Quang Ngai Sugar Joint Stock Company (QNS) has come a long way since its inception in the 1970s as Quang Ngai Sugar Company under the Ministry of Agriculture and Rural Development. Back then, its main products were RS Sugar and Alcohol.

In 2005, the company underwent a transformation into a joint-stock company. Fast forward to today, after more than 50 years of growth and expansion, it has become one of Vietnam’s largest sugar producers.

Quang Ngai Sugar is the parent company of Vinasoy (known for its Fami brand) and owns a diverse range of factories, including Dung Quat Brewery, Biscafun Confectionery, Thach Bich Mineral Water, and large sugar mills.

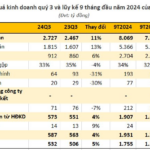

According to its Q3 2024 financial report, Quang Ngai Sugar witnessed positive business results. The company achieved net revenue of VND 2,727 billion and gross profit of VND 912 billion, marking a 10.5% and 6% increase, respectively, compared to the same period last year.

Both financial income and expenses decreased by 31% and 30%, amounting to VND 60 billion and VND 20 billion, respectively. Pre-tax profit stood at VND 587 billion, a 4% increase compared to Q3 2023. The company’s net profit reached VND 531 billion, a slight improvement of VND 25 billion over the previous year.

For the first nine months of 2024, the owner of the Fami soymilk brand recorded net revenue of VND 8,069 billion, a 4% increase year-on-year. Notably, both the sugar and soymilk segments contributed approximately 33% each to the company’s total revenue.

The company reported a net profit of nearly VND 1,755 billion, a 14% increase compared to the same period last year. This equates to an average daily profit of VND 6.5 billion.

The year 2023 was a golden year for QNS, with net revenue reaching nearly VND 10,023 billion and net profit amounting to VND 2,190 billion. However, for 2024, the company has set more conservative business targets, aiming for a total revenue of VND 9,000 billion and a post-tax profit of VND 1,341 billion, which is significantly lower than the record high achieved in 2023. As of Q3 2024, the company has already achieved 90% of its revenue target and 131% of its profit target for the year.

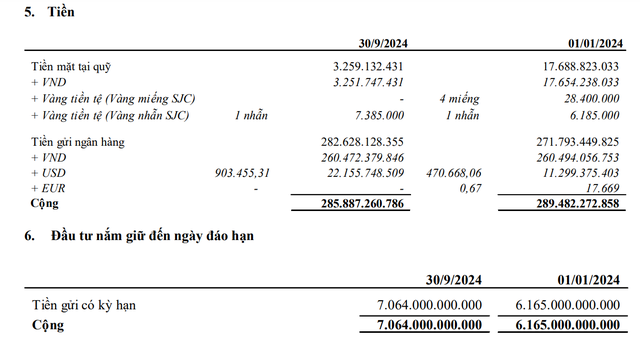

As of the end of Q3 2024, Quang Ngai Sugar’s total assets exceeded VND 13,000 billion, an increase of nearly VND 1,000 billion from the beginning of the year. The largest proportion of these assets was in bank deposits, amounting to VND 7,064 billion, or 54% of total assets, which is a 15% increase from the beginning of the year. These deposits are mainly fixed-term deposits with maturities ranging from six months to less than a year.

With this substantial amount of money, the company earned nearly VND 175 billion in interest income during the nine-month period, equivalent to nearly VND 650 million per day. Despite increasing its bank deposits, the company’s total financial income for the period decreased by VND 64 billion compared to the previous year, totaling VND 192 billion, mainly due to reduced interest income.

This year, Quang Ngai Sugar plans to ramp up its investment activities. The company has announced a total investment of VND 2,000 billion to increase the processing capacity of its An Khe Sugar Mill (in Gia Lai) to 25,000 tons/year and to expand the capacity of its An Khe Biomass Power Plant to 135 MW. Additionally, the company is in the process of researching and developing a project to produce Ethanol from molasses, a byproduct of sugar production, with a total investment of VND 1,500-2,000 billion.

Furthermore, Quang Ngai Sugar is actively working to expand its sugarcane growing area by 3,000 hectares per year, aiming to reach 40,000 hectares by the 2027/2028 crop year.

In terms of dividends, in 2023, when the company achieved record-high profits, it distributed cash dividends at a rate of up to 40%. For 2024, the company plans to maintain a dividend payout ratio of 15% or higher, to be paid in cash. In September, the company paid the first interim dividend at a rate of 10%.

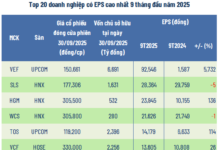

On the stock market, QNS shares closed the week at VND 48,600 per share, a 0.41% decrease from the reference price. Compared to the beginning of the year, the share price has increased by 7% from the VND 45,500 range at the start of 2024.

The Soy Milk “King”: Fami Earns Nearly $300,000 in Daily Interest Over 9 Months, Holding 1 SJC Gold Taels and Over $900,000 USD.

With impressive results, the company achieved 90% of its revenue target and surpassed its annual profit goal by a significant 31%.