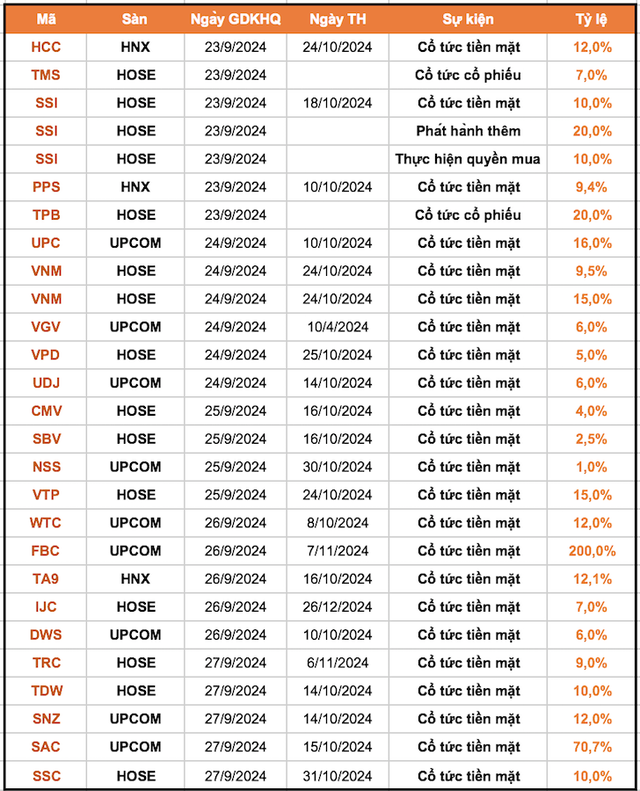

According to statistics, 24 enterprises announced dividend closures for the week of September 23-27. Of these, 22 enterprises paid cash dividends this week, with the highest rate being 200% and the lowest being 1%. In addition, there are 2 enterprises paying stock dividends and 1 enterprise paying combined dividends.

The Board of Directors of SSI Securities Company (code: SSI) announced that September 24 will be the last registration date to close the list of shareholders paying 2023 cash dividends, at a rate of 10% (VND 1,000/share). The expected dividend payment date is October 18, 2024. The ex-dividend date is September 23.

With more than 1.5 billion shares circulating, SSI is expected to spend more than VND 1,500 billion to pay shareholders this time.

Also on September 24, SSI will close the list of shareholders to issue a total of more than 453 million shares. Accordingly, SSI plans to issue more than 302 million bonus shares to increase charter capital from equity; at the same time offering to sell 151 million shares to existing shareholders. The time for registration and payment is from October 7, 2024 to November 4, 2024. The transfer time of the right to buy is from October 7 to October 24, 2024.

At the same time, Fomeco JSC (FBC code) has just announced information about the last registration date to exercise the right to receive 2023 dividends. Accordingly, Fomeco will distribute 2023 dividends at a rate of 200% in cash (VND 20,000/share), the last registration date is September 27, 2024 and will be paid from November 7, 2024. With 3.7 million shares circulating, Fomeco is expected to spend VND 74 billion in dividends.

The generous dividend policy for shareholders comes after the enterprise has just reported large profits in the past year. Although revenue in 2023 reached VND 1,049 billion, down 20% over the same period, profit increased by 10% to nearly VND 73 billion – the highest record ever.

In addition, Vietnam Dairy Products Joint Stock Company (Vinamilk, code VNM) announced that it will close the list of shareholders on September 25 to pay the last dividend of 2023 and advance the first dividend of 2024. The total payment rate is 24.5% in cash, meaning each share receives VND 2,450 (the rate of the last dividend of 2023 is 9.5% and the advance rate of the first dividend of 2024 is 15%).

The payment date is October 24, 2024. With 2.09 billion circulating shares, Vinamilk is expected to spend a total of more than VND 5,120 billion for this dividend.

TPBank Joint Stock Commercial Bank (code: TPB) will issue bonus shares to increase its charter capital by more than VND 4,403 billion.

Accordingly, TPBank increases its charter capital by issuing a maximum of 440.3 million new shares to pay dividends to shareholders, at a rate of 20%. Accordingly, shareholders owning 100 shares will receive 20 newly issued shares. This plan to increase capital was approved by the bank’s shareholders at the 2024 Annual General Meeting of Shareholders. With this issuance, TPBank’s charter capital will increase from VND 22,016 billion to a maximum of VND 26,419 billion.