|

This is a statement from Ms. Nguyen Thi Linh, Director of Investment Banking Services at Everest Securities Joint Stock Company (HOSE: EVS), regarding the story of transparency in business information.

Upgrading the market opens up great potential for the IB sector

How do securities companies evaluate the potential of the Investment Banking (IB) market in Vietnam?

Ms. Nguyen Thi Linh: EVS assesses that Vietnam remains a land of great potential for the IB market due to the following reasons:

- Vietnam is one of the fastest-growing economies in Southeast Asia, with high and stable GDP growth. The demand for capital to support business expansion and the need for foreign investment are enormous.

- The Vietnamese government is encouraging the participation of private economic components in fields that were once considered state monopolies, such as electricity, water, energy, and pharmaceuticals.

- The startup wave and the development of private enterprises: Startups and private companies in Vietnam are seeking capital to expand and grow, creating opportunities for IB services such as capital mobilization, underwriting, and financial advisory.

- M&A deals are increasing in number and diversity, and successful transactions prove the attractiveness of the Vietnamese market.

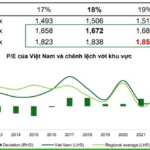

- The strong development of the capital market: The Vietnamese stock market is growing with an increasing number of listed companies and market capitalization. This drives the demand for financial services from IB companies, including securities issuance and investment advisory.

- International integration trend: Vietnam’s participation in multiple trade agreements and the adoption of international regulations enhance foreign investment inflows and boost the demand for international financial services, including IB.

How important is it to upgrade the stock market? What benefits will the IB market, and the IB sector of securities companies, reap from this upgrade, in your opinion?

– Upgrading the stock market will attract a significant amount of capital from foreign investors. Additionally, the market upgrade solutions being implemented enhance transparency and provide more information to foreign investors, enabling them to make more informed and efficient investment decisions.

Foreign investors tend to make long-term investments in high-quality investment products such as stocks, bonds, fund certificates, and M&A deals. Therefore, the IB market has enormous potential for growth, and the IB sector of securities companies will benefit immensely from the stock market upgrade.

What is EVS’s vision and strategy for the IB sector in the next five years?

– EVS recognizes the IB sector as one of the pillars of its business operations. Developing IB products and services not only brings direct benefits to the company but also provides indirect advantages for proprietary investment, increased brokerage market share, etc.

In addition to traditional strengths in services such as state capital divestment advisory, equity privatization advisory, share offering and issuance advisory, bond issuance underwriting, etc., EVS aims to develop value-added products to provide comprehensive financial management solutions for listed companies and potential enterprises planning to enter the stock market or startups seeking capital from domestic and foreign funds.

Focusing on Improving Investor Relations (IR) Advisory

When will listing and IPO activities become vibrant again? How effective is the listing advisory sector for the company?

– The vibrancy of IPO and listing activities depends on factors such as the growth of the Vietnamese economy, the stock market’s performance, legal frameworks related to IPO and listing regulations, and companies’ capital needs.

Listing advisory is one of EVS’s activities. For well-performing companies, in addition to providing listing advisory services, the company can become an investor even before the enterprise goes public and accompany the business throughout the IPO process and listing on stock exchanges.

What is your assessment of the role of Investor Relations (IR) in the development of enterprises?

– EVS considers IR activities to be crucial in the process of IPO, listing, or securities offering. IR activities are directed towards investors, providing financial information, management information, and enhancing the company’s reputation and relationships. These activities are essential for the success of IPOs, listings, or share offerings.

When engaging in financial advisory or IB services, EVS always emphasizes improving the IR capabilities of enterprises. This includes advising companies on periodic and extraordinary information disclosure in accordance with legal regulations and good practices; corporate governance advisory; advising on the adoption of ESG commitments and declarations; organizing investor conferences and workshops; and constructing reports on sustainable development, related factors, and assessing the impacts of business activities on the company.

