According to the Vietnam Real Estate Brokers Association, the experience of other countries shows that credit policy is one of the essential tools for governments to regulate the real estate market. Many of the policies successfully implemented by other countries can be referenced, learned from, and applied in Vietnam.

Based on the lessons learned from these countries, the Brokers Association proposes several credit policy solutions to regulate the market when there is a fluctuation of more than 20% in three months or when there are other real estate market fluctuations that impact socio-economic stability without affecting the demand for housing from citizens.

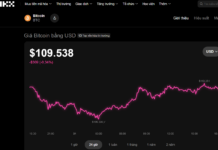

Real estate prices are soaring. |

The Association proposes tightening credit policies for speculators. Specifically, to reduce the number of people borrowing for speculative purposes or using excessive leverage, credit institutions can adjust loan limits by changing the loan-to-value ratio, requiring a higher proportion of payment with self-funded capital, or applying higher interest rates for second-home buyers and beyond.

Secondly, it is recommended to enhance credit monitoring and management. The government can impose regulations on credit quality control and require banks to provide more detailed reports on real estate-related loans, thereby strengthening risk oversight. Establishing a credit mechanism for social housing projects and prioritizing capital allocation for affordable housing projects will help address the housing needs of low-income earners.

Additionally, the state should implement credit relaxation policies, including reducing interest rates and providing long-term loans with preferential rates for first-time home buyers or other priority groups to maintain social stability, such as newly married couples.

To ensure the accuracy and effectiveness of these policies, the Brokers Association believes that the state needs to develop a large, accurate, and up-to-date database to distinguish between genuine homebuyers and those engaging in speculative activities.

Expediting the publication of real estate transaction price indices and other influential indicators is essential to determine when government intervention is necessary, especially with the current concerns about rising real estate prices.

For a more comprehensive regulation of the real estate market, credit policies should be combined with the implementation of real estate transfer taxes or property taxes. Moreover, when applying regulatory policies, flexibility is crucial to ensure stability in the real estate market and minimize risks.

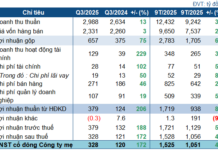

In the last two years, condo prices in Hanoi have risen rapidly and significantly. The price gap between Hanoi and Ho Chi Minh City’s condo markets has narrowed (in 2019, the primary price gap between the two markets was 30%; by 2024, the gap ranged between 5-7%).

As of Q2 2024, according to surveys and reports from major provinces and cities like Hanoi and Ho Chi Minh City, condo prices have increased by an average of 5-6.5% quarterly and 25% annually, depending on the area and location.

According to the Ministry of Construction, the localized increase in condo prices in major localities like Hanoi and Ho Chi Minh City is due to the continued limited new supply and the small number of new projects on the market. The scarcity of mid-range and affordable housing options has contributed to the rising prices in these projects.

Ngoc Mai