The Ho Chi Minh Stock Exchange (HOSE) has recently introduced the VNDiamond Index Ground Rules version 3.0, which will come into effect from the review period of October 2024. ETF portfolios will undergo a quarterly restructuring in Q4 2024, as per the schedule below, with the completion date set for November 1st.

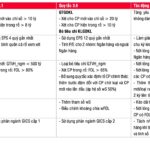

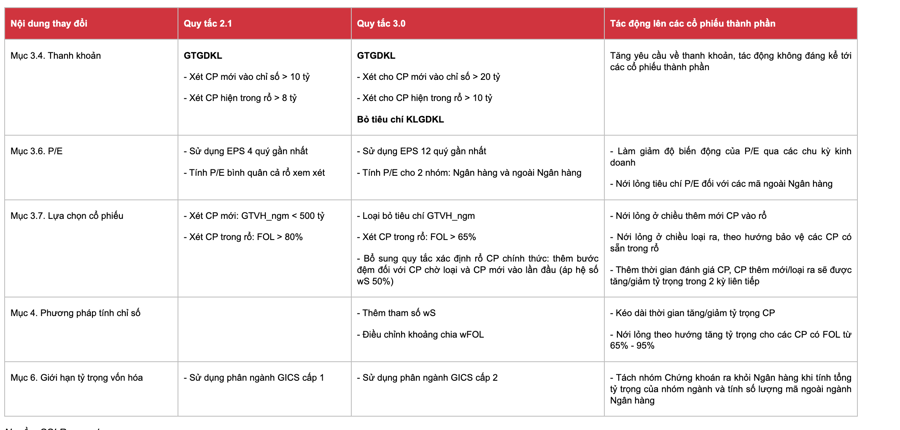

The new index rules tighten liquidity conditions for stocks while relaxing FOL conditions to ensure a sufficient number of stocks meet the index criteria. Additionally, the new rules adjust the P/E filter, add rules for determining the official stock basket, and introduce the wS parameter to limit volatility.

According to SSI Research, the detailed changes include: for liquidity, version 3.0 considers over VND 20 trillion for new stocks entering the index; over VND 10 trillion for existing stocks and removes the criteria for matched orders. The impact on constituent stocks is an increased liquidity requirement, with negligible impact on existing constituents.

Regarding PE: Using the EPS of the last 12 quarters, P/E is calculated for two groups: Banks and non-Banks. This rule reduces the volatility of P/E across business cycles; the P/E criteria are relaxed for non-bank codes.

For stock selection, the GTVH_ngm criteria are removed; stocks with FOL > 65% are considered. Rules for determining the official stock basket are added: a buffer is introduced for stocks awaiting removal and new stocks entering for the first time (with a wS coefficient of 50%).

The impact is a relaxation in terms of adding new stocks to the basket; relaxation in the direction of protecting existing basket stocks; more time is given for stock evaluation, with newly added/removed stocks having their weights increased/decreased over two consecutive terms.

For the index calculation method: The wS parameter adjusts the wFOL split range; impact – extending the time to increase/decrease stock weights; relaxation towards increasing weights for stocks with FOL between 65% – 95%.

For the capitalization limit: The GICS Level 2 sub-industry is used to separate Securities from Banks when calculating the total weight of the industry and the number of non-banking industry codes.

Based on provisional data as of September 5, SSI Research forecasts notable points regarding the VNDiamond Index portfolio as follows: VRE’s FOL fell below 65% and no longer meets the retention criteria. According to the new rules, VRE is placed in the “To be Removed” group and assigned a wS coefficient of 50%, equivalent to a 50% reduction in stock weight. In the next term, if VRE’s FOL does not improve above 65%, it may be completely removed from the index. As VRE remains in the index for this term, the number of non-banking stocks remains sufficient at eight, hence no new stock selection is required.

MWG has met the P/E criteria according to the new index rules (<2 times the average PE of the non-banking stock group), but its FOL has not yet reached the required threshold of 95%, so it will not be added to the index in this term. In the next term, MWG may be added to the index if VRE is officially removed.

NLG, KDH, VPB, and BMP will have their weights increased due to adjustments in the wFOL coefficient scale. The weights of the remaining stocks will be reduced to balance the portfolio.

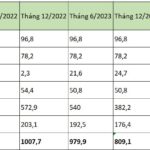

Thus, the predicted VNDiamond Index portfolio remains unchanged for this term, comprising 18 stocks, including 10 banking stocks and 8 non-banking stocks.

Among the ETFs in the market, five currently use the VNDiamond Index as a reference: DCVFMVN Diamond, MAFM VNDiamond, BVFVN Diamond, KIM Growth Diamond, and ABF VNDiamond. As of September 5, 2024, their combined net asset value is approximately VND 12,600 billion. The DCVFMVN Diamond fund alone has a total asset value of about VND 12,100 billion.

SSI Research estimates the portfolio index weight and trading of the DCVFMVN Diamond fund as follows: VPB is the most purchased stock with 9.9 million shares; followed by KDH with 8.4 million shares; NLG with 6.6 million shares, and BMP with 1.4 million shares.

On the other hand, VRE is sold off with 8.87 million shares; OCB sells 3.4 million shares; TCB sells 2.9 million shares; ACB and GMD sell 2.4 million shares each; and other stocks sell over 1 million units, including REE, MBB, HDB, and MSB…

Will MWG Stock Return to the Nearly VND 13,000 Billion ETF Portfolio with the VNDiamond 3.0 Update?

SSI Research has reported that the VNDiamond Index’s rules have been revised to tighten liquidity conditions for stocks while relaxing FOL conditions. The new rules also amend the P/E filter criteria, introduce a formal stock basket determination rule, and add a wS parameter to curb volatility in the index.

“Novagroup Finalizes Sale of Over 3 Million Shares; Major Shareholder Group Linked to Mr. Bui Thanh Nhon Now Holds Less Than 39% Stake in Novaland”

Since the beginning of the year, NovaGroup has sold over 36 million Novaland shares, including shares liquidated by the securities company.