|

Source: VietstockFinance

|

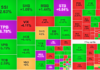

Vietnamese stock market ended on September 19 with a slight increase, partly in response to the performance of other Asian stock markets such as Hang Seng and Nikkei 225. The market also experienced the futures expiration day with some fluctuations but no significant changes in scores.

The late-session rally and the momentum that pushed the index up by more than 6 points today were largely driven by banking stocks, notably SSB surging 7% and contributing 0.77 points to VN-Index. This was followed by VCB with 0.68 points, CTG with 0.39 points, TCB with 0.34 points, and BID with 0.28 points. Additionally, several other stocks such as KBC, VHM, HPG, VIC, and FPT also provided positive support to the index.

| Top 10 stocks impacting the VN-Index on September 19, 2024 (in points) |

In terms of sectors, food and essentials retail witnessed the strongest growth in the market, surging by 8.06%. This was followed by the entertainment and media sector, which rose by 5.09% due to the performance of VNZ increasing by 7.8%. The telecommunications services sector also saw a notable increase of 2.34% thanks to VGI‘s gain of 2.88%.

Foreign investors accelerated their net buying in the latter half of the afternoon session, pushing the total net buying value to nearly VND 402 billion. The majority of this was concentrated in SSI with over VND 274 billion, far surpassing other stocks such as HCM with just over VND 57 billion, VHM with over VND 41 billion, and the fund certificate FUEVFVND with nearly VND 52 billion. On the opposite side, HPG witnessed the strongest net sell-off with a value of nearly VND 74 billion, followed by VND with almost VND 40 billion and VPB with over VND 35 billion.

This result also marked the fourth consecutive session of net buying by foreign investors, which has rarely occurred during the past extended period.

| Top 10 stocks net bought by foreign investors on September 19, 2024 |

14:15: Many Asian markets posted gains, but Vietnam has yet to follow suit

The tug-of-war continued for the VN-Index. As of 14:00, the index had gained 2.87 points to reach 1,267.77, while HNX increased by 0.48 points to 233.43. Meanwhile, the UPCoM was down 0.25 points to 93.22. In contrast, many Asian stock markets recorded more prominent increases.

The market breadth leaned slightly towards gainers. Financial stocks witnessed positive performance with numerous stocks rising, notably SSB surging by 5.13%, SSI climbing by 0.75%, and HCM advancing by 1.33%… Real estate stocks also performed well, with KBC rising by 3.76%, PDR by 2.76%, CEO by 2.6%, and DXG by 1.28%…

In terms of percentage change, the VN-Index was up only 0.23%, significantly lower than the performance of many Asian markets, especially Hang Seng, which climbed by 2.28%, and Nikkei 225, which rose by 2.15%. Additionally, most other major indexes also posted gains, such as Singapore Straits Times, which increased by 1.05%, and Shanghai Com, which was up by 0.71%.

According to the latest updates, the Hong Kong Monetary Authority (China) has followed the Fed’s lead in cutting interest rates for the first time in four years, reducing them by 50 basis points. It is anticipated that central banks in Asia will also follow the Fed’s monetary policy lead and cut interest rates after the Fed’s reduction.

Source: VietstockFinance

|

Morning session: Continuous tug-of-war

The VN-Index started the day on a high note but quickly entered a tug-of-war, even dipping into negative territory at one point, before recovering in the latter half of the morning session. The index concluded the morning session with a gain of 2.22 points, climbing to 1,267.12. HNX also increased by 0.34 points to 233.29, while UPCoM decreased by 0.06 points to 93.41.

The trading value of the three exchanges reached VND 7,486 billion, a notable increase compared to the previous session and slightly higher than the 10-session average.

The market breadth was tilted towards gainers, with 334 stocks rising, including 22 stocks hitting the ceiling price. On the other hand, 263 stocks declined, of which 10 hit the floor price, and 1,009 stocks remained unchanged.

Source: VietstockFinance

|

The slight market gain was largely attributed to VCB, which contributed a significant 0.82 points to the increase. Several other “heavyweights” also made notable contributions, including SSB, VIC, and HPG, each contributing over 0.3 points.

In terms of sectors, entertainment and media witnessed the strongest growth in the market, surging by 8.56%, driven primarily by VNZ‘s increase of 12.94%. However, this sector also included a stock that hit the daily limit down of 15%, namely CAB.

