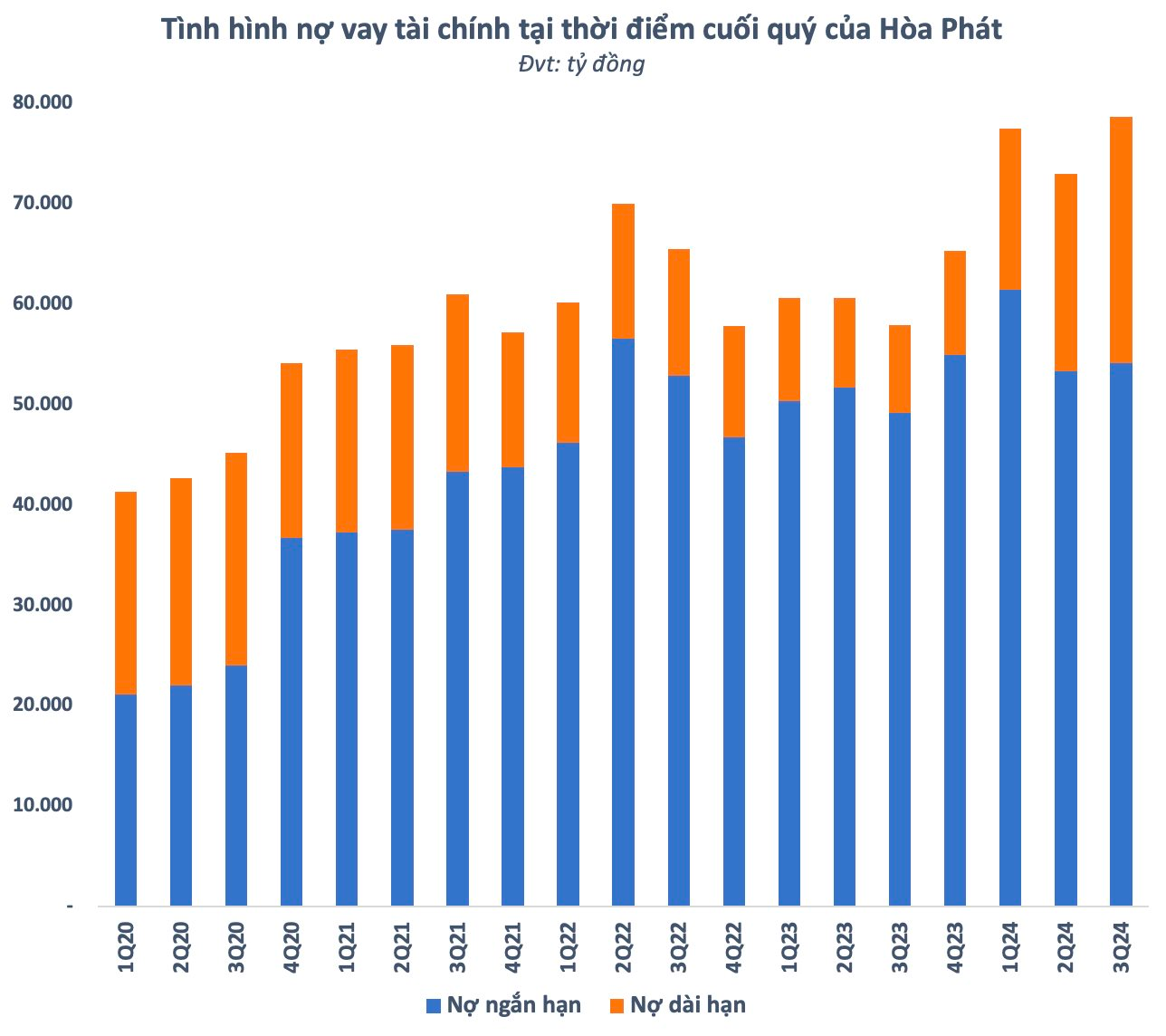

According to the recently published consolidated financial statements for Q3, Hoa Phat (code HPG) reported total financial debt of nearly VND 79,000 billion as of September 30, an increase of nearly VND 6,000 billion from the end of Q2 and over VND 13,000 billion higher than the beginning of the year. This is the company’s highest-ever financial debt since its establishment.

