On September 11, Mr. Tran Anh Thang – Vice Chairman of the Board of Directors and General Director of VFS – registered to sell more than 7.6 million shares from September 18 to October 17, expecting to reduce ownership from more than 15.6 million shares (13.01%) to 8 million shares (6.67%).

|

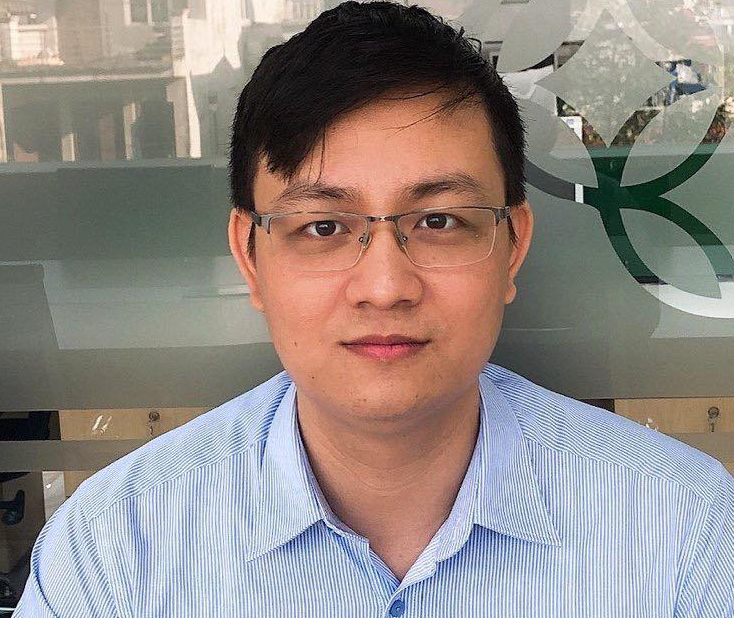

Mr. Tran Anh Thang, born in 1984, holds a Master’s degree in Finance and Banking from La Trobe University, Australia. He joined the VFS Board of Directors in February 2017 and was subsequently appointed Chairman of the Board in March of the same year. In May 2018, he took on the additional role of General Director. In April 2021, his role at VFS changed to Vice Chairman of the Board, while he continued to serve as General Director until the present.

Mr. Tran Anh Thang is introduced by VFS as an extremely important member, playing a pivotal role in the leadership team and contributing to the company’s sustainable growth. With over 6 years of companionship with VFS, he has been instrumental in strategy formulation, providing development orientations, and managing operations, growing VFS from a company with a modest chartered capital of 135 billion VND to 1,200 billion VND.

According to the management report for the first half of 2024, in addition to his key roles at VFS, Mr. Tran Anh Thang is also an independent member of the Board of Directors at the Vietnam Export Import Commercial Joint Stock Bank (HOSE: EIB).

The report also mentions that Mr. Thang used to be the Chairman of the Board of Directors at Amber Capital Holdings JSC and Hanoi Non Nuoc Tourism Investment JSC. However, it provides additional information that both organizations are no longer related to Mr. Thang as of April 2024. Amber Capital Holdings, in particular, remains a major shareholder of VFS, holding 8.8 million shares, equivalent to a 10.97% stake.

The intention to sell a large number of shares held by the Vice Chairman of VFS was announced just two days after an organization, Hoa An Financial Investment JSC, registered to buy 20.5 million new shares, equivalent to a 17.083% stake in VFS.

In terms of connections, both VFS and Hoa An Company have Ms. Nghiem Phuong Nhi as their Chairman of the Board of Directors. It is worth noting that Ms. Nhi has only recently become the Chairman of VFS since April 2024. Additionally, she also serves as the Chairman of the Board of Directors of Amber Fund Management JSC, another member of the Amber ecosystem.

*Data updated as of August 2023

|

Turning back to Hoa An Company, the organization stated that the purpose of the purchase is to increase ownership, expected to be carried out during the period from September 16 to October 15. Based on the closing price of VFS shares in the latest session on September 13 of 13,500 VND/share, it is estimated that Hoa An Company needs to spend nearly 277 billion VND to complete this transaction. On the other hand, Mr. Tran Anh Thang could pocket nearly 103 billion VND if he sells all the registered shares.

In the stock market, VFS shares have been on a downward trend, continuously plummeting and currently trading at a 3-year low. Compared to the peak of around 29,000 VND/share set in September 2023, VFS has lost more than half of its market price.

| VFS shares are currently trading around a 3-year low |

|

|

Hoa An Financial Investment JSC, which is likely to become the largest shareholder of VFS in the near future, was established on May 26, 2023, mainly operating in the field of management consulting (excluding legal consulting and representation; lobbying activities; accounting and auditing) and is headquartered at Capital Place, 29 Lieu Giai, Ngoc Khanh Ward, Ba Dinh District, Hanoi.

At the time of its establishment, Hoa An Company had a chartered capital of 79 billion VND with 3 founding shareholders, including Ms. Nghiem Phuong Nhi owning 51%, Ms. Nghiem Thi Thuy Nhi holding 30%, and Mr. Nguyen Trung Kien (General Director and legal representative) with 19%. On October 13 of the same year, the company increased its chartered capital to 579 billion VND, but the ownership structure was not disclosed.

In terms of business results, in the second quarter of 2024, VFS recorded operating revenue of 50 billion VND, an increase of more than 28% over the same period. Higher total expense growth compared to revenue caused net profit to decrease by nearly 19% to below 30 billion VND, but it was still the highest profit in the past four quarters.

For the first six months, net profit reached 57 billion VND, the highest semi-annual profit ever, and an increase of nearly 30% over the same period. Compared to the plan to make a profit of 124 billion VND in 2024, the company achieved nearly 46% in the first six months.

| VFS’s quarterly financial results in recent years |

|

|

Huy Khai

The Stock Market Awaits Another Boost

Contrary to expectations of VN-Index surpassing 1,300 points with a slew of positive news, the stock market has been on a continuous downward trajectory since the 2nd of September holiday break.