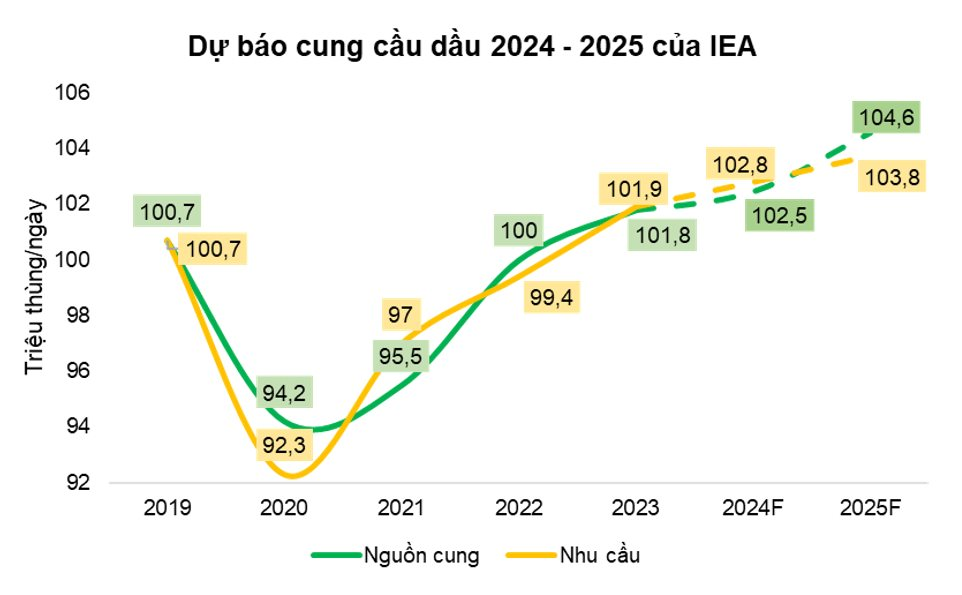

Forecasted Oil Supply Increase by 2025

According to the IEA, global oil demand is projected to increase by just over 0.9 million barrels per day, reaching 102.8 million barrels per day (+1.2% YoY) in 2024. This is a decrease of 0.4 million barrels per day compared to the early-year forecast, mainly due to the rapid slowdown in oil consumption growth in China.

In 2025, the IEA forecasts a slight increase in global oil demand by 0.95 million barrels per day, with total oil consumption reaching 103.8 million barrels per day. This is attributed to the expected slow recovery of the global economy and the strong development of renewable energy sources.

Source: IEA, PSI Synthesis

On the other hand, the IEA predicts a global oil supply increase of 0.66 million barrels per day to 101.8 million barrels per day in 2024. Oil production from non-OPEC+ countries could rise by 1.5 million barrels per day, while OPEC+ production is expected to decrease by approximately 0.81 million barrels per day.

In 2025, the organization anticipates a further increase in oil supply as OPEC+ may relax their output cuts. This could result in an additional 2.1 million barrels per day, with OPEC+ alone contributing 0.51 million barrels per day. Consequently, the market may experience a surplus in 2025.

PSI expects oil prices to hover around $70-80 per barrel in 2025, assuming that tensions in the Middle East do not escalate further. This price range remains profitable for extraction businesses and could support the overall recovery of the global economy.

How Will Oil and Gas Companies Be Affected?

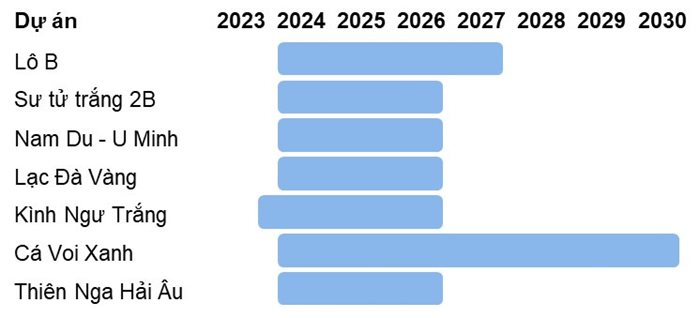

According to PSI, exploration, extraction, and transportation activities in the oil and gas industry are ongoing, even as older fields enter their decline phase. Notable projects include Lot B, White Lion 2B, and Golden Camel. Among these, Lot B stands out as the most prominent and a key driver for the industry.

Source: PSI Synthesis

There are still obstacles to resolving FID, particularly in signing GSPA/GSA with committed volume, gas pricing, and the final investment decision for the O Mon 3 & 4 power plant project.

