Legamex’s Private Placement Plan: A Turnaround Strategy?

Legamex’s extraordinary general meeting of shareholders in 2024 approved a private placement plan, aiming to raise capital and address financial challenges. The company plans to offer 4.4 million shares at VND 15,000 per share, a 25% premium to the closing price of LGM shares on September 20, 2024 (VND 12,000 per share). This move is expected to boost Legamex’s chartered capital significantly.

If successful, the capital increase will bring Legamex’s chartered capital to VND 118.4 billion from VND 74 billion. The total amount of capital raised, at the offering price, is expected to be VND 66.6 billion. The company intends to utilize these funds to settle tax liabilities (including overdue interest), repay loans, and clear social insurance debts, with a total of over VND 40.5 billion, VND 18.5 billion, and nearly VND 7.6 billion, respectively. The disbursement is planned to take place over the next two years, in 2024 and 2025.

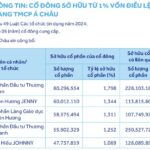

It’s worth noting that the privately placed shares will be restricted for a period of one year. Two investors have shown interest in this offering: Công ty TNHH Dệt may và Thương mại Hà Nam (referred to as Hanoi Textile and Trading), which has registered to purchase nearly 4 million shares, and Mr. Nguyen Hoang Lam, who intends to buy 444,000 shares. Should the transaction be completed, Hanoi Textile and Trading will increase its ownership to 79.17% of Legamex’s capital (equivalent to nearly 9.4 million shares), while Mr. Hoang Lam will become a new significant shareholder with a 3.75% stake.

Hanoi Textile and Trading is the parent company of Legamex, currently holding 72.67% of LGM shares. On the other hand, Mr. Hoang Lam is not related to any existing major shareholders and does not hold any executive position within Legamex.

The year 2024 has seen significant changes in Legamex’s leadership and major shareholders. In May, a group of five large shareholders transferred their collective 72.67% stake in LGM to Hanoi Textile and Trading. It’s worth noting that Hanoi Textile and Trading was only established on March 25, 2024, less than two months before becoming a major shareholder in Legamex. The company primarily operates in management consulting and is headquartered at 265 Dien Bien Phu, Vo Thi Sau Ward, District 3, Ho Chi Minh City.

With a chartered capital of VND 90 billion, Hanoi Textile and Trading is owned by two founding shareholders: Mr. Do Van Huy (born in 1992), holding 80% of the capital, and Ms. Bui Thi Thuy Chung, holding the remaining 20%. Mr. Huy is currently the General Director and legal representative of the company.

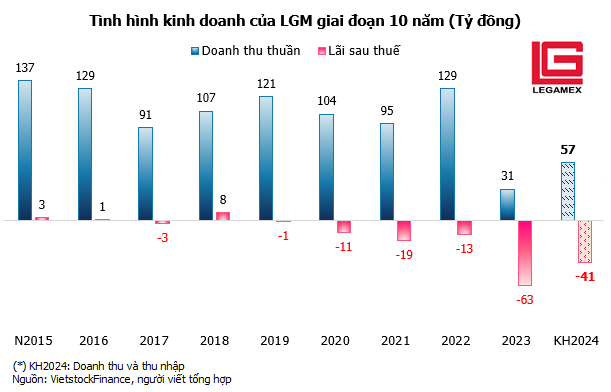

Despite consistently generating hundreds of billions of dong in revenue since becoming a public company in 2007, Legamex has struggled to turn a profit, even incurring losses. The year 2023 marked the fifth consecutive year of losses for the company, with a record loss of nearly VND 63 billion. As of December 31, 2023, Legamex’s accumulated losses exceeded VND 133 billion, and its owner’s equity fell to negative VND 46 billion.

For 2024, Legamex has set a target of nearly VND 57 billion in total revenue but expects a loss of nearly VND 41 billion. The company aims to maintain its existing garment orders, retain its workforce, and await a recovery in the textile industry.

Te Manh