Hoa Phat’s financial debt as of Q3 2024

The increase was mainly due to long-term debt. As of the end of Q3, Hoa Phat’s long-term financial borrowings stood at VND 24,500 billion, an increase of VND 5,000 billion from the previous quarter and VND 14,000 billion higher than the beginning of the year. This is also the company’s highest-ever long-term debt. The funds were likely invested in the Dung Quat 2 steel complex project.

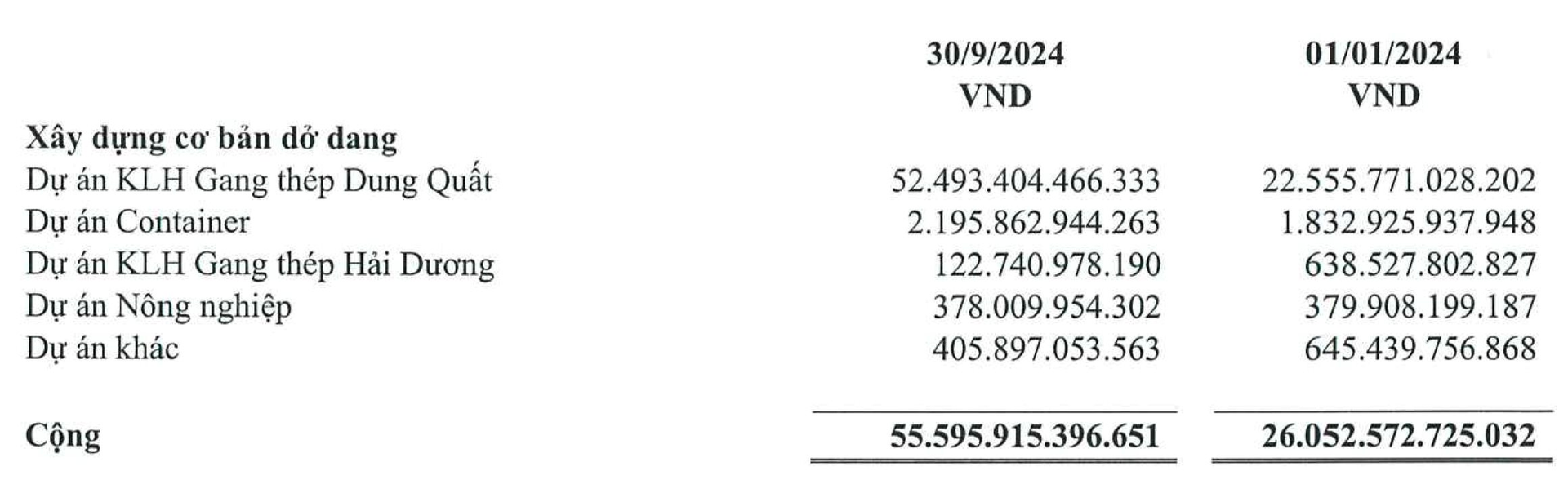

As of September 30, the construction-in-progress costs for the Dung Quat project reached nearly VND 52,500 billion (USD 2 billion), an increase of VND 10,000 billion from the previous quarter . In the first nine months of the year, Hoa Phat invested an additional VND 30,000 billion in this key project, which has a total investment of over USD 3 billion.

Construction-in-progress costs for Dung Quat 2 Steel Complex

According to the plan, the Dung Quat 2 project will be completed in Q1/2025 with a capacity of 2.8 million tons/year for phase 1, and a total designed capacity of 5.6 million tons/year. It is expected to take Hoa Phat about three years to operate Dung Quat 2 at maximum capacity, thereby increasing its crude steel capacity to over 14 million tons/year.

