Bond Debt Pressure Forces Bitexco to Sell 100% of Saigon Glory

On September 20th, the representative of Saigon Glory bondholders issued a document regarding the permission for Bitexco Group to transfer secured assets to a Hanoi-based enterprise.

Specifically, the representative of Saigon Glory bondholders agreed to allow Bitexco Group to transfer its secured capital contribution to the new owner, Hanoi-based Dong Phuong Real Estate Company.

This transfer does not change the obligations of Saigon Glory Company to the bondholders and the resolutions previously passed by the bondholders. After the completion of the transfer, the new owner, Dong Phuong Hanoi Company, must mortgage the secured capital contribution at Techcombank (HOSE: TCB) to ensure the obligations of the bonds from SGL-2020.01 to SGL-2020.10.

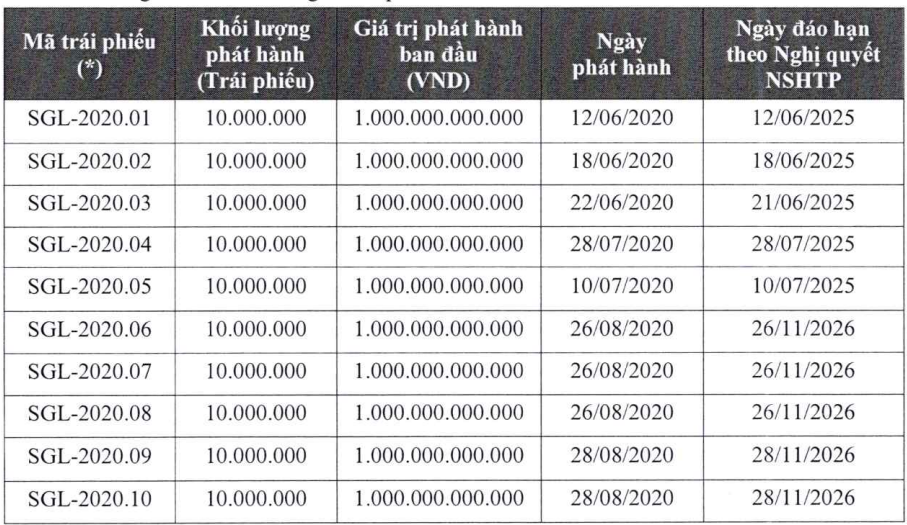

Previously, Bitexco stated that the company owned 100% of Saigon Glory and had mortgaged all secured assets to ensure the obligations of 10 bond packages from SGL-2020.01 to SGL-2020.10 issued by Saigon Glory, with a total par value of 10 trillion VND.

After working with partners interested in the The Spirit of Saigon project to find a long-term solution for Saigon Glory – the project’s investor, Bitexco announced that it had found a common solution with its partner. As a result, the Group proceeded to sell and transfer the secured assets, which are the capital contributions. The new owner will then mortgage the capital contributions in accordance with the bondholders’ resolution on December 4th, 2020.

Bitexco and Dong Phuong Hanoi Company have agreed that Bitexco will continue to fulfill its obligations to pay the principal and interest of 10 Saigon Glory bond packages from September 1st, 2024, to the last period on June 12th, 2025, and the interest payment on June 18th, 2025, according to the bond principal and interest payment schedule in the bondholders’ resolution on February 5th, 2024.

Dong Phuong Hanoi Company will continue to fulfill its obligations to pay the principal amount due on June 18th, 2025, and the obligations to pay the principal and interest of the 10 bond packages from June 18th, 2025, onwards, in accordance with the schedule specified in the resolution on February 5th, 2024.

|

Saigon Glory’s Bond List

|

Regarding the secured asset of 100% capital in Saigon Glory, after a successful transfer, Dong Phuong Hanoi Company will mortgage the capital contribution again to continue guaranteeing the bond obligations. For the secured asset that is a future asset attached to the land, belonging to Tower A, which comprises the office and hotel components of the The Spirit of Saigon project, it will remain as a secured asset as per the real estate mortgage contract signed between Saigon Glory and Techcombank on March 16th, 2021.

In addition to inheriting and fulfilling Bitexco’s obligations regarding bond payments from June 18th, 2025, onwards, the new owner of Saigon Glory stated that, as the project’s acquirer, the company will request Techcombank, as the credit institution, to consider providing financing for the company to execute the project as per legal regulations.

