Specifically, Ha Long Bay Hotel failed to send information disclosure content to the Hanoi Stock Exchange (HNX) for the following documents: Status of the use of proceeds from bond issuance for bonds with outstanding debt audited by qualified audit organizations in 2022.

At the same time, the company sent information disclosure content to HNX late for the following documents: 2021 Financial Statements, Report on the use of capital sources from bond issuance in 2021, Bond interest and principal payment situation in 2021, 2022 Semi-annual Financial Statements, Status of the use of capital sources from bond issuance in 2022, Status of the implementation of the commitments of the issuing organization to bondholders in 2022, 2022 Financial Statements, Bond interest and principal payment situation in 2022.

Ha Long Bay Hotel was established in late 2011 with a charter capital of nearly VND 121 billion and mainly operates in the field of short-term accommodation services. The company is located on Ha Long Road, Zone V, Bãi Cháy Ward, Ha Long City, Quang Ninh Province. The legal representative and Chairman of the Board of Directors is Mr. Nguyen Ba Tien.

Mr. Tien is also the representative of a number of other enterprises such as Global Financial Investment Consulting Joint Stock Company; Vietnam Tourism Joint Stock Company – Hanoi; TWX Vietnam Co., Ltd…

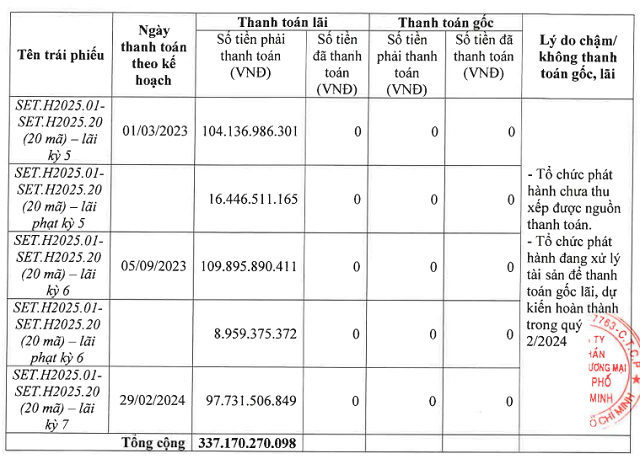

In terms of business results, for the first 6 months of 2024, Ha Long Bay Hotel recorded a post-tax loss of VND 944 million, decreasing from a loss of VND 1.4 billion in the same period last year.

Financial indicators for the first 6 months of 2024 of Ha Long Bay Hotel. Source: HNX

|

As of June 30, 2024, Ha Long Bay Hotel’s owner’s equity was VND 143.4 billion, up 8% over the same period. The debt-to-equity ratio was 6.81 times, equivalent to a total debt of nearly VND 977 billion, of which nearly VND 250 billion was bond debt.

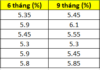

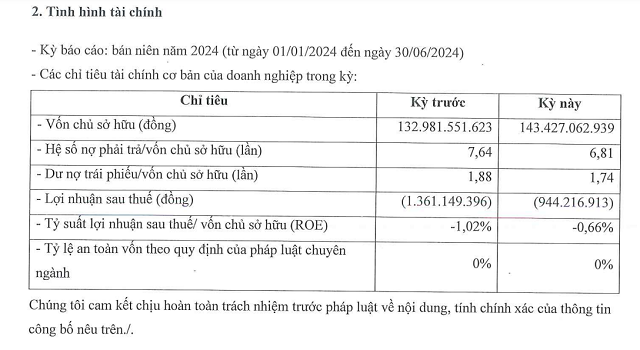

This is the outstanding debt of the company’s only circulating bond with the code HLHCH2125001, issued on August 02, 2021, with a term of 48 months, an interest rate of 11%/year for the first 2 interest calculation periods and then floating. In the first half of 2024, the Company paid more than VND 12.8 billion for principal and interest of the above bond.

The VND 250 billion bond proceeds were supplemented by Ha Long Bay Hotel for the The Holiday Ha Long project. The project was approved in principle by the Quang Ninh Provincial People’s Committee on April 26, 2019, with an initial scale of over 4,100m2. After adjusting the policy on March 25, 2020, the project area increased to 5,502m2, of which 1,363m2 was added for greenery and landscaping, then handed over to Ha Long City for management.

The Holiday Ha Long project is constructed by the General Contractor Ricons. Photo: Ricons

|

The Holiday Ha Long project includes a 39-story tower, expected to provide 156 hotel rooms and 510 condotel apartments, from studio apartments to duplex apartments. The total investment of the project is VND 800 billion, in which 20% (VND 160 billion) is the owner’s capital and 80% (VND 640 billion) is legal loan capital and mobilization capital.