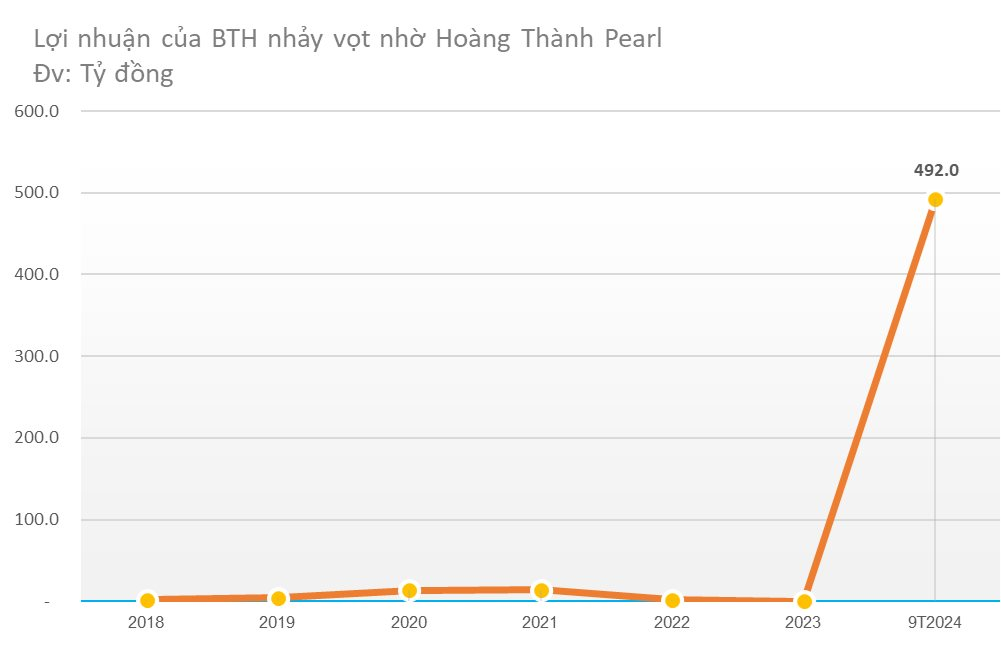

Hanoi Transformer and Electrical Equipment Manufacturing JSC (stock code BTH) announced its Q3/2024 financial report with a revenue of VND 216 billion, 576 times higher, and an after-tax profit of VND 94 billion – 244 times higher than the same period last year.

For the first nine months of the year, the company’s revenue reached VND 1,430 billion, and its after-tax profit was VND 492 billion, an increase of 1,254 times compared to the same period last year, exceeding the annual plan. Earnings per share (EPS) for the nine months reached nearly VND 20,000, among the top in the stock market.

Origin of the Land that Made the “Golden” Project

The company’s business results soared thanks to the Hoang Thanh Pearl Apartment project located in Cau Dien Ward, Nam Tu Liem District, Hanoi. According to the introduction, the project has an area of 14,786 m2 with a scale of 3 blocks – 1 tower of 30 floors, providing 334 apartments with an area of 79 – 112 m2. The total investment is VND 1,107.7 billion.

In the third quarter, the company handed over and recognized revenue for tax calculation of 32 apartments and 2 adjacent houses.

At the 2023 Annual General Meeting of Shareholders, the company said that of the 287 apartments sold as of June 2024, 213 were sold to Vietnamese customers and 74 to foreign customers.

As of September 30, 2024, the company has recognized the business results of 293/334 apartments and 2/25 adjacent houses. Last year, the project was still under construction.

Despite investing in real estate projects, at the end of the quarter, the company’s financial debt balance was VND 0. Owner’s equity is VND 725 billion (including VND 250 billion of capital contribution and VND 467 billion of undistributed after-tax profit), accounting for 55% of total assets.

Hoang Thanh Pearl is built on the land that used to be the factory of Hanoi Transformer and Electrical Equipment Manufacturing JSC.