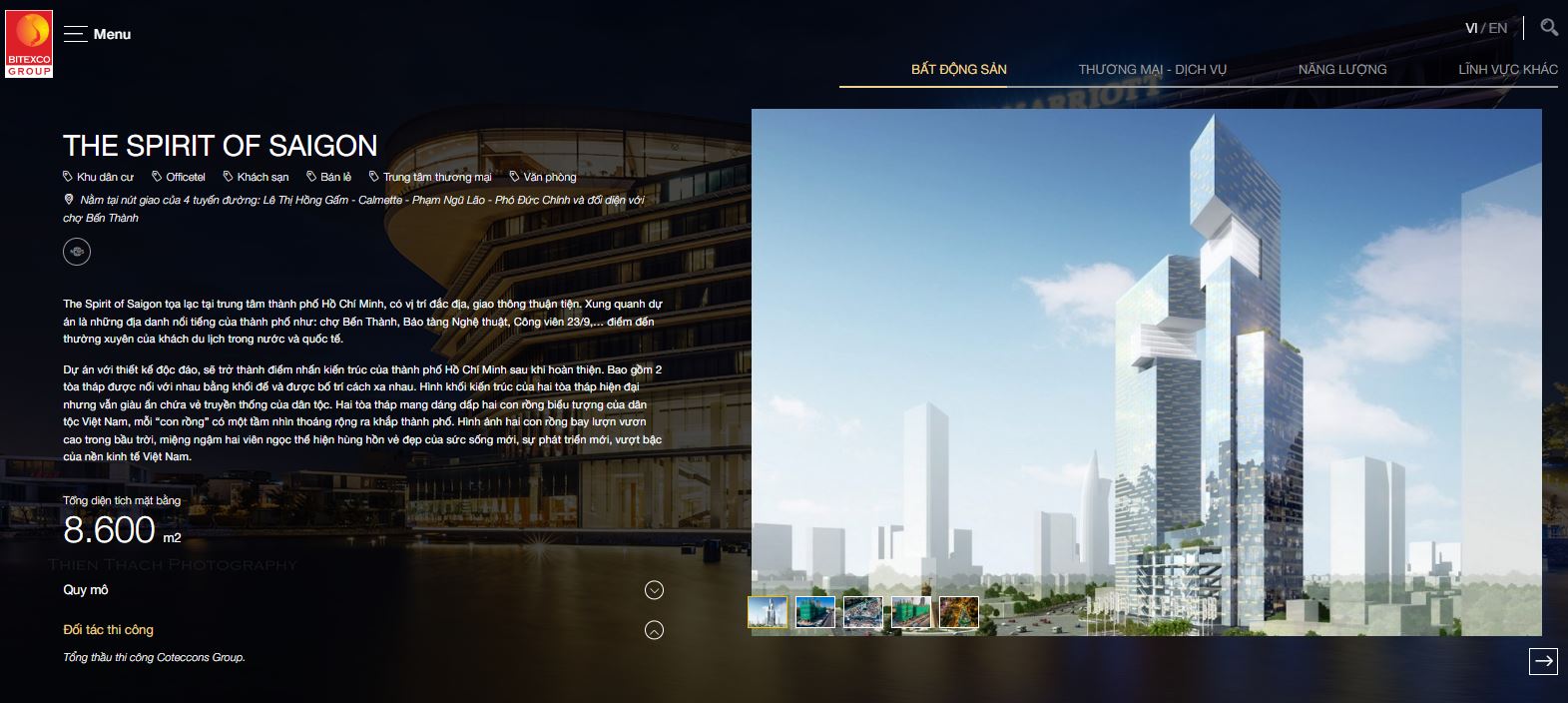

The Spirit of Saigon, a long-delayed project in the heart of Ho Chi Minh City. Photo: Tien Vu

|

The Project’s Troubled History

One Central (formerly known as The Spirit Of Saigon) is a 6-star office, commercial, service, residential, and hotel complex located in the “super-block” of four major streets: Le Thi Hong Gam, Calmette, Pham Ngu Lao, and Pho Duc Chinh, directly across from Ben Thanh Market and next to the Metro Line 1 station. The land area covers 8,537.4 square meters.

The project was initially owned by Bitexco Group with an investment of 50 million USD. In 2013, construction was halted for several years before being transferred to Masterise Homes and renamed One Central HCM. In early 2022, the construction fence displayed a new investor, Viva Land, and a new project name, Pearl.

According to the original design, the project was to be 224 meters tall, consisting of two towers connected by a retail podium. The 55-story West Tower was to include 37,400 square meters of Ritz Carlton hotel space with 250 rooms and 17,800 square meters of Class A office space. The 48-story East Tower was to feature 58,400 square meters of luxury residential space across 350 units.

Following the events at Van Thinh Phat, Viva Land removed all information about the project from its website. In November 2022, the project’s original name and owner, Bitexco, resurfaced. And in September 2024, faced with bond debt pressure, Bitexco announced the transfer of the project to Dong Phuong Hanoi Company as mentioned above.

The Spirit of Saigon reappeared on Bitexco’s website after Viva Land withdrew from the project. Screenshot

|

According to the latest registered secured transaction contract in April 2023, Saigon Glory mortgaged the One Central project to two legal entities: Masterise Agents Brokerage Company Limited and Hung Phat Invest Hanoi Joint Stock Company.