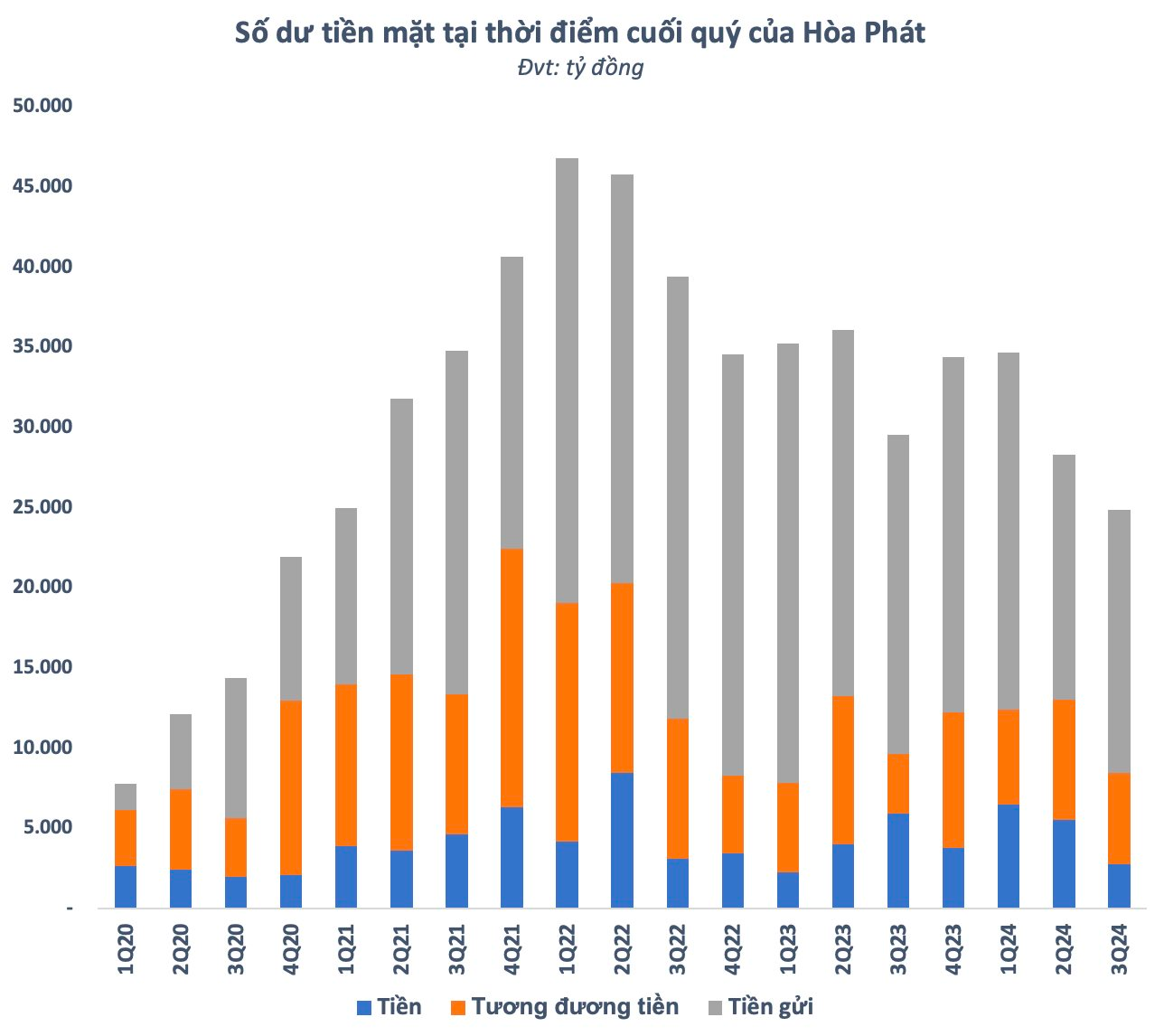

Lowest cash balance in 15 quarters

In the context of focusing on disbursement for the Dung Quat 2 steel complex project, Hoa Phat’s cash balance (cash, cash equivalents, and short-term deposits) decreased significantly after Q3. As of September 30, the cash balance was less than VND 25,000 billion, a decrease of approximately VND 3,500 billion from the end of Q2 and VND 9,500 billion lower than the beginning of the year . This is Hoa Phat’s lowest cash balance in 15 quarters since the beginning of 2021.

