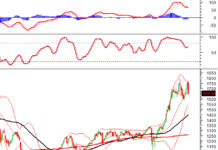

A surge in trading activity this morning boosted the matched liquidity of the two exchanges by 34% compared to yesterday morning, with the breadth indicating that the upward momentum spread across the board. However, the money flow was not evenly distributed and instead focused on a group of strong stocks. FPT and MSN attracted enormous buying interest from both domestic and foreign investors, accounting for 23.2% of the total matched value on the HoSE and nearly 37% of the VN30 basket.

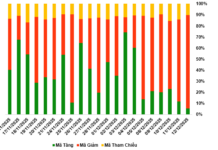

The money flow is seeking out stocks with anticipated exceptional earnings for the third quarter of 2024. Most of the stocks that surged this morning had their profits projected by securities companies in advance. Although there were 201 gainers and 135 decliners on the HoSE, only 45 stocks rose by more than 1%. FPT and MSN stood out with the most prominent trading activities.

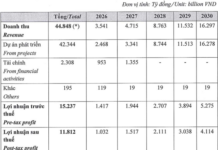

FPT closed the morning session at 140,900 VND, officially setting a new all-time high with a 4.06% gain compared to the reference price. The blue-chip stock’s liquidity reached 1,032.2 billion VND, equivalent to nearly 7.41 million shares changing hands, the highest trading threshold since the beginning of September. Foreign investors purchased 2.25 million units, accounting for over 30% of the total trading volume. The net buying value amounted to 286.4 billion VND.

While MSN did not receive as much net buying from foreign investors as FPT, it was the stock with the highest liquidity in the market this morning, reaching 1,100.8 billion VND, equivalent to 13.9 million units. MSN’s price increased by 3.51%. Approximately 4.6 million shares were bought by foreign investors, constituting one-third of the total trading volume, with a corresponding net value of 267.1 billion VND.

FPT is currently the third-largest market capitalization stock in the VN-Index, while MSN is smaller, ranking 15th. Nonetheless, the substantial price increase positively impacted the index, with these two stocks contributing approximately three points to the index’s total gain of 7.84 points this morning. In terms of liquidity, compared to yesterday morning, MSN and FPT witnessed an increase of approximately 1,875 billion VND in matched orders, implying that the rise in liquidity on the HoSE and in the VN30 basket was primarily driven by these two stocks. Specifically, the increase in liquidity of MSN and FPT accounted for 76% of the HoSE’s liquidity growth and 93% of the VN30’s.

Aside from the aforementioned prominent blue chips, the market also observed several stocks with positive trading dynamics, albeit without similar liquidity surges. DGC, SSI, HDB, FRT, VNM, CMG, LPB, and others demonstrated robust price increases on a relatively large volume. The remaining strongest gainers mostly belonged to the small and mid-cap groups, with low liquidity, such as VFG, APG, CNG, HAG, and LHG…

The VN-Index closed the morning session with a gain of 7.84 points, or 0.61%. This was not the best performance of the index, as it rose to nearly 21.3 points (+0.97%) intra-day. In the latter half of the session, the upward momentum eased slightly due to profit-taking activities. Several large-cap stocks witnessed price declines, such as VCB, which lost 1.29% from its peak, closing the morning session with a 0.88% increase. VHM reversed to a slight decline of 0.24%, down 1.17%. BID fell by 0.9%, ending with a 0.1% gain. CTG dropped by 1.09%, closing with a 0.42% increase. HPG declined by 0.9%, reversing to a 0.18% loss. TCB fell by 0.6%, closing with a 0.81% gain. GAS slipped by 0.41%, ending with a 0.83% increase. FPT and MSN also retreated, with FPT giving back 0.28%, and MSN almost 1%.

The unexpected sharp rise in prices may encourage investors to sell more. In reality, the 1300-point level remains a haunting memory for many, as the VN-Index peaked at 1,294.33 points this morning. Nevertheless, the buying power was also impressive, particularly inspired by the performance of MSN and FPT. The matched liquidity of the two exchanges increased by 34% compared to yesterday morning, reaching 9,587 billion VND, the highest in the past five morning sessions. Moreover, the supporting buying force maintained a good price correlation, with the HoSE still having 201 gainers versus 135 decliners. Almost all the losses were minimal, and among the 30 stocks that fell by more than 1%, only D2D had slightly higher liquidity, matching 21.8 billion VND at a price of 1.97 VND. As for CTF, TCO, BMP, and DVP, which had the highest trading volume after D2D, their volumes were still in the range of a few billion.

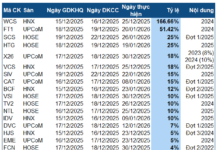

Foreign investors this morning stepped up their investment, with a net buy value of up to 1,173.2 billion VND on the HoSE, including a net buy of 413.7 billion VND. This was the highest investment threshold in the past five weeks. The buying focus was on FPT, MSN, and additionally, TCB, with a net buy value of 93.2 billion VND. On the selling side, STB, VPB, VHM, and MWG were notable, with net selling values of -42.7 billion VND, -26.5 billion VND, -26.2 billion VND, and -20.8 billion VND, respectively.