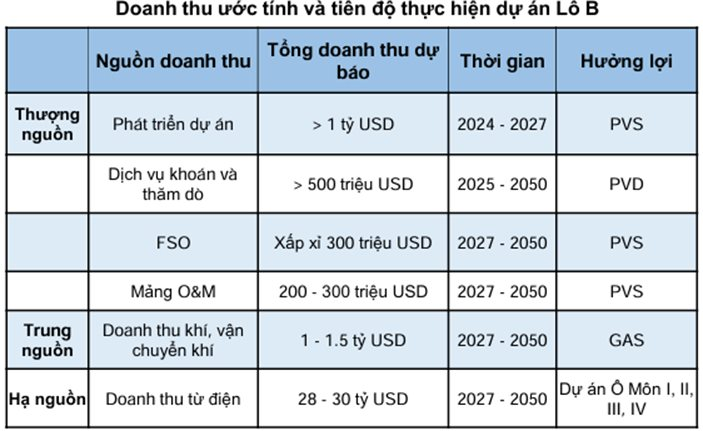

However, with the official commencement of the Lot B – O Mon project on September 18, 2024, as announced by PVN, and the implementation of EPCI 1 and EPCI 2 packages in the upstream sector, PSI believes that FID for this mega-project is imminent. Updates on the project will continue to support stock prices in the oil and gas industry, especially for upstream companies.

Source: PSI Synthesis

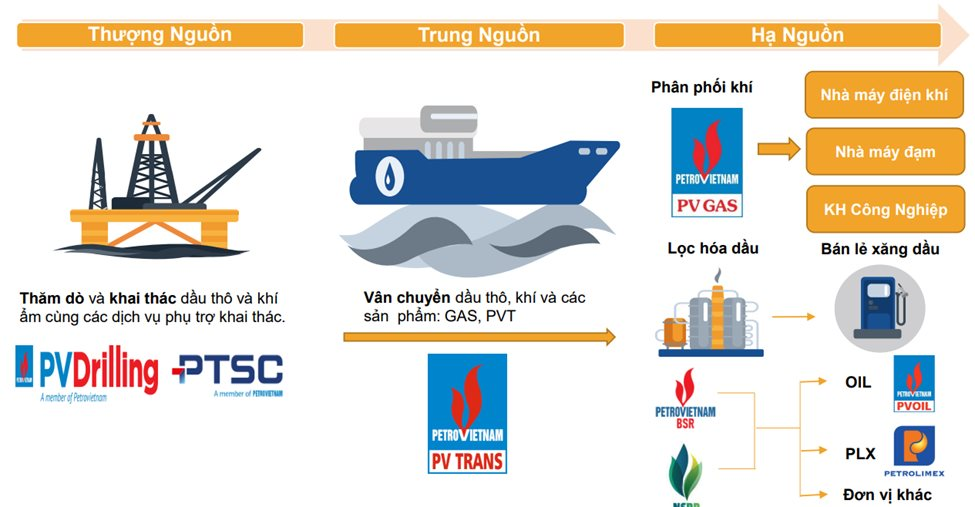

With ongoing exploration, extraction, and transportation activities, PSI forecasts benefits and positive prospects for several related businesses in 2024-2025.

Specifically, Petroleum Drilling and Well Services Corporation – PV Drilling (HSX: PVD) has secured contracts for 2025 with regional partners at higher rig rental rates. PVD also has the potential to lease out 2 additional rigs and secure well service contracts for the Lot B project (with an estimated total contract value of $2 billion).

For Petroleum Technical Services Corporation – PTSC (HSX: PVS), the Lot B project could bring in $5.8 billion in M&C contracts starting in 2024 and a floating oil storage lease contract commencing in 2028. From late 2024 onwards, PVS is expected to start recognizing revenue from the EPCI 1, 2, and 3 contracts. Additionally, PVS has a promising business prospect in the development of the offshore wind energy market as both a contractor and investor.

In the midstream sector, Petroleum Transportation Corporation (HSX: PVT) has a positive outlook for 2025 across its crude oil tanker, LPG tanker, and bulk carrier segments. The company primarily engages in the long-term charter market, so fluctuations in the spot market will not impact its profits.

Meanwhile, Vietnam National Gas Corporation (HSX: GAS) has a positive outlook for 2024, with dry gas and LPG prices expected to recover due to oil prices sustaining in the $70-80 per barrel range, while dry gas demand continues to grow at 2.6% in 2024.

In the downstream sector, there are indications that crack spreads for petroleum products have been recovering significantly since hitting rock bottom in June 2024. PSI anticipates this trend to continue through the end of the year, as global consumption of these products is expected to improve, benefiting Binh Son Refining and Petrochemical Joint Stock Company (UPCoM: BSR).

Additionally, on May 27, the People’s Court of Quang Ngai province initiated bankruptcy proceedings for Central Petroleum Fuel Joint Stock Company (BSR-BF). As a result, BSR-BF is no longer a subsidiary of BSR, which will facilitate BSR’s progress toward stock exchange listing.

The Great Gas Price Plunge: What Happened Over the Last 3 Years?

As of 3 pm on September 12th, the joint decision by the Ministry of Industry and Trade and the Ministry of Finance to adjust retail fuel prices came into effect. Domestic fuel prices have seen a reduction of VND 688-1,192 per liter across the board.