Hoa Phat’s cash balance

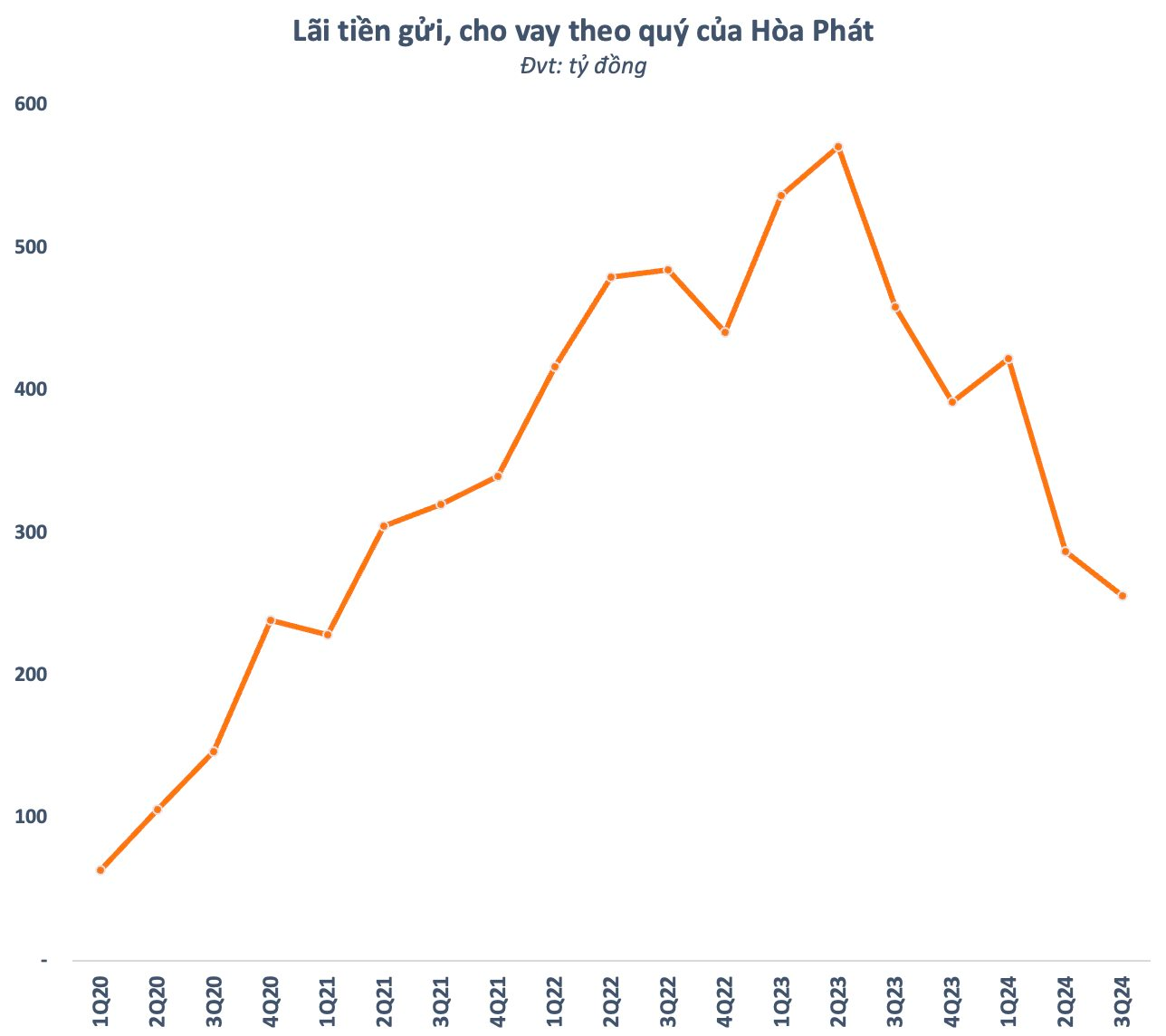

The decrease in idle cash, coupled with the low-interest-rate environment, resulted in a decline in Hoa Phat’s interest income. In Q3, interest income from deposits reached only VND 256 billion, a decrease of more than 44% compared to the same period in 2023, and the lowest since Q1/2021 . After peaking in Q2/2023, the company’s interest income has been on a downward trend.

