Ms. Tran Thi Thanh Nha announces related-party transactions of an insider at the Joint Stock Commercial Bank for Foreign Trade of Vietnam (EIB-HOSE)

Accordingly, Ms. Tran Thi Thanh Nha, spouse of Mr. Ngo Tony (USA), Chief Controller at Eximbank, registered to sell all 123,298 shares, equivalent to 0.006% of capital, from October 30 to November 8, to recoup investment.

The trading method will be through order matching. If the transaction is successful, Ms. Nha will no longer be a shareholder of EIB. At the closing price on October 25, with the stock price dropping to VND 20,850 per share, she is expected to retrieve nearly VND 2.6 billion.

Meanwhile, Mr. Ngo Tony does not hold any EIB shares.

Recently, according to the list of shareholders owning at least 1% of Eximbank’s chartered capital, as of October 10, there were five major shareholders: Gelex Group Joint Stock Company, holding 174,695,614 shares, equivalent to 10%; the Foreign Trade Bank of Vietnam (Vietcombank) holding nearly 78.9 million EIB shares, equivalent to 4.51%; Securities Joint Stock Company VIX holding 62,345,488 shares, equivalent to 3.58%; Ms. Luong Thi Cam Tu holding 19,539,948 shares, equivalent to 1.12%; and Ms. Le Thi Mai Loan holding 17,940,876 shares, equivalent to 1.03%.

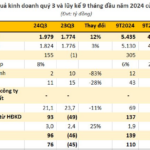

In Q3/2024, EIB recorded a 76.79% increase in net interest income compared to the same period, reaching VND 1,536 billion; profit from foreign exchange trading increased by 265% to VND 282 billion, and profit from other activities surged by 181%, yielding VND 89 billion.

On the other hand, service income decreased by 10.97% to VND 103 billion, and investment securities trading suffered a loss of over VND 40 billion, whereas the same period last year enjoyed a profit of VND 142 billion.

During this period, operating expenses and credit risk provisions increased by 14% and 19%, respectively, totaling VND 864 billion and VND 201 billion. Nevertheless, Eximbank still achieved an extraordinary pre-tax profit in Q3/2024, amounting to VND 903 billion, a surge of 194.41% compared to the same period last year (VND 306,940 billion)

For the first nine months of 2024, EIB recorded a pre-tax profit of VND 2,378 billion, a 39% increase compared to the previous year (VND 1,712 billion). However, the bank set a profit target of VND 5,180 billion for 2024, and thus, has accomplished only 46% of its goal so far.

The Retail Investors Return to Net Buying on October 24th

The proprietary trading arms of securities companies recorded a net buy value of VND 55 billion across the market.