The market experienced a rather dull trading week, with continuous declines and lackluster trading volume. The index performance was somewhat out of sync with global stock markets as economic data pushed back the possibility of a recession in the US, leading to a recovery in global stocks. Meanwhile, the Vietnamese economy was impacted by Typhoon Yagi, dampening expectations and leaving many investors with a negative trading psyche.

With a lack of supportive domestic news, Mr. Nguyen Anh Khoa, Head of Securities Analysis at Agriseco, believes that the sideways trend with alternating gains and losses will continue into the next week. The resistance level that needs to be overcome for a potential trend reversal is around the 1,260-1,270-point range. Meanwhile, the support level is expected to be around the 200-day MA, corresponding to the 1,220-1,230-point region.

The FED is predicted to cut interest rates at its meeting on September 18, which would be the first reduction in over a year since the US Central Bank maintained the highest interest rate in over two decades. The FED may reduce rates by 25-50 basis points, but the market anticipates a 0.25% cut as the more likely scenario. Should this occur, it would reinforce that the US economy is on the right track and could achieve a soft landing.

Agriseco’s expert opined that the FED meeting and interest rate policy would generally have a positive impact on the Vietnamese market, although the element of surprise is minimal as most investors had already anticipated this move. This event will mark a turning point for a phase of global interest rate reductions, and capital may flow back into emerging and frontier markets, becoming one of the driving forces in the next phase.

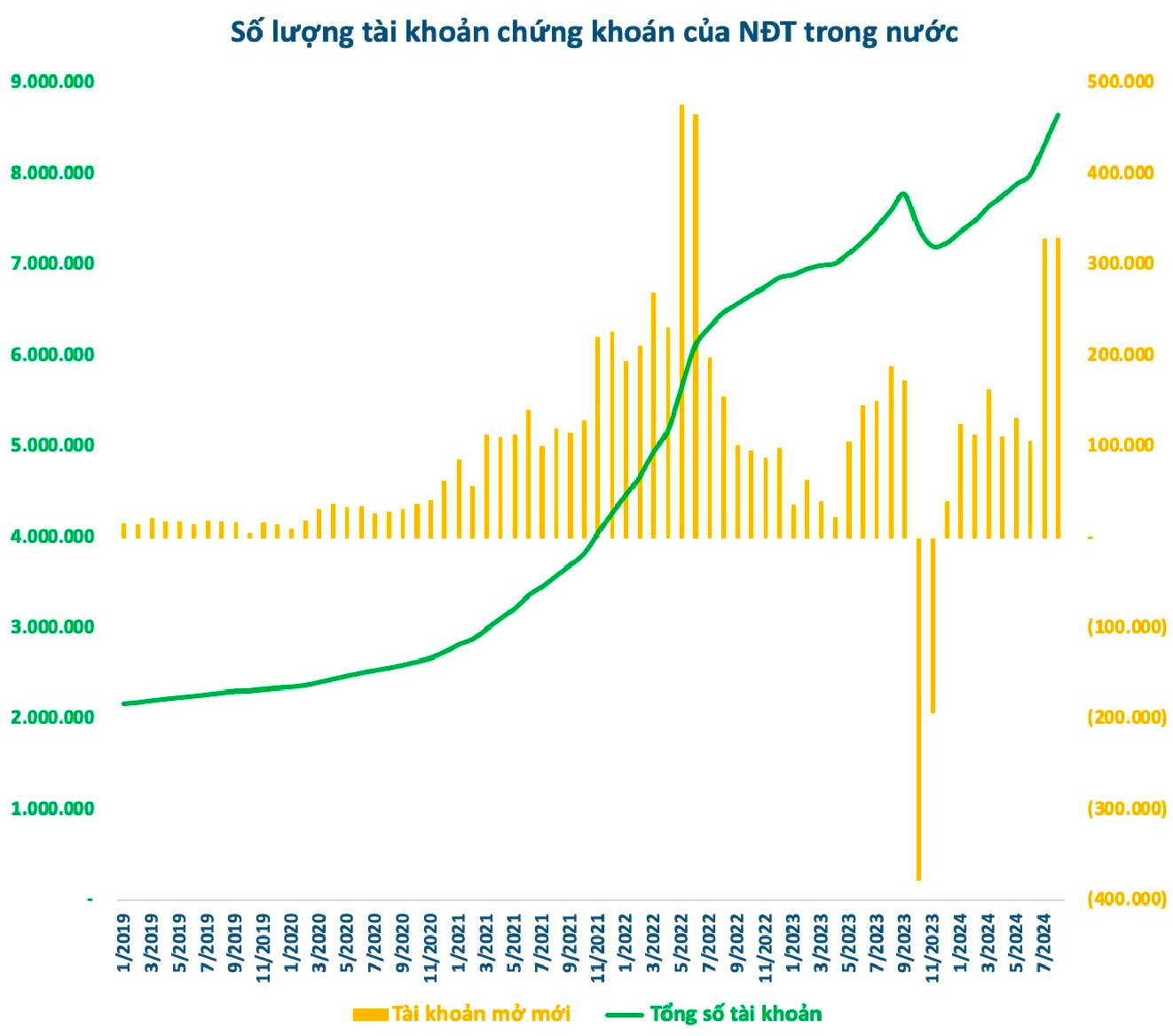

“The low liquidity is only a short-term phenomenon due to psychological and index-related pressures. Capital is still waiting for opportunities to invest, as the stock market remains one of the most efficient investment channels since the beginning of the year, with an average return of ~10-13%,” said Mr. Nguyen Anh Khoa.

The market’s adjustment has not been significant, and selling pressure has not increased considerably, indicating low risk at present. However, the market needs to establish a balanced zone to stabilize investor sentiment and attract capital inflows to propel the index upward.

In the current context, with the FED preparing to cut interest rates and positive signs in US economic data indicating a soft landing, global stock markets have been on an upward trajectory. In Vietnam, as the information drought of September passes and Q3 economic and corporate earnings data is unveiled, capital will have the impetus to return to the market.

After the recent correction, steel stocks have become relatively undervalued, falling 20-30% from their mid-term peaks, making them more attractive to investors. In addition to the steel sector, other industries have witnessed less significant declines but still offer investment opportunities, including export sectors (seafood, textiles, rubber), banks, and securities.

In the coming period, capital may differentiate between sectors based on business prospects and unique investment stories within each stock group. September will be a pivotal month for the Vietnamese stock market ahead of the release of Q3 macroeconomic data and corporate earnings reports. With expectations of a market accumulation and upward trend, investors can implement a strategy of capital deployment during market corrections.