Ending on March 8, the stock market witnessed its sharpest drop since the beginning of 2024 as the VN-Index lost 22.11 points to 1,247.35 points. However, on the red market day, MCH shares of Masan Consumer Corporation continued to maintain its momentum as it increased by 5.09% to a price of 144,500 VND per share.

This has been the 16th consecutive increase session for this stock recently. The market value of MCH has increased by 66% since the beginning of the year and nearly 90% in the past six months.

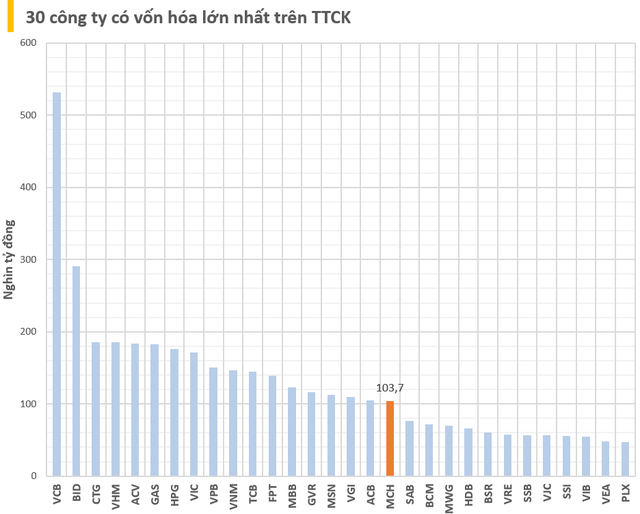

With a price of 144,500 VND per share, the market capitalization of Masan Consumer has also exceeded the 100,000 billion mark for the first time, reaching 103,680 billion VND. The value of this company has increased by 41,200 billion VND since the beginning of the year. Moreover, the current market capitalization of Masan Consumer even surpasses a series of giants on the exchange such as Sabeco, Becamex IDC, The Gioi Di Dong, Vincom Retail, HDBank, Seabank…

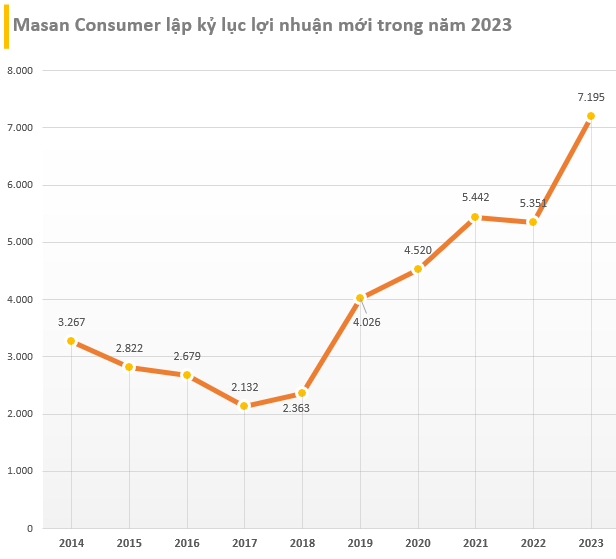

The upward trend of MCH shares is supported by positive business results. In 2023, Masan Consumer set a new record profit when it recorded a after-tax profit of 7,195 billion VND, an increase of 30% compared to 2022. EPS 2023 reached 9,888 VND per share, a strong increase compared to EPS 2022 which is 7,612 VND per share.

Especially, the gross profit margin of Masan Consumer for the first time has reached nearly 50%. Specifically, Q4 gross profit reached 4,017 billion VND, gross profit margin of 47.29%, significantly increased from 41.48% in Q4/2022.

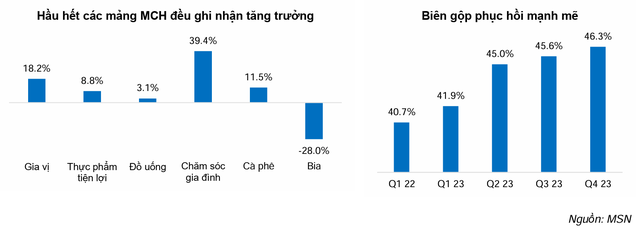

According to Ban Viet Securities (BVSC), if excluding the impact of transferring MSN Jinju to Masan MeatLife, the revenue of MCH grew by 9% compared to last year. BVSC evaluates this as an extremely impressive number in the context of tightened spending due to low consumer confidence caused by unfavorable macroeconomic conditions.

Spice, Convenience Food, and Household Care lines benefited from increased home consumption trends, while Beverages and Beer recorded slow growth due to reduced spending on eating out and entertainment. Revenue from new products increased by 39% compared to the previous year, contributing 4.4% to total revenue in 2023.

The company’s “Go Global” strategy also achieved an encouraging milestone with revenue exceeding 1,000 billion VND in 2023. Chin-su brand products are currently exported to developed markets such as the US, Canada, Australia, Europe, and Japan. In particular, Chin-su chili sauce is one of the best-selling products on the Amazon platform.

According to Masan, the outstanding growth of gross profit margin is the result of having high selling prices consolidated by a strong brand, a product portfolio with high profit margins, the ability to ensure low raw material costs, and an optimized supply-demand plan to improve production conversion costs.

In the annual Shareholders’ Meeting held in April 2023, Mr. Truong Cong Thang – CEO of Masan Consumer – stated that Masan’s target for the next 5 years (2023 – 2027) is to achieve revenue of 80,000 – 100,000 billion VND, of which 85% comes from domestic market and 15% from exports.