The textile and footwear industries are Vietnam’s two key export sectors, with consistent growth in export turnover over the years, averaging more than 10% annually. According to reports by the World Trade Organization (WTO) and World Footwear magazine, Vietnam is the world’s second and third largest exporter of footwear and textiles, respectively.

DEPENDENCY ON FOREIGN RAW MATERIALS

With 16 free trade agreements (FTAs) signed, Vietnam has access to and established trade relations with nearly 230 markets. The footwear, handbag, and textile industries benefit the most from these agreements, with significant export turnover. In addition to tariff preferences, these industries have also diversified their export markets, avoiding dependence on a single market.

However, the Vietnam Leather, Footwear and Handbag Association (Lefaso) points out that the major challenge for the textile and footwear industries is their heavy focus on processing and dependence on foreign raw materials. Export partners refuse to accept processed products if they do not use raw materials from designated suppliers, hence, 70% of businesses still rely on the CMT (cut, make, trim) method, with inputs provided by the buyer. As a result, profits are only 1-3% in processing orders, the lowest in the entire value chain and with little room for price negotiation. Businesses have to rely on labor costs to make a profit.

One of the main reasons Lefaso cites is the underdevelopment of the supporting industry that supplies raw and auxiliary materials for textiles and footwear. Currently, most of the raw materials for export production are imported from China, South Korea, and ASEAN countries. Therefore, meeting the intra-bloc origin ratio required by the FTAs is a significant challenge.

On the other hand, while the export turnover of the textile and footwear industries has been steadily increasing, the contribution of domestic enterprises has not improved significantly over the past decade. More than 60% of textile exports belong to foreign direct investment (FDI) enterprises, although foreign-invested enterprises account for only 24%. In the footwear industry, FDI accounts for nearly 80% of export turnover and only about 30% in quantity.

In addition to the mandatory criteria of quality and price, brands must ensure that the companies supplying raw and auxiliary materials do not violate social and environmental responsibilities to avoid risks. If the factory is given the right to purchase raw materials, the brand must know who their partners are so that they can hire an independent auditor to assess the overall situation. This process would take at least a few months, while the production schedule has already been set a year in advance.

Moreover, the market for trading raw and auxiliary materials for textiles and footwear in Vietnam is almost non-existent. There are only a few household material markets serving small-scale domestic market businesses. Factories import raw and auxiliary materials under preferential import tax exemption policies, mainly for production purposes. Factories that produce raw and auxiliary materials can only supply enough for their own export production needs.

In the footwear industry, according to statistical reports, there are about 129 enterprises investing in the production of raw and auxiliary materials for footwear in Vietnam. However, only about 20 domestic enterprises are capable of supplying high-quality raw materials. This makes it difficult for footwear manufacturers to take the initiative in orders and raw materials.

“The problem is that more than 60-70% of small and medium-sized enterprises in the textile and footwear industries in Vietnam have to find raw material sources on their own or follow the instructions of their customers,” Lefaso stated. This will pose many risks in the future, as a series of new policies are being introduced by importing countries, such as product traceability requirements, social and environmental responsibility requirements, and the near-future requirement for recycling content in products. In addition, other policies likely to have a significant impact on the industries include the carbon tax policy on goods imported into the EU and the global minimum tax policy.

NEED FOR BREAKTHROUGH SOLUTIONS

To continue developing the industries in the upcoming period, Mr. Nguyen Duc Thuan, Chairman of Lefaso, believes that breakthrough solutions are needed to upgrade the industry’s value chain to create longer-term and more sustainable benefits. Upgrading the value chain means changing and shifting activities to create higher value addition. Higher value can be achieved by shifting to the production of higher-value products or by adding new segments in the value chain, such as participating in design and marketing.

“There is no other way to do this but to promote the development of the raw and auxiliary material supply market towards a large-scale, standardized, and transparent direction,” emphasized Mr. Thuan. “Only then can businesses in the industry, especially small and medium-sized enterprises, innovate and improve their dynamism and efficiency, with the opportunity to participate more strongly in the industry’s supply chain.”

Currently, the raw and auxiliary material markets are operating on a small scale and inefficiently. Therefore, in the long run, Vietnam must have a center for the transaction and development of raw and auxiliary material supplies. As the domestic textile and footwear markets grow, there will be a need for a place to concentrate samples, distribute raw and auxiliary materials, invest, transfer technology, and conduct transactions between domestic and foreign enterprises. This model has been very successful in China, considered the world’s largest fashion industry workshop.

Mr. Thuan proposed building a center for the transaction and development of raw and auxiliary materials and innovation of the Vietnamese fashion industry in Binh Duong. The center will gather suppliers of raw and auxiliary materials for textile and footwear production, saving factories from the trouble of searching for suppliers. Especially, it will shorten the time for sample production as factories will have ready access to raw material suppliers; and competitive pricing will be achieved. This will form a standardized and transparent fashion industry raw and auxiliary material market. At the same time, it will promote research, development, application, transfer, and innovation activities to help businesses quickly access new and environmentally friendly technologies…

The article was published in the Vietnam Economic Magazine, Issue 38-2024, released on September 16, 2024. Please visit the following link to read the full article:

https://postenp.phaha.vn/chi-tiet-toa-soan/tap-chi-kinh-te-viet-nam

“Korean Conglomerate Invests $200 Million in Wind Power Equipment Manufacturing in Long An”

South Korea’s CW Wind Corp has signed a memorandum of understanding (MOU) to lease land in Can Duoc District, Long An Province. The company plans to develop a large-scale wind power equipment manufacturing facility with an estimated investment of $200 million.

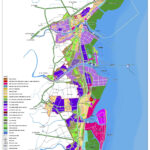

The Economic Zone, Spanning the Size of Hanoi’s Inner City, Features a Host of Industrial Parks, Sea Ports, and a Future Private Airport

The Thai Binh Economic Zone in Tien Hai will be home to a coastal specialized airport by 2030. In addition to this, the area will also see the development of a seaport capable of accommodating ships up to 50,000 tons. This ambitious plan showcases a commitment to transforming the region into a bustling hub of activity, connecting it to both domestic and international markets.

“Vietnam: Gateway to ASEAN for Global Investors.”

For the first time in Vietnam, the UOB-organized Gateway to ASEAN conference recently took place in Ho Chi Minh City, attracting over 600 guests. This included experts, business leaders, and trade partners from ASEAN countries, Hong Kong, and China, as well as representatives from various Vietnamese agencies.