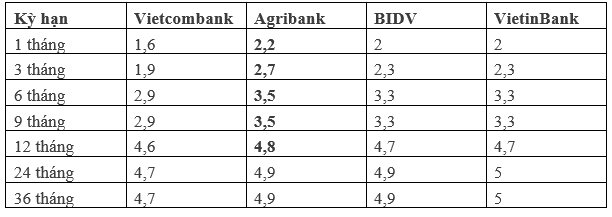

The Big 4 banks in Vietnam have recently made adjustments to their savings interest rates, with some banks offering significantly higher rates than before. However, it’s worth noting that Vietcombank continues to offer the lowest interest rates among the group.

For the 1-2 month term, Vietcombank offers a savings rate of 1.6%/year, while BIDV and VietinBank provide a slightly higher rate of 2%/year. Agribank, on the other hand, offers the highest rate at 2.2%/year, a 0.6% increase compared to Vietcombank.

Moving on to the 3-month term, Agribank once again takes the lead with an interest rate of 2.7%/year, followed by BIDV and VietinBank at 2.3%/year, and Vietcombank at the lowest rate of 1.9%/year.

For the 6-9 month term, Agribank maintains its position as the highest-paying bank in the group with a rate of 3.5%/year. BIDV and VietinBank offer a slightly lower rate of 3.3%/year, while Vietcombank’s rate remains the lowest at 2.9%/year.

When it comes to the 12-month term, Agribank offers an interest rate of 4.8%/year, while BIDV and VietinBank are close behind at 4.7%/year. Vietcombank, on the other hand, offers a slightly lower rate of 4.6%/year for this term.

For longer-term deposits of 24-36 months, Vietcombank continues to offer the lowest interest rate at 4.7%/year. Agribank offers a slightly higher rate of 4.8%/year, followed by BIDV at 4.9%/year. VietinBank remains the most competitive among the Big 4, offering an impressive 5%/year for this term.

While the recent adjustments have resulted in higher savings interest rates for some of the Big 4 banks, it’s important to note that their rates still remain relatively low compared to other banks in the market.

Newest online savings interest rates at the Big 4 banks.

Currently, the highest 1-month term deposit rate in the market is offered by SeABank at 3.95%/year. For the 3-month term, Eximbank takes the lead with a rate of 4.3%/year. CBBank offers the highest 6-month term rate at 5.55%/year, while NCB leads the 9-month term with a rate of 5.65%/year. Bac A Bank offers the most competitive 12-month term rate at 5.9%/year, and for the 24-month term and above, several banks, including HDBank, OceanBank, and SaigonBank, offer rates ranging from 6% to 6.1%/year.

The Ultimate Guide to Captivating Copy: “3 Businesses with Substantial Assets Have Their Debts Up for Grabs by Banks”

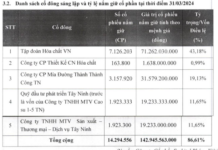

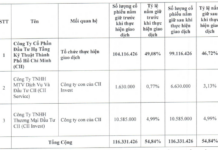

Three businesses’ debts are up for sale by the bank, with an attractive package of collateral. This includes land rights to over 30 plots and 2.6 million shares in a publicly traded company on the HNX. A unique opportunity for investors to acquire these valuable assets and secure a strong financial future.

“Bank Assesses Storm Damage to Restructure Debt and Reduce Loan Interest for Customers”

The banking sector is actively collating and updating information regarding the extent of damage incurred by their clients. While there has been no official announcement regarding specific relief measures for affected customers, such as repayment extensions, waivers, or reduced interest rates, banks are working to assess the situation and formulate appropriate support strategies.