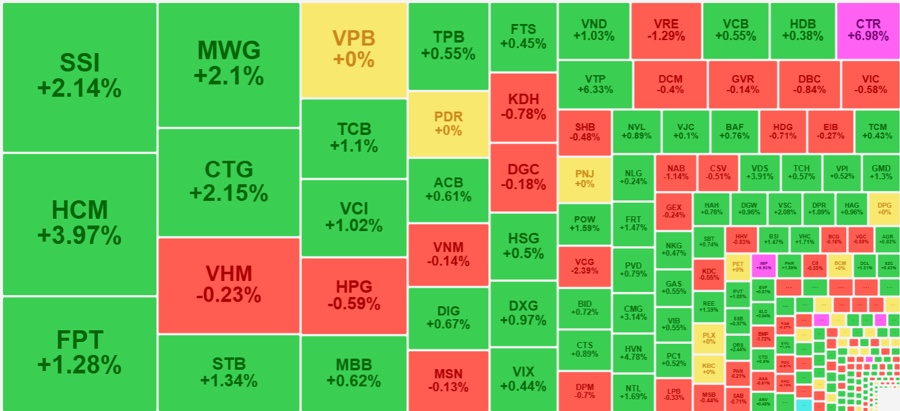

Selling pressure showed signs of increasing in the afternoon session as cheap stocks from the previous session’s adjustment hit accounts, causing many blue-chips to dip and narrowing the VN-Index’s gain. However, money flow remained stable, maintaining a green dominance in stocks. The index closed up 5.95 points (+0.47%), compared to an intraday high of 12.8 points (+1.02%).

Statistics from the VN30 basket showed that 23 stocks declined in the afternoon session compared to the morning’s close, with only 5 stocks advancing. Notably, two key stocks, VIC and VHM, witnessed a significant drop. VIC erased 1.5% of its morning gains and turned negative, closing 0.58% lower. VHM also gave back 1.57% and ended the day 0.23% below the reference price.

Additionally, among the declining stocks in the VN30 group were VCB, which lost 0.87% to end 0.55% higher, BID, which fell 0.4% but still managed a 0.72% gain, CTG, which dropped 1.38% to a 2.15% increase, and MSN, which shed 1.06% to close 0.13% lower…

The afternoon session saw the bottom-fishing stocks from September 16th hitting accounts, and it was at this session that the market hit its bottom. Many stocks witnessed their lowest prices during this adjustment phase at T+. After a strong surge yesterday and further gains this morning, short-term profits enticed a section of investors to take profits or, at the very least, reduce their stock holdings.

Nevertheless, the selling pressure was not overwhelming. Firstly, the afternoon session’s liquidity was relatively low, with the two exchanges matching an additional 7,504 billion VND, a 9% decrease from the morning session. HoSE’s afternoon trading volume was 7,062 billion VND, an 8.7% decline. Typically, the afternoon session witnesses higher liquidity than the morning, and this was the first time in over a month that the opposite occurred.

Secondly, the breadth continued to show a dominant upward trend. The VN-Index closed with 231 gainers and 148 losers. While the number of declining stocks increased significantly from the morning session (85 losers), the majority of stocks merely narrowed their gains. HoSE still had 79 stocks rising over 1%, compared to 94 in the morning. These healthy stocks accounted for approximately 44% of the exchange’s total matched value, indicating that the stocks attracting the most significant money flow were holding their ground and absorbing the profit-taking pressure during the upward trend.

Let’s look at some of the most liquid stocks: SSI, for instance, closed 2.14% higher than the reference price, implying a 1.04% drop from its peak. It traded at a 5-month high with 28.15 million shares and a value of 941.2 billion VND. HCM also fell 2.11% from its peak but still managed a 3.97% gain over the reference price, with a liquidity of 893.7 billion VND, a 7-month high. FPT only lost 0.44% of its peak value, ending 1.28% higher, with a liquidity of 722.8 billion VND. MWG dipped 0.58% but remained 2.1% higher, with a liquidity of 722.1 billion VND… Due to the significant gain margins of the leading stocks, despite the profit-taking pressure, prices held relatively well in the higher range. This indicates a capacity to absorb short-term selling volume.

Naturally, stocks with higher liquidity face more significant pressure due to conflicting trades. Stocks with lower liquidity benefit from price control situations, as seen with CTR, FIT, IMP, ST8, and TSC, which maintained their ceiling prices, and HVN, VTP, ELC, ORS, and others, which witnessed minimal price drops.

Today’s red group included VIC and VHM, along with a few others that experienced relatively strong selling pressure and clear price reversals. VRE closed 1.29% lower after a prolonged slide, resulting in a 3.04% decline from its intraday high. GVR fell 2.2%, reversing to a 0.14% loss, while VCG reversed 2.65% to a 2.39% loss, and DBC reversed 1.51% to a 0.84% drop. However, similar to the advancing group, due to the initial strong gain margins, only a few stocks witnessed deep cuts by the end of the day. Out of the 148 red stocks on the HoSE, only 36 declined by more than 1%, and the majority had low liquidity.

The Vietnamese Stock Market Surges as the Top Performer in Asia on Mid-Autumn Festival

The VN-Index surged by 20 points, marking the strongest gain in over a month. With a 1.59% increase, Vietnam’s stock market boasted the best performance in Asia on September 17th.