In the Vietnamese convenience store market, GS25 is a well-known name, despite only operating in Ho Chi Minh City and its neighboring provinces.

This chain operates on the model of GS25 in South Korea and is brought to Vietnam by GS Retail Korea and Son Kim Retail, a member of the Son Kim Group.

As of June 2024, GS25 Vietnam has opened its 300th store, and this is the first one built on a special scale.

The familiar image of GS25 is that of small stores under 100m2, single-story, and offering takeaway services.

Meanwhile, its competitor, Circle K, is famous for its combination of takeaway services and seating for self-service dining. Especially with the option to “dine-in” all night long as it operates 24/7, Circle K attracts a large number of young customers, including students and university students.

The 300th GS25 store is 392m2, has 2 floors, and is located on Dien Bien Phu Street, near an area with many major universities in Ho Chi Minh City.

With a scale 2 to 3 times larger than a typical convenience store, GS25 provides 20 tables on the 2nd floor for customers, along with a self-service counter that includes a microwave, hot water dispenser, and a bookshelf for young people to read.

Image: GS25’s 300th store is located on Dien Bien Phu Street, an area with many universities such as Hutech, Foreign Trade, and Hong Bang…

Image: The VN300 store is 3 times larger than a typical store.

Image: There are 3 tables downstairs for on-the-spot self-service.

Image: GS25-branded beverages.

Image: For the first time, a convenience store has installed 2 microwaves for customers to self-serve and heat up their food.

Image: 2nd floor of GS25 VN 300, featuring a bookshelf and 20 dining tables.

Image: GS25’s 300th store on Dien Bien Phu Street, 3 times larger, 2 stories with a spacious and convenient self-service dining area.

Downstairs, with a larger area, GS25 also has 3 standing tables and a Twisted Bread store – known as a project resulting from the collaboration between GS25, the Ministry of Agriculture, Food, and Rural Affairs, and the domestic small business brand Bontemps, which specializes in doughnuts and coffee.

This is the first store of its kind in Vietnam since the tripartite agreement was signed in April to support the export of K-food. GS25 also has a beverage counter with its own brand and serves Korean-style dishes.

In reality, the large-scale GS25 store is very busy, especially during lunchtime, when the 2nd floor is packed with groups of students gathering to study or work on group projects…

Image: A typical GS25 store, still located on the frontage but with a small area.

Image: Typical GS25 stores only have the ground floor.

Image: Typical GS25 stores usually do not have dine-in areas.

Thus, after many years, GS25 is showing strong signs of reinvestment. Known as one of the “younger siblings” in the market, having only appeared since 2018, GS25 initially experienced rapid growth.

