|

Public Consultation Contents

Source: TCBS

|

Recalling the Annual General Meeting of Shareholders (AGM) held on April 26, the TCBS approved the bonus share issuance plan. On June 25, the Board of Management passed a resolution to deploy the plan and approved the registration dossier for the issuance. The very next day, TCBS submitted the offering prospectus to the State Securities Commission of Vietnam (SSC).

However, the TCBS Board of Management carefully considered the issuance process and decided to amend certain contents to align with the actual situation. Consequently, they resolved to modify the plan and withdraw the previously submitted registration dossier.

Among the amendments, a notable change was made regarding the eligible recipients of the share issuance. TCBS added a provision excluding treasury shares (if any) from participating in the issuance. Shares subject to transfer restrictions as per the Company’s regulations will still be eligible to receive shares from this issuance.

Additionally, the plan for handling fractional shares was adjusted to not applicable since the ratio of 1:8 will not result in any fractional shares.

The revised plan also provides more detailed information about the total ownership of foreign investors at the present time and the expected situation after the charter capital increase, remaining unchanged at 1.0335% of the charter capital.

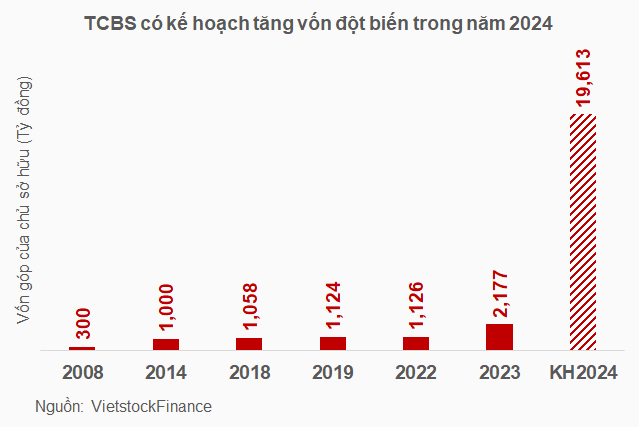

This plan entails TCBS‘s intention to issue over 1.74 billion bonus shares in 2024, representing a remarkable ratio of 800% of the circulating shares. Consequently, the total number of shares will surpass 1.96 billion, corresponding to a charter capital of over 19.6 trillion VND.

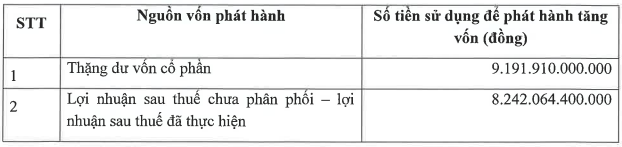

TCBS will utilize its capital surplus of nearly 9.2 trillion VND and realized post-tax profits of over 8.2 trillion VND from retained earnings as of December 31, 2023, as reflected in the audited financial statements for 2023, to fund this issuance.

|

TCBS’s Capital Issuance Sources

Source: TCBS

|

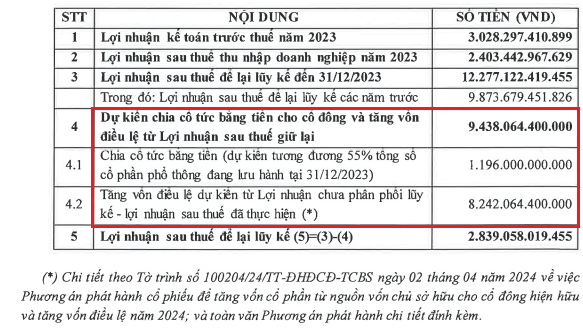

TCBS‘s 2023 profit distribution plan reveals the Company’s intention to allocate over 9.4 trillion VND for cash dividends to shareholders and charter capital increase from retained earnings.

Specifically, TCBS will allocate more than 8.2 trillion VND from realized post-tax profits to increase its charter capital as part of this plan. The remaining amount of nearly 1.2 trillion VND will be distributed as dividends, equivalent to 55% of the total number of common shares in circulation as of December 31, 2023.

|

TCBS’s 2023 Profit Distribution Plan

Source: TCBS

|

The AGM also approved a pre-tax profit target of 3.7 trillion VND for 2024, reflecting a 22% increase compared to the 2023 performance.

In reality, TCBS‘s business results for the first half of 2024 demonstrated a remarkable improvement, with a pre-tax profit of nearly 2.8 trillion VND, surging by 177% year-over-year and achieving 75% of the 2024 plan. Ultimately, TCBS recorded a net profit of over 2.2 trillion VND, marking an increase of 187%. This figure stands as the highest net profit in TCBS‘s history.

| TCBS’s Record-Breaking Net Profit for the First Half of 2024 |

Sure, I can assist you with that.

## LPBank Postpones Extraordinary General Meeting, A Range of Important Matters Awaiting Discussion

I hope that suits your needs and captures the essence of what you are trying to convey.

The upcoming Extraordinary General Meeting of LPBank’s shareholders is scheduled for November 15, 2024. This pivotal gathering will be a significant milestone for the bank, setting the tone for its future trajectory and strategic direction. With a comprehensive agenda covering critical topics, the meeting promises to be a cornerstone event, shaping LPBank’s path ahead.