The Joint Stock Sea Transport Company Hai Au (SESCO, UPCoM: SSG) has just announced its asset restructuring plan. SSG shared that after nearly 18 years of operation, the Sea Dream vessel is entering its old age, with technical issues becoming more frequent while it continues to be operated on a very demanding international route.

As a result, the operating costs of the Sea Dream vessel have entered a high-cost phase, and there is a risk of extended off-hire periods. Additionally, the ship is due for its fourth intermediate docking (IS4) on January 15, 2025, and the preliminary estimated cost for this docking could range between VND 12-15 billion, with an additional VND 5 billion in lost revenue and operating costs during the 35-day docking period.

Given this context, SSG plans to sell the Sea Dream vessel as soon as possible, before the intermediate docking, to reinvest in another ship.

The company has conducted a valuation with Vinacontrol Joint Stock Corporation (HNX: VNC), and as of September 6, the Sea Dream vessel was valued at over VND 90 billion, including VAT. The company offered the ship for sale at VND 100 billion domestically and USD 4 million for foreign customers.

As a result of the brokerage sale, the Sea Dream received purchase offers ranging from USD 2.8-3.3 million, equivalent to VND 70-82 billion.

After liquidating the Sea Dream, SSG plans to reinvest in a vessel with a similar deadweight tonnage of 12,000-13,000 DWT, aged between 10-12 years, and of Japanese origin, for approximately USD 8 million. The expected selling price of the old vessel is USD 3.4-3.6 million, and SSG will plan to increase its charter capital or borrow from banks for the remaining amount.

The Sea Dream vessel that SSG is looking to sell

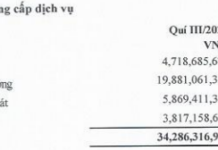

|

With the planned sale of the vessel, SSG has also adjusted its 2024 business plan, with total revenue increasing from over VND 30 billion to over VND 98 billion, a 3.2-fold increase, and profit after tax increasing from over VND 5 billion to nearly VND 50 billion, a tenfold increase. This plan is based on a scenario where the ship is expected to be sold for nearly VND 74 billion, excluding VAT.

In terms of business results, in the first eight months of this year, SSG‘s total revenue reached nearly VND 20 billion, of which transportation revenue accounted for the majority with over VND 18 billion, and over VND 1 billion came from financial revenue. The enterprise reported a post-tax loss of nearly VND 200 million.

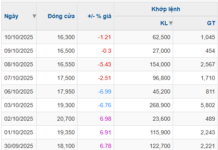

In the afternoon session on September 13, SSG shares were trading around VND 10,100 per share, down 3% since the beginning of 2024, with an average liquidity of only 2,600 shares per session.

Trading movements of SSG shares since the beginning of 2024

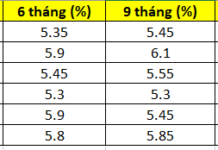

The Calming Forex Rates and “Breathable” Interest Rates

The U.S. dollar plummeted, prompting the State Bank to purchase this foreign currency to boost its reserves. This strategic move helped to temper the exchange rate and provided more room for interest rate stability on loans, offering a much-needed reprieve to borrowers.

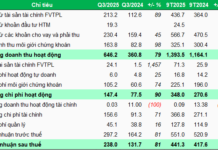

An Ambitious Long-Term Partner Seeks to Increase Investment in HAH.

On September 12, Marina Logistics – a leading multi-modal transport and agency company – announced its purchase of 600,000 HAH shares. This strategic move elevated their ownership stake to an impressive 3.922%. Not content to rest on their laurels, Marina Logistics immediately set their sights on further expansion, registering to buy an additional 650,000 shares with the ambitious goal of reaching a 4.457% stake.