How are information disclosure and responding to information requests meeting the needs of institutional investors?

– Currently, listed companies communicate with investors through one-way interactions via information disclosed as per legal requirements (periodic reports including financial statements, annual reports, management reports, and irregular disclosures such as resolutions of the Board of Directors, related-party transactions, resolutions of the Annual General Meeting of Shareholders, etc.).

Only a few large listed companies and representative enterprises have IR newsletters or quarterly, semi-annual, or annual business information forums and workshops.

Institutional investors are interested in the regular business and competitive landscape of enterprises. They require bilingual newsletters, trend forecasts, and competitor analyses.

EVS is currently supporting listed companies in interacting with investors at multiple levels. The comprehensive support package includes annual general meetings with direct and online modes, IR advisory on information disclosure as per regulations and good practices, implementing governance practices according to scorecards, advising on and supporting the organization of workshops and investment forums, and providing monthly reports and in-depth analytical reports for investors. These measures enable enterprises to focus on their core business while maintaining good relationships with investors and related parties.

What criteria do buy-side entities set for information transparency when considering investing in a company?

– Typically, buy-side entities have very specific criteria regarding information transparency when considering investing in or acquiring a company. These criteria may include:

- Accuracy and completeness of information: Legal, financial, and commercial information must be provided accurately and comprehensively as per the buy-side entity’s requirements.

- Provision of information on the company’s vision and strategy.

- Risk assessment and management measures.

- Market and competitor information.

- Information on potential risks and special events that may impact the company’s continuous operations.

- Related-party transactions.

- Timeliness and continuity of information provision.

Integrating ESG into Development Strategies

How should enterprises approach ESG to attract investment capital?

– Integrating environmental, social, and governance (ESG) factors into the investment decision-making process of international funds is a significant and inevitable trend in investment, according to EVS’s assessment. To stay abreast of this ESG integration trend, the company has developed relevant expertise regarding frameworks, analysis tools, and measurement metrics and communicated the profound impact of ESG to clients, businesses, and stakeholders.

Enterprises wishing to embrace ESG should first assess and identify the critical ESG factors for their industry and business. After formulating a strategy (specific commitments), enterprises need to integrate it into their operations and act accordingly.

For example, if a company declares a commitment to governance regarding DEI (Diversity, Equity, and Inclusion), it must apply these principles in building a more independent Board of Directors and management team to enhance decision-making quality based on diverse information. This supports efforts to attract customers and expand into new markets.

If a company adopts DEI as a social commitment, it must implement equitable recruitment policies, engage in community involvement, and have transparent procurement strategies.

Thank you very much, Ms. Linh, for your insights!

The Manh

“Enhancing ESG Disclosure: A Key Imperative for Vietnamese Companies to Attract Foreign Investment, Says Maybank Securities’ CEO”

“ESG is more than just a buzzword for businesses seeking to raise capital in the stock market. This was evident in the sharing session by Mr. Kim Thien Quang, CEO of Maybank Investment Bank, who emphasized the importance of Environmental, Social, and Governance factors in attracting investors. Mr. Quang’s insights shed light on the evolving landscape of capital mobilization, where ESG is no longer an option but a necessity for companies aiming to stay competitive and appeal to modern investors.”

When Will the Vietnamese IB Market Bounce Back?

The Vietnamese IB market was once likened to a land of opportunity, but it has become stagnant in recent years due to various reasons. However, according to Mr. Nguyen Van Quang, Head of Investment Banking at NH Vietnam Securities Company (NHSV), it remains a market with strong long-term potential and could bounce back to life if Vietnam’s stock market is successfully upgraded.

“Effective IR: How Companies Can Sustain Their Allure Post-IPO”

Investor Relations (IR) is about providing transparent and timely information, empowering investors to make informed decisions about their investments in a company and take timely action (buy/sell/hold). It is about giving investors the full picture, both good and bad, to enable them to make astute choices.