Bitexco’s website has since “erased” all information about this super-block project and Saigon Glory, indicating that the Group has completely withdrawn from it.

The Spirit of Saigon is no longer listed among Bitexco’s real estate projects. Screenshot

|

Information about Saigon Glory and The Spirit of Saigon is completely absent from Bitexco’s website. Screenshot

|

|

Masterise Agents Brokerage Company Limited was established in February 2020 in Ho Chi Minh City, with its main business lines being real estate consulting, brokerage, and auction. Its initial chartered capital was 20 billion VND, and Mr. Tran Quoc Hoai served as the Director. After several changes, in August 2024, the newest Director is Mr. Tran Hoai Viet Anh. Hung Phat Invest Hanoi Joint Stock Company was established in 2016 in Hanoi, with Ms. Hoang Kieu Thu as the Director. In 2018, the company merged with Hai Binh Trading and Investment Joint Stock Company (headquartered in Capital Tower, 109 Tran Hung Dao, Cua Nam Ward, Hoan Kiem District, Hanoi), with Ms. Nguyen Thi Thu Nhung as the Chairman and Director. In March 2019, Mr. Chan Min Simon (Chinese nationality) became the Director. In December 2019, the company’s chartered capital reached 3,070 billion VND, and the owner was Hung Thinh Invest Hanoi Joint Stock Company, with Ms. Nguyen Thi Thanh Tuyen as the Chairman of the Members’ Council. The position of Director and legal representative of the company has changed several times, including Mr. Ng Wen Shyan (Singapore), Pham Thi Van Giao, Nguyen Hong Phong, Lai Thuy Dan Thanh, and currently Mr. Ngo Quoc Tuan (born in 1996). |

Profile of the New Owner

Dong Phuong Hanoi Real Estate Company Limited was established in May 2019 in Hanoi, with its main business lines being investment and construction, trading and service, and real estate business. Its initial chartered capital was over 517 billion VND, with Dong Phuong Investment and Trading Real Estate Company Limited holding 50% and Mr. Pham Quoc Nhat (serving as the Director) owning the remaining 50%. In June 2019, the company increased its capital to 1,200 billion VND, with Dong Phuong Company holding 58.653% and Mr. Nhat owning 41.347%. In April this year, Mr. Nhat’s position and capital contribution were transferred to Ms. Tran Thi Minh Hieu, and Dong Phuong Company’s capital contribution was transferred to Eastern Real Investment Company Limited.

Eastern Real Investment Company Limited is a newly established company in January this year, headquartered in Thao Dien Ward, Thu Duc City, Ho Chi Minh City, with its main business line being real estate. Its chartered capital is over 1,522 billion VND, owned by two individuals residing in Hanoi: Ms. Vu Thi Phuong Thu holds 99.999%, and Mr. Ho Thu (serving as the Director and legal representative of the company) holds 0.001%.

In 2019, Dong Phuong Hanoi Company was permitted by the Hanoi People’s Committee to acquire a part of the Tay Mo – Dai Mo – Vinhomes Park new urban area project from Thai Son Construction and Investment Joint Stock Company. This project is now being developed as Masteri West Heights within the smart city of Vinhomes Smart City.

Ms. Vu Thi Phuong Thu is also the Director of Parkland 53 Joint Stock Company, which was established in 2015 in Thu Duc (former District 2) with an initial chartered capital of 20 billion VND. Mr. Anthony Raymond Cheng (Canadian nationality) was the initial legal representative. In November 2015, the company increased its capital to over 360 billion VND, with Jenvilas Inc. (headquartered in Hong Kong) as the owner. Subsequently, the owner was changed to Dong Phuong Investment and Trading Real Estate Company Limited. Currently, the company’s chartered capital has been raised to over 640 billion VND, with Ms. Thu serving as the Director and legal representative since February 2023.

Parkland 53 is the investor of the Parkland 53 residential and commercial center project in An Phu Ward, Thu Duc City, with a land area of 11,615 square meters and an investment capital of over 2,300 billion VND.

Bigwig Vu Quang Bao Removed from the List of Legal Representatives of Energy Companies

Thu Minh

“BB Sunrise Power Plagued by Losses, Negative Equity Exceeds VND 200 Billion”

BB Sunrise Power, owned by Chairman Vu Quang Bao, reported a loss of over 134 billion VND in the first half of 2024, with a negative equity of 222 billion VND. The company is facing financial challenges, and its future remains uncertain. With losses continuing to mount, the company’s survival hangs in the balance.

“A Troubling Loss for My Khanh Development Investment: $164 Million in Tax Losses”

Investment and Development Company My Khanh suffered a loss of 164 billion VND in the first half of 2024, compared to a loss of 1 billion VND in the same period last year. Notably, its debt soared to 2,590 billion VND, an alarming 36 times its equity.