Hoa Phat’s interest income from deposits

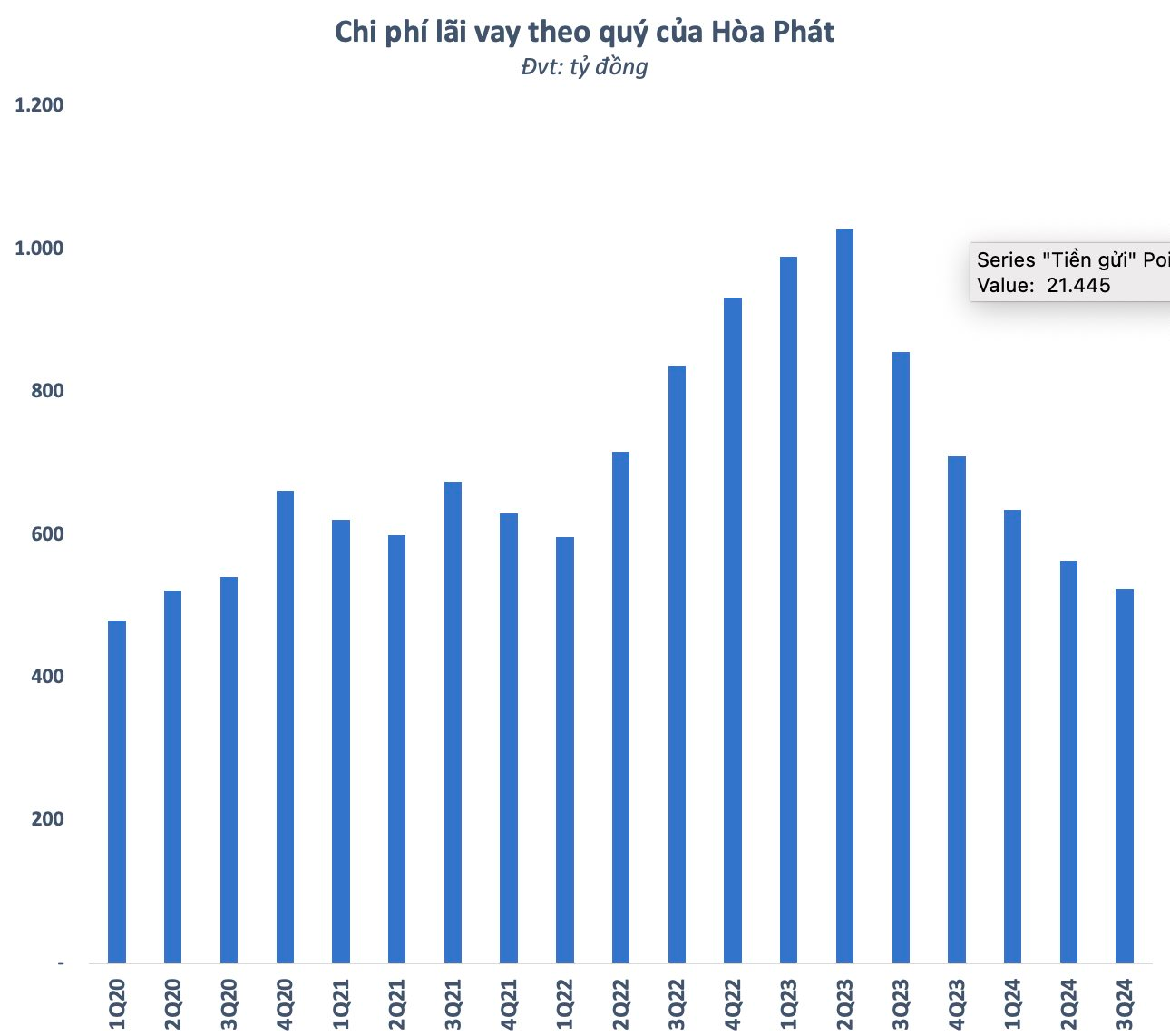

Similarly, quarterly interest expenses also showed a decreasing trend despite the high debt balance. In Q3, Hoa Phat incurred VND 525 billion in interest expenses, a decrease of nearly 39% compared to the same period last year . In the past, the company had to bear over a thousand billion VND in interest expenses in a single quarter, as recorded in Q2/2023. Since then, this expense has consistently decreased compared to the previous quarter.

