In the afternoon trading session, an overwhelming bottom-fishing force emerged and gradually strengthened, turning the electronic board green. Countless blue-chip stocks reversed from red to green, some even posting strong gains, helping the VN-Index quickly surpass the 1,250-point mark and continue its upward trajectory in the final minutes, closing nearly 20 points higher.

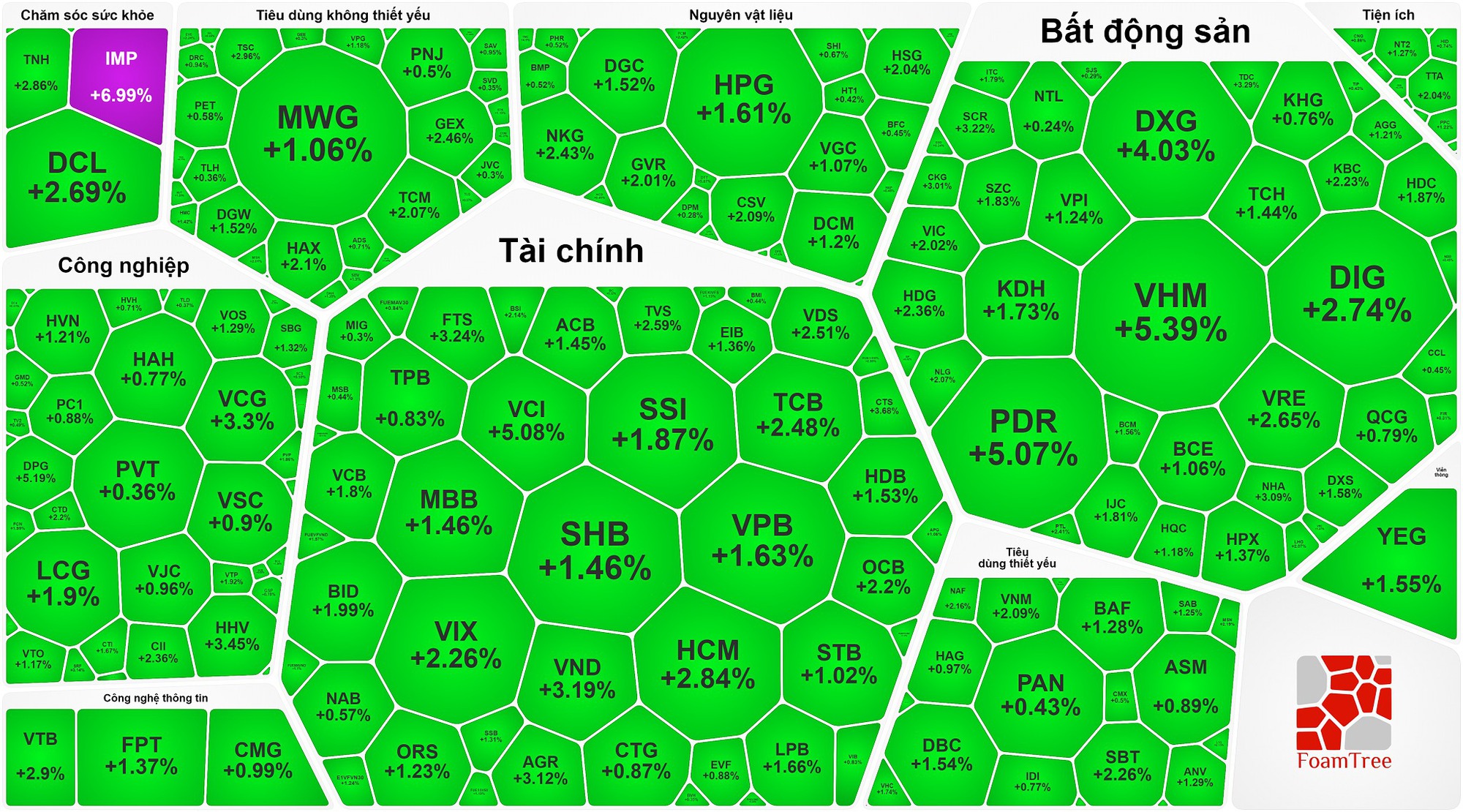

The VN-Index ended today’s session on September 17 with a gain of 19.69 points, or 1.59%, to close at approximately 1,259 points. The HoSE floor saw 312 advancing stocks, 70 stocks unchanged, and 88 declining stocks. Green dominated the VN30 basket with 29/30 stocks in positive territory, with only PLX trading sideways.

A host of stocks surged in the afternoon of September 17

The stock that made the most positive contribution to the index was VHM of Vinhomes, as it accelerated, gaining 5.4% to 44,000 VND with a matching volume of 15.78 million units. It was also the best-performing stock in the VN30 basket and had the highest trading volume among the group. Following suit was VRE, another related stock, which climbed 2.7% to 19,400 VND with over 6 million units traded.

The strong rally of the VN-Index was largely driven by foreign investors. According to statistics, foreign investors net bought 327 billion VND on the HoSE exchange. The stocks that saw the largest net buying by foreign investors were VHM (192 billion VND), FPT (188 billion VND), SSI (45 billion VND), NVL (44 billion VND), and DIG (40 billion VND).

On the other hand, foreign investors net sold MWG (143 billion VND). This was followed by KDH, VPB, DCM, and STB.

Despite the strong rally, trading liquidity remained low, with 632 million shares changing hands, equivalent to a trading value of 13,528 billion VND. The top five stocks attracting the most capital inflows on the HoSE floor were VHM (680 billion VND), MWG (577 billion VND), FPT (350 billion VND), NVL (336 billion VND), and HPG (329 billion VND).

On the Hanoi Stock Exchange, the two indices also closed in positive territory, with the HNX-Index up 1.46 points and the UPCoM-Index up 0.55 points.