Services

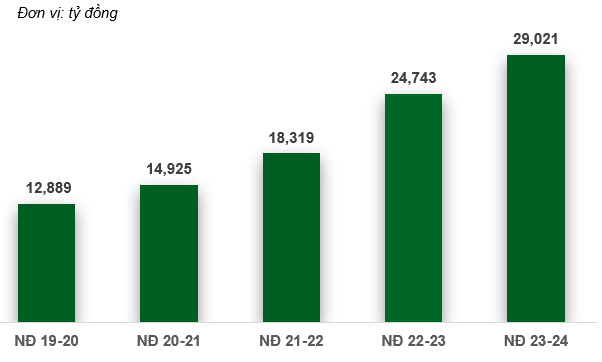

TTC AgriS, HOSE: SBT, concluded the 2023-2024 fiscal year with outstanding results, surpassing the targets set by the Annual General Meeting of Shareholders. The company achieved net revenue of VND 29,021 billion, a 17% increase from the previous year and 41% above the annual plan. Pre-tax profit reached nearly VND 908 billion, a 26% increase, exceeding the plan by 7%. After-tax profit grew impressively by 33% to VND 806 billion compared to the previous year.

Sugar products accounted for the highest proportion of the company’s revenue structure, at over 91.5%. However, TTC AgriS continued to witness a significant shift in its revenue structure towards other products. Specifically, revenue from molasses grew impressively by over 120%, contributing VND 798 billion, or 2.8%, to total revenue. Electricity sales revenue exceeded VND 268 billion, a 17% increase, accounting for nearly 1% of total revenue. Fertilizer revenue saw a slight increase of 8% from the previous year, contributing VND 291 billion, or 1%, to the total revenue. The remaining areas, including machinery, other agricultural products such as coconut, banana, rice, and rubber, as well as natural nutritional drinks like coconut water, sugarcane juice, and pure sugarcane juice, also recorded a 10% growth to over VND 1,000 billion, making up 3.8% of the revenue structure.

TTC AgriS’s revenue has consistently grown over the years, aiming for VND 60 trillion in revenue by 2030.

|

Sugar consumption volume surpassed 1 million tons, with the domestic channel accounting for 66% and exports contributing 34%. For domestic consumption, the B2C and trader channels witnessed robust growth, increasing by 22% and 18%, respectively, compared to the previous year, further solidifying TTC AgriS’s leadership position. The B2B channel maintained its strong performance, holding a similar proportion to the previous year in the consumption volume structure.

As of June 30, 2024, TTC AgriS’s scale continued to expand, with total assets growing significantly to VND 34,078 billion, a more than 14% increase from the beginning of the fiscal year. This reinforces the company’s strong financial position. The current ratio improved to 1.22, up from 1.17 in the previous year. The company also aims to accelerate financial restructuring to ensure a robust financial statement and align with its sustainable development strategy.

The new Chairman of TTC AgriS (SBT) affirmed the VND 60,000 billion revenue target.

On July 13, 2024, the Board of Directors of TTC AgriS unanimously elected Ms. Dang Huynh Uc My as the new Chairman of the Board of Directors. Ms. My has been a key member of the TTC AgriS leadership team for many years and played a pivotal role in the company’s successful transition from a traditional to a smart and sustainable agricultural business model.

In her new role, Ms. Dang Huynh Uc My, along with the company’s management team, is committed to focusing their efforts on developing a sustainable agricultural economic model to achieve the revenue target of VND 60,000 billion by 2030. The Circular Commercial Value Chain will be the nucleus for TTC AgriS’s business transformation in this new phase of development.

The new Chairman of TTC AgriS, Ms. Dang Huynh Uc My, affirmed her determination to achieve the VND 60,000 billion revenue target.

|

Recently, TTC AgriS officially announced the appointment of Mr. Thai Van Chuyen as the new General Director, the reappointment of Ms. Doan Vu Uyen and Mr. Tran Quoc Thao as Deputy General Directors, and the appointment of Ms. Nguyen Thi Phuong Thao as a new Deputy General Director.

Mr. Thai Van Chuyen, the new General Director of TTC AgriS, brings over 22 years of experience in various fields, including agriculture, renewable energy, tourism, and real estate. He is expected to drive the modernization of TTC AgriS and help the company conquer the global agricultural value chain. This appointment comes at a pivotal moment as the company celebrates its 55th anniversary and continues on its path of sustainable growth.

Ms. Nguyen Thi Phuong Thao has over 15 years of experience in financial management in the fields of construction, real estate, investment, and agriculture. She will contribute to the company’s financial strategy and ensure alignment with the business and growth goals set by the Board of Directors.

Firmly adhering to its culture and vision of “Putting People at the Center of Development,” the Board of Directors of TTC AgriS considers human resource development as an integral part of its corporate strategy. As a result, TTC AgriS is committed to upgrading its talented workforce to facilitate the successful operation of its smart integrated agricultural economic model. The changes in the organizational structure of TTC AgriS at this juncture are deemed timely and in line with the strategy of operating a transformation model based on the Circular Commercial Value Chain.

Foreign investors increase their holdings in SBT, focusing on ESG criteria.

On July 25, 2024, Legendary Venture Fund 1 (Legendary), a foreign investment fund based in Singapore, completed the purchase of a total of 60.8 million SBT shares, equivalent to an 8.21% voting ratio, bringing its total ownership to 15.71%, or over 116.3 million shares. Prior to this, the fund held more than 55.5 million shares, representing a 7.5% stake.

As of July 23, 2024, the ownership ratio of foreign shareholders in TTC AgriS continuously increased, reaching 21%, a 73% rise compared to the beginning of the year. Recently, SBT has consistently been among the top stocks with the highest net foreign buying, along with MWG, PVS, MBB, and HPG.

The market trend is shifting as macroeconomic factors such as interest rates, exchange rates, and monetary policies have significantly impacted the global capital restructuring actions of foreign investors. Foreign capital inflows into Vietnam are now more cautious and selective, focusing on sustainable development enterprises that meet ESG standards.

TTC AgriS is recognized among the top 500 most profitable enterprises in Southeast Asia by Fortune (USA) for the first time.

|

TTC AgriS is currently one of the pioneering enterprises in Vietnam in upgrading and standardizing its corporate governance system based on sustainable development, applying ESG criteria across all governance, production, and business activities, and striving to improve its governance framework to meet stringent international standards. As a result, the company has become an attractive destination for foreign investors seeking opportunities in Vietnam.

The Capital Stampede: A Rush to Invest

The market witnessed a strong comeback today (September 25th) with the VN-Index surging over 10 points at the closing bell. Domestic and foreign investors ramped up their buying activity, pushing the benchmark index towards the old peak of 1,300 points.