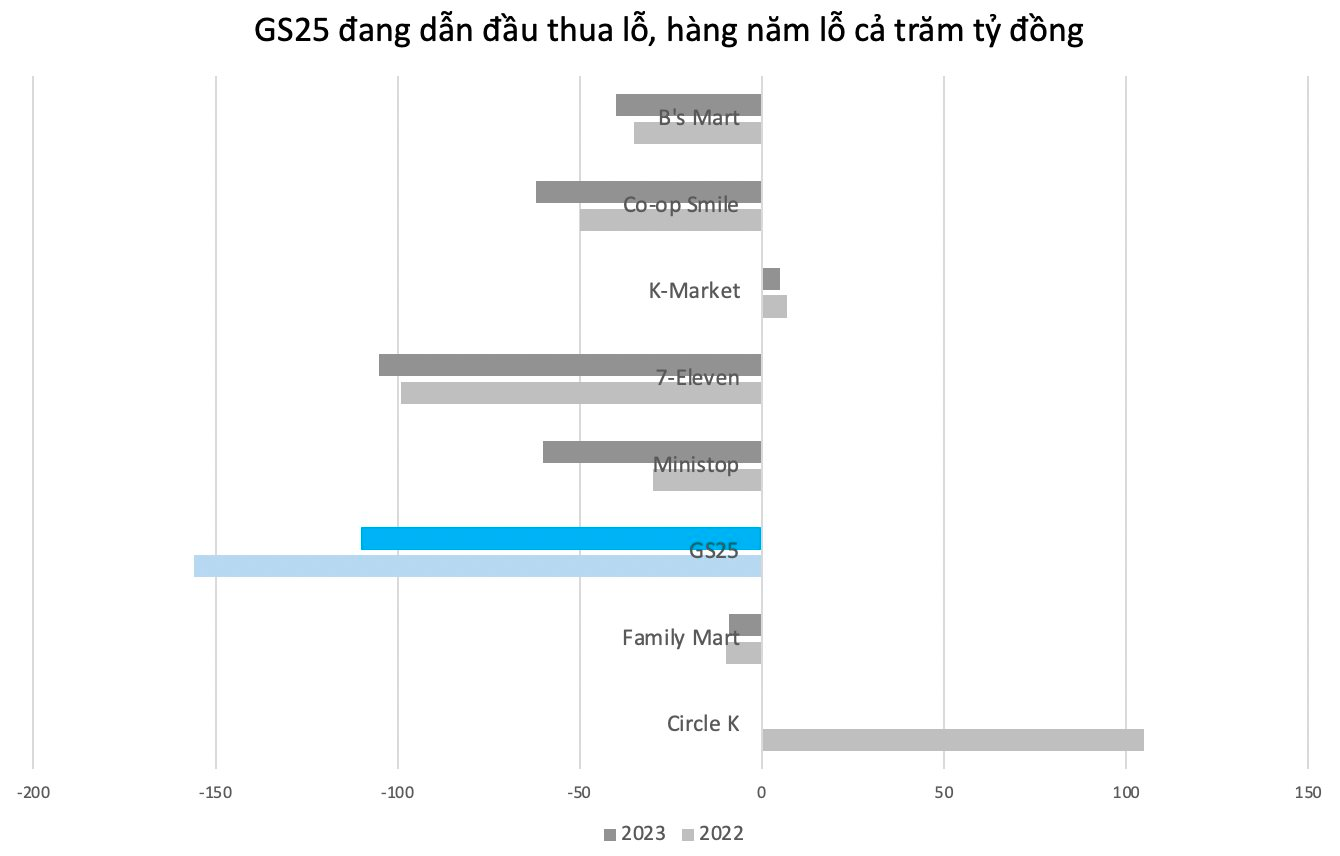

GS25 is currently leading in losses with hundreds of billions each year, with a peak of half a billion VND in losses per day in 2022

The target customers of GS25 convenience stores are young people, office workers, and busy individuals who need quick and convenient services. Therefore, their prominent products include ready-to-eat food such as boxed meals, noodles, sandwiches, takeaway drinks, fruits, and fresh vegetables.

GS25 once announced a plan to open more than 2,500 stores within 10 years (including through franchising). The “money-burning” strategy for the convenience store business has caused continuous losses for GS25, despite steady revenue growth in the 2021-2023 period, reaching over 1,500 billion VND in 2023 (up 23% from the previous year).

In 2021, the unit lost 153.5 billion VND. In 2022, GS25 lost an additional 167 billion VND. And in 2023, the brand even led the way in losses compared to its competitors, with 100 billion VND in losses.

Due to these losses, the owner’s equity at the end of 2022 of the managing company in Vietnam decreased by more than 41% to 191.5 billion VND. The debt-to-equity ratio increased significantly, from 0.42 to 2.13 when the enterprise issued bonds.

Image: In 2022, GS25 averaged a loss of half a billion VND per day.

In reality, the retail chain market always faces fierce competition, with most players incurring losses.

Backed by 2 giants: GS Retail Korea and Vietnam’s Son Kim

GS25 is a convenience store brand of GS Retail Korea Group, established in 1990. The name GS25 is an abbreviation of the GS Retail Korea Group’s name, and the number 25 signifies 24 hours + 1 hour for dedicated service = 25. As of January 2019, GS25 has become the number one convenience store brand with 14,000 stores, according to information on the company’s website.

In early 2018, GS25 was launched in the Vietnamese market through a joint venture between GS Retail Korea Group and Son Kim Group. Specifically, CVS Holdings, a subsidiary of Son Kim Retail – a unit of Son Kim Group, holds 99% of the capital – contributed 70% of the capital to GS Retail Vietnam Joint Venture Company. This company owns GS25 Vietnam Company Limited, which owns and operates the GS25 convenience store chain.

According to the agreement, GS Retail holds 30% of the joint venture, and Son Kim holds 70%. GS Retail will provide the joint venture with the right to use the brand name, management experience, and convenience store operation. In return, the joint venture will pay royalties and retail profits to GS Retail, corresponding to a 30% stake.

Regarding Son Kim, it is a multi-sector business group in Vietnam, including real estate (Son Kim Land), commercial trading, services, catering, and restaurants (Son Kim Retail), pharmaceuticals (Nanogen-Bio), interior design (Duy Quân), tea and coffee (Golden Mountain), fashion production (VERA), online sales, and television channels (GS.SHOP).

In Son Kim’s ecosystem, Son Kim Land stands out for its focus on limited-edition luxury real estate. In addition, Son Kim Land also operates in the hotel and office sectors.

In the fashion segment, Son Kim is a fashion franchising company with brands such as Vera, Jockey, and Dickies…

Finally, in the F&B segment, this discreet enterprise owns several high-end restaurants and franchises the Japanese culinary brand Watami.

The Great F&B Expansion: Vietnam’s Culinary Conquests Abroad

The influx of international F&B brands into Vietnam has been a well-observed phenomenon, but the reverse journey has proven challenging for Vietnamese brands looking to conquer the global market.

The International Food and Beverage Ingredients Exhibition

The food and beverage (F&B) industry in Vietnam is a key driver of economic growth and food security in the country, and the F&B ingredients sector plays a pivotal role in this success story. With an impressive average annual growth rate of 10-12%, the F&B ingredients industry has become a powerhouse, fueling not just the economy but also ensuring that Vietnam’s food security needs are met.