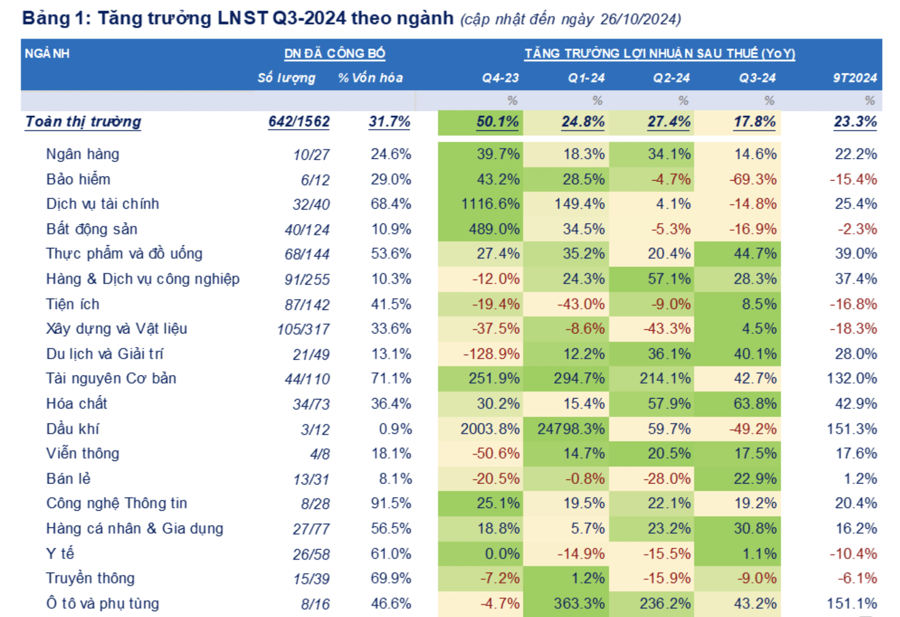

As of October 26, 2024, 642 listed companies, representing 31.7% of the total market capitalization, have published their Q3 financial results, including 10 out of 27 banks, 31 out of 35 securities companies, and 594 out of 1483 non-financial enterprises, according to Fiintrade statistics.

The combined after-tax profit of these 642 companies increased by 17.8% year-on-year, but this growth rate is lower than the 27.4% recorded in Q2 due to higher comparative figures in the previous year. Compared to Q2 2024, profits declined by 7.8%, mainly due to less favorable results from the financial sector, including banks, securities, and insurance companies.

Banks face challenges in maintaining growth: Out of 27 banks, 10 have released their Q3 financial statements, with ACB being the newest addition. While Q3 profits showed a 14.6% year-on-year increase, they also reflected a 12.1% decline compared to the previous quarter, indicating the challenges banks face in sustaining their growth momentum.

Insurance companies were negatively impacted by Typhoon Yagi: The after-tax profits of 6 out of 12 insurance companies, all of which are non-life insurers, plummeted by 69.3% year-on-year and 70.1% compared to the previous quarter. For the leading non-life insurance company, PVI, after-tax profits decreased by 46.1% year-on-year and 43.2% compared to the previous quarter, mainly due to higher claims reserve expenses. Similarly, AIC recorded an after-tax loss of over 39 billion VND in Q3 due to a significant increase in post-Typhoon Yagi compensation costs.

For the non-financial sector: Seafood (VHC, ANV) and Garment (STK, TNG, HTG) were the two export-oriented industries that witnessed exceptional profit growth in Q3, with increases of 78.8% and 155.1%, respectively, compared to the same period last year, benefiting from low comparative figures in the previous year.

The groups with high profit growth remain in the Food, Livestock, Building Materials, Steel, Rubber, and Passenger Transport sectors.

On the other hand, the groups that experienced significant profit declines include industries closely linked to the recovery in domestic consumer demand, such as Real Estate and Personal Goods, as well as goods-related sectors like Chemicals and Coal. For Real Estate, in particular, the profit decline in Q3 indicates that the industry is in the process of bottoming out.