The company was formerly known as the Transformer Manufacturing Factory under the Electrical Equipment Corporation, established in 1963, equitized in 2005, and merged with Hanoi Electrical Equipment JSC. Vietnam Electrical Equipment Corporation (GELEX) holds 49.5%.

The company once listed 3.5 million shares on HNX in 2008 with the stock code BTH.

In 2014, when Mr. Nguyen Hoa Cuong held the position of Chairman of the Board of Directors, Gelex sold all its shares in BTH to Hoang Thanh Infrastructure Investment and Development JSC (Hoang Thanh Group) at a price of VND 16.3 billion (equivalent to VND 9,400/share). At that time, Ms. Nguyen Thi Bich Ngoc, Chairman of Hoang Thanh Group, was also a member of the Board of Directors of Gelex.

Subsequently, BTH was delisted in 2015 due to continuous losses for three years (2012-2014) and returned to trading on UPCOM in 2017. The Chairman of the Board of Directors is Ms. Nguyen Thi Bich Ngoc.

In these years, the company’s business performance was not remarkable, and its most valuable asset was the land in Cau Dien – where Hoang Thanh Pearl is located today – with a land lease term of 30 years from December 13, 2006.

In early 2015, the Prime Minister had a policy to relocate production facilities inside Hanoi. The land was planned as a mixed-use area. In October 2017, the Hanoi Department of Planning and Architecture granted the Project Planning Permit to the investor – Hanoi Transformer and Electrical Equipment Manufacturing JSC.

In 2017, the General Meeting of Shareholders approved the policy to stop production, continue to maintain commercial activities, and implement real estate investment projects. In 2018, the company increased its charter capital to VND 250 billion according to the plan to issue 21.5 million shares to 3 strategic investors: Hoang Thanh Group (14.52 million shares), and 2 individuals, Mr. Nguyen Hoa Cuong (1.25 million shares) and Mr. Hoang Ngoc Kien (5.73 million shares).

The charter capital has been maintained to the present, and Hoang Thanh Group currently holds 65% of BTH’s charter capital. Two sons of Chairwoman Nguyen Thi Bich Ngoc, Mr. Hoang Ngoc Kien, hold 19.4%, and Mr. Hoang Ngoc Quan holds 5.2%.

Who Owns Hoang Thanh Group?

Hoang Thanh Infrastructure Investment and Development JSC (Hoang Thanh Group) was established in 2004 with an initial charter capital of VND 27 billion by domestic shareholders, of which Ms. Bich Ngoc was the largest shareholder. After many capital increases, by 2022, the company’s charter capital reached VND 1,359 billion.

Hoang Thanh Group is the business of Mr. Hoang Ve Dung and Mrs. Nguyen Thi Bich Ngoc. In which, Mr. Hoang Ve Dung is the Chairman of the Board of Directors of Duc Giang Garment Company (stock code MGG). Currently, Hoang Thanh Group has one foreign shareholder, The SANKEI BUILDING Company, holding 18.156%.

The first project that made Hoang Thanh Group famous was Hoang Thanh Tower (at 114 Mai Hac De, Hanoi). The Group cooperated with the Singaporean real estate group CapitaLand to build two projects: the high-end apartment complex Mulberry Lane and Seasons Avenue in the new urban area of Mo Lao, Ha Dong district, Hanoi. Also in this area, Hoang Thanh Group is implementing the Hoang Thanh Villas project.

In addition, there is the Du Long Industrial Park project invested and developed by Hoang Thanh Du Long Industrial Park Investment Joint Stock Company located in Loi Hai and Bac Phong communes, Thuan Bac district, Ninh Thuan province.

Vinamilk: Overseas Market Revenue Surges 15.7%, Exports Remain the Key “Driver”

For the fifth consecutive quarter, Vinamilk’s overseas market revenue has maintained its stellar performance, with a notable boost from its export business. In the first nine months of the year, international markets contributed 8,349 billion VND to Vinamilk’s coffers, marking an impressive 15.7% increase.