Hoa Phat’s quarterly interest expenses

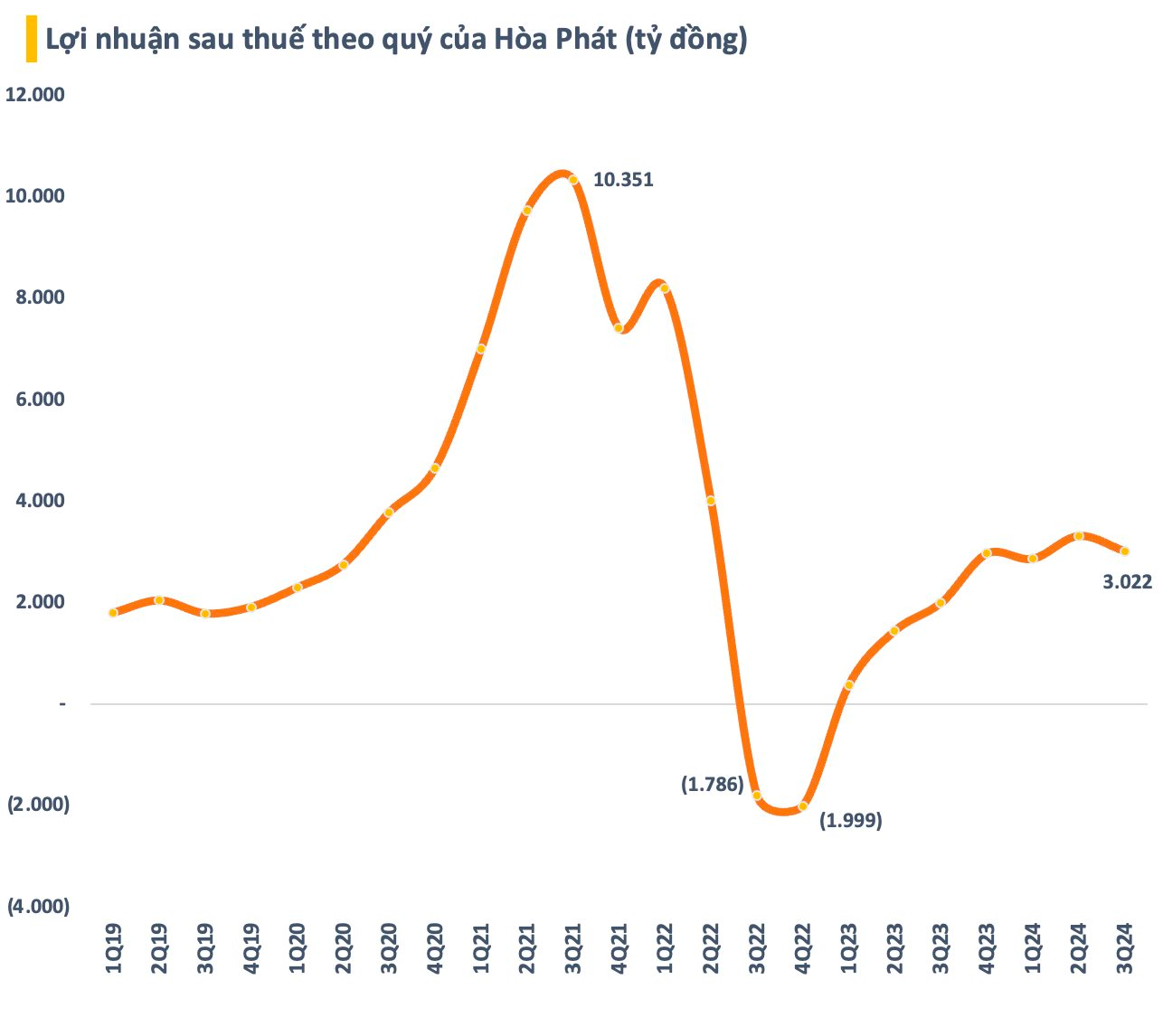

Profit increased by 51% compared to the same period in 2023

In terms of financial performance for Q3/2024, Hoa Phat recorded net revenue of nearly VND 34,000 billion, an increase of 19% compared to the same period in 2023. Cumulative revenue for the first nine months reached VND 105,000 billion, up 23% year-on-year, completing 75% of the set plan.

In the first nine months of 2024, Hoa Phat produced 6.4 million tons of crude steel, an increase of 34% compared to the same period in 2023. Sales volume of steel products (excluding pipe and coated steel products) reached 6.1 million tons, an increase of 32%.

Among these, high-quality construction steel and quality steel contributed 3.3 million tons, an increase of 29%. Hot-rolled coil (HRC) reached 2.27 million tons, and steel billets reached 505,000 tons. For downstream steel products, steel pipes reached 503,000 tons, an increase of 3% over the same period last year. Hoa Phat’s steel sheets reached a production volume of 344,000 tons, up 43% year-on-year, surpassing the full-year volume of 2023 (329,000 tons).

After deducting expenses, Hoa Phat’s net profit in Q3 was VND 3,022 billion, an increase of 51% over the same period last year . Cumulative net profit for the first nine months reached VND 9,210 billion, up 140% year-on-year, completing 92% of the set target. The main contributors to this result were steel and related products, accounting for 85%, followed by the agriculture sector.

Hoa Phat’s net profit in Q3 2024