot Size for a Red Book in Binh Dinh Province?

The People’s Committee of Binh Dinh Province has set out regulations regarding minimum land sizes and dimensions for subdivided land plots. These new rules stipulate that residential land plots in urban areas must maintain a minimum area of 40 square meters, with a minimum frontage and depth of 3 meters post-subdivision.

Four Instances of Encroachment and Violations Eligible for Red Book Consideration

As per the Land Law 2013, which comes into effect on August 1, there are four scenarios where land use violations that occurred prior to July 1, 2014, will be considered for the issuance of land-use rights certificates (red books).

“Understanding the New Land Use Charges When Converting Agricultural Land to Residential: A Guide for the Community”

Under Clause 5, Article 116 of the 2013 Land Law, households and individuals who wish to convert agricultural land within residential areas, within the same land lot, or to convert non-agricultural land that is not for residential purposes into residential land, must ensure that it complies with the approved district-level land use planning.

The City of Ho Chi Minh will Adjust the Collection Rates in the New Land Price Table

The newly proposed land price schedule has increased prices by as much as 5 to 51 times compared to the previous schedule. However, the authorities will collaborate and report to the People’s Committee of Ho Chi Minh City, proposing that the government review and adjust the tax rates and collection amounts as necessary to ensure equitable financial obligations regarding land matters.