Apart from entertainment and media, the telecommunications and specialized services sectors also performed well, rising by 2.44% and 1.25%, respectively.

Conversely, the sector experiencing the most significant decline was household goods and personal items, falling by 2.52%. No other sector witnessed a decline of more than 1%.

Foreign investors were net buyers of nearly VND 130 billion, but this buying power was mainly concentrated in SSI, with a net purchase value of over VND 151 billion. If this net buying trend continues today, foreign investors will have recorded net buying for four consecutive sessions, which is a rare occurrence in the past extended period.

| Foreign investors’ net buying and selling activities (as of the morning session on September 19, 2024) |

10:30: Enthusiasm waned

Contrary to the initial enthusiasm, the market soon faced corrective pressure and quickly turned red. As of 10:30, the VN-Index reversed to a loss of 0.06 points, falling to 1,264.84, while UPCoM also decreased by 0.22 points to 93.25. The HNX index managed to stay in positive territory, climbing by 0.13 points to 233.08.

The number of gaining and declining stocks was not significantly different, with 291 stocks rising and 258 stocks falling, while 1,057 stocks remained unchanged. This mixed performance was evident among financial stocks, which have a significant impact on the market. While stocks like EIB, TPB, VPB, and SSI rose, others such as VCI, MBB, TCB, and HDB fell.

Foreign investors were net buyers of nearly VND 40 billion, but this buying power was mainly concentrated in SSI, with a net purchase value of over VND 91 billion. Conversely, the selling pressure was weaker but gradually decreased in stocks like VPB, with a net sell-off of over VND 25 billion, HPG with over VND 20 billion, and VND with over VND 16 billion.

Opening: A slight increase in a session expected to be full of fluctuations

Vietnam’s stock market started the day on a positive note, with all three exchanges opening in the green. Today’s market performance is an intriguing topic, as several factors are expected to have a significant impact. The Fed has officially cut interest rates by 50 basis points, causing fluctuations in the US stock market. Additionally, today marks the futures expiration day, and the trial of Truong My Lan and her accomplices is also underway.

As of 9:30 am, the VN-Index had gained 2.33 points to reach 1,267.23, the HNX-Index had climbed by 0.5 points to 233.45, and the UPCoM-Index had increased by 0.06 points to 93.53. Trading liquidity improved compared to the previous session.

Several “hot” events are expected to influence the stock market today.

Globally, US stocks declined in a volatile session after the Federal Reserve (Fed) cut interest rates by 50 basis points. While investors applauded the larger-than-expected rate cut, it also raised concerns that the Fed is trying to get ahead of a potential economic downturn.

In a notable shift in the US monetary policy approach, Fed Chairman Jerome Powell signaled a significant change in the Fed’s focus. Instead of primarily targeting inflation control, the Fed is now considering both aspects of its dual mandate: stable prices and maximum employment.

Asian markets opened on a positive note, with green signals across many indexes such as Hang Seng, Singapore Straits Times, and especially Nikkei 225, which climbed by over 2.6%.

Today’s performance of the Vietnamese stock market is particularly noteworthy, given the questions surrounding the market’s reaction to the Fed’s 50-basis-point rate cut, the futures expiration, and the trial of Truong My Lan and her accomplices.

Looking ahead to the capital flow trend after the Fed’s rate cut, Tran Hoang Son, Director of Market Strategy at VPBank Securities (VPBS), shared his insights. He stated that capital tends to shift from overheated markets to markets with higher growth expectations.

Recently, Southeast Asian and Asian markets have successfully raised capital, notably in Thailand, the Philippines, Malaysia, Indonesia, and India. In contrast, strong selling pressure has been observed in Japan, South Korea, and Taiwan, leading to a divergence among indexes. The positive signal in Southeast Asian markets is expected to attract capital back to Vietnam in the near future, possibly by the end of 2024 or early 2025.

The Art of Liquidity: Why Low Trading Volume Isn’t Always a Bearish Sign

The recent decline in liquidity can be attributed to investors awaiting pivotal monetary policy decisions by major central banks globally, according to KIS Vietnam Securities (KIS Securities). A series of socioeconomic events have also diverted investors’ attention, leading to reduced trading activity.