Condo apartments remain hard to sell despite the “fever”

“People keep saying the market is ‘on fire’, but I’ve been trying to sell my apartment for almost 3 months without success,” shared Ms. Ngọc Giao from Cầu Giấy, Hanoi.

Ms. Giao’s family resides in a 70m2 old resettlement apartment, purchased in October 2022 for 2 billion VND, approximately 28 million VND/m2.

Over the past year, along with the general “fever” in the condo market, their apartment has also seen continuous price increases. Ms. Giao and her neighbors often receive phone calls from brokers inquiring about selling their homes. The prices offered by these brokers have sometimes left her astonished, and they tend to increase gradually every month, or even every week.

On resident groups, community forums, and real estate trading websites, she noticed that many apartments in her building were advertised for sale at 57-60 million VND/m2. Some brokers even posted prices several hundred million higher than what the owners advertised within the resident group. In just under two years, the price had doubled, so Ms. Giao and her husband wanted to sell their apartment to buy a newer one.

“I’ve been trying to sell since July. Many brokers have called to inquire, and potential buyers have come to see the place. However, it’s been three months, and it’s still unsold,” she said.

According to Ms. Giao, while their condo building is located in a favorable position, it was constructed many years ago and