The upcoming Federal Reserve meeting, scheduled for September 17-18, is anticipated to be one of the most significant events of the year for international financial markets. There are expectations that the Fed will initiate an interest rate cut for the first time since the rate hike cycle that began on March 17, 2022.

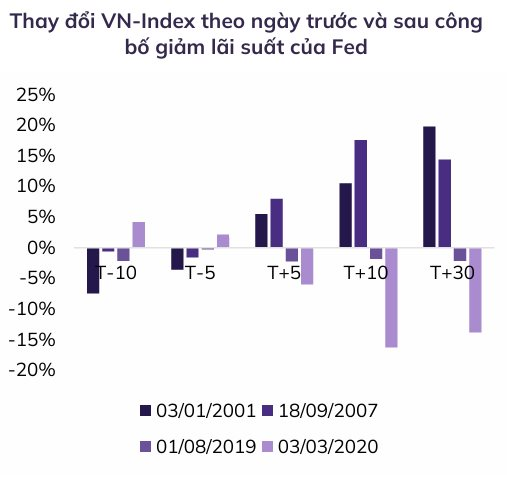

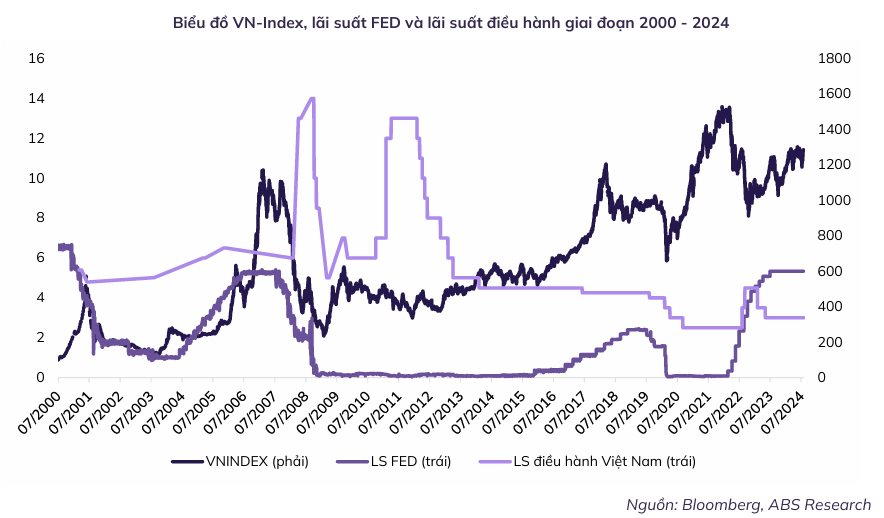

In a recent update, An Binh Securities (ABS) forecasts a 25-basis point cut by the Fed in September. Since its establishment in July 2000, the Vietnamese stock market, represented by the VN-Index, has witnessed a total of four interest rate cuts from the Fed, three of which were significant reductions associated with global economic crises in 2001, 2007, and 2020.

While the overall economic context has impacted the VN-Index, the index’s response has varied across cycles.

Regarding the impact of the Fed’s rate cut on Vietnam, ABS Research indicates that a decrease in USD interest rates would ease pressure on the VND/USD exchange rate and Vietnamese dong interest rates.

This would reduce Vietnam’s foreign currency borrowing costs and help curb inflation caused by exchange rate increases. Additionally, while a lower exchange rate could make Vietnamese export goods less competitive compared to the peak rate, the impact is not expected to be significant. At the same time, confidence in the value of the domestic currency in attracting foreign investment would increase.

ABS also believes that the State Bank of Vietnam will have more room to maneuver monetary policy flexibly when the Fed cuts interest rates. Previously, the high USD interest rates had put significant pressure on the exchange rate.

On the impact of the Fed’s rate cut on the stock market, ABS analysts assess that the banking system’s potential to boost credit and improve liquidity would benefit the economy as a whole and the stock market in particular.

Lower USD interest rates attract international investment to developing countries, which often have significant differences in domestic interest rates compared to USD rates. This is a reversal of the trend observed when USD rates were high, causing investment capital to flow back to the US from emerging and frontier markets.

“Data from the past two weeks shows that foreign investors have been net buyers in some ASEAN markets, such as Indonesia and Malaysia… While they continue to sell in Vietnam, the net selling has significantly decreased in the past two and a half months, and net buying sessions have reappeared,” the report states.

In conclusion, the Fed’s short-term rate cut is expected to have more positive than negative impacts on Vietnam’s economy and stock market. The movement of the VN-Index will be largely influenced by the domestic economy’s intrinsic strength, fiscal policy, and monetary policy of Vietnam.

However, given the openness of Vietnam’s economy and the significant influence of the US economy on the global economy and Vietnam-US economic relations, the specific actions arising from the Fed’s easing policy and the scenario of a hard or soft landing for the US economy will have non-negligible impacts on Vietnam. Investors need to closely monitor developments to make timely evaluations and forecasts.