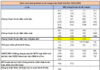

Market liquidity increased compared to the previous trading session, with the VN-Index’s matched trading volume reaching over 598 million shares, equivalent to a value of more than 14.8 trillion VND. The HNX-Index recorded over 57.3 million shares traded, equivalent to a value of more than 947 billion VND.

The VN-Index began the afternoon session on a less favorable note, with selling pressure mounting again, but buying power remained strong, helping the index stay in the green at the end of the session. In terms of impact, CTG, VCB, FPT, and HVN were the most positive influences on the VN-Index, with an increase of over 2.8 points. On the other hand, HPG, VIC, VRE, and SAB had the most negative impacts, but their impacts were insignificant.

| Top 10 stocks affecting the VN-Index on 18/09/2024 (in points) |

Similarly, the HNX-Index also performed quite positively, with positive influences from MBS (+2.55%), SHS (+2%), PVS (+0.5%), and IDC (+0.34%)…

|

Source: VietstockFinance

|

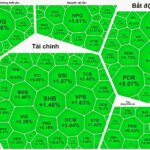

The telecommunications sector was the group with the strongest growth, with a 7.77% increase mainly driven by VGI (+9.76%), CTR (+6.98%), FOC (+2.15%), and ELC (+2.94%). This was followed by the information technology and healthcare sectors, with increases of 1.36% and 0.97%, respectively. On the other hand, the materials sector saw the largest decline in the market, falling by -0.18%, mainly due to HPG (-0.59%), DGC (-0.18%), DCM (-0.4%), and GVR (-0.14%).

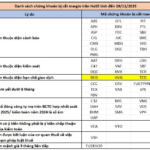

In terms of foreign trading, they continued to net buy over 306 billion VND on the HOSE exchange, focusing on SSI (139.79 billion), FPT (104.58 billion), TCB (53.07 billion), and TPB (52.43 billion). On the HNX exchange, foreign investors net bought over 6 billion VND, focusing on IDC (13.63 billion), PVI (5.53 billion), PVS (3.54 billion), and MBS (2.85 billion).

| Foreigners’ buying and selling activities |

Morning session: Expanding the gain

The market continued its positive recovery trend on a large scale in the morning session of September 18. By midday break, the VN-Index rose sharply by 12.02 points, or 0.95%, to 1,270.97 points; the HNX-Index gained 0.51% to reach 233.49 points. Buyers dominated the market, with 426 stocks rising and 172 falling.

Liquidity this morning also improved significantly, with the trading volume of the VN-Index reaching over 302 million units, equivalent to a value of more than 7.7 trillion VND, an increase of nearly 64% compared to the previous low. The HNX-Index recorded a trading volume of over 30 million units, with a value of nearly 505 billion VND.

Source: VietstockFinance

|

VCB, CTG, and BID are currently the three main pillars positively influencing the market, helping the VN-Index gain more than 4 points. On the other hand, the stocks with the most negative impacts include BCM, NAB, and KDH, but their impacts are insignificant.

All industry groups are currently in the green. Notably, the telecommunications group stands out with a 7.79% increase. Large-cap stocks in this group are surging, including VGI (+9.76%), CTR (+6.98%), FOX (+2.14%), and VNZ (+4.31%).

Following closely are the information technology and healthcare sectors, rising by 1.54% and 1.27%, respectively. Notable gainers in these two groups include FPT (+1.43%), CMG (+3.93%); IMP and FIT hit the ceiling price, LDP (+8.81%), DAN (+9.28%), DVN (+2.72%), and DTP (+1.81%).

In the financial sector, most securities stocks are recording outstanding gains, typically HCM (+5.86%), VDS (+4.65%), VFS (+3.76%), MBS (+3.64%), SHS (+3.33%), and SSI (+3.06%). In addition, most of the “king” stocks are also in the green, contributing significantly to the rise of the overall index, such as VCB (+1.44%), BID (+1.13%), CTG (+3.58%), TCB (+1.32%), STB (+1.68%), SSB (+1.62%),… However, several insurance stocks are experiencing unfavorable trends, notably BIC (-1.29%), PVI (-0.44%), PTI (-2.05%), and AIC (-1.72%). Meanwhile, BVH, MIG, and BMI only edged up slightly by less than 1%.

Foreigners continued to net buy in the morning session, with a value of over 200 billion VND on the HOSE exchange. FPT remained the stock most favored by foreign investors, net bought with a value of over 88 billion VND. In contrast, VPB and KDH were the two codes that foreign investors net sold the most (over 50 billion VND).

10:30 am: Investors’ sentiment continues to improve

Investors’ optimism was maintained after the strong gains in the previous session, helping the main indices stay in positive territory. The VN-Index rose 5.53 points to around 1,264 points, while the HNX-Index gained 0.63 points to trade around 232 points.

The breadth of the VN30 basket was mostly positive. Notably, VHM, FPT, SSB, and MWG contributed 0.99 points, 0.69 points, 0.38 points, and 0.35 points to the VN30 index, respectively. On the other hand, HDB, ACB, HPG, and SHB were still under selling pressure, but their impacts on the index were negligible.

Source: VietstockFinance

|

Telecommunications stocks were in the green from the beginning of the session. Specifically, VGI rose by 5.37%, CTR by 4.74%, FOC by 1.69%, and ELC by 1.47%… In addition, this industry group currently has outperformed the VN-Index since the beginning of the year. Although there has been a significant decline since July 2024, it remains the top-performing sector in the market.

Source: VietstockFinance

|

Following closely, the healthcare sector also contributed to the market’s upward momentum, although the performance remained mixed. Specifically, the recovery was driven mainly by IMP (+6.93%), DCL (+1.12%), DBD (+0.95%), and DVN (+1.95%)… Meanwhile, NDC, PMC, TRA, and DMC remained unchanged, while some stocks continued to face selling pressure, such as DP3 (-0.78%), DTG (-2.02%), and TNH (-0.23%)…

Compared to the opening, buyers still held the upper hand. There were 362 gainers and 173 losers.

Source: VietstockFinance

|

Opening: Caution from the start

At the start of the September 18 session, as of 9:30 am, the VN-Index fluctuated around the reference level, reaching 1,258.09 points. Meanwhile, the HNX-Index edged up slightly to 232.56 points.

The government has just issued Resolution No. 143/NQ-CP dated September 17, 2024, on key tasks and solutions to urgently overcome the consequences of Storm No. 3 (Yagi), quickly stabilize the situation of the people, promote production and business recovery, actively boost economic growth, and control inflation.

The resolution estimates the total property damage caused by Storm No. 3 at over 50,000 billion VND. It is predicted that the storm could reduce the country’s GDP growth rate by about 0.15% compared to the scenario of achieving a growth rate of 6.8-7%. The economic growth rate of many localities such as Hai Phong, Quang Ninh, Thai Nguyen, and Lao Cai… may decrease by more than 0.5%.

As of 9:30 am, large-cap stocks such as GVR, VHM, and GAS led the market with gains of nearly 1 point. On the other hand, stocks such as VCB, ACB, and VPB weighed on the market, dragging the indices down by more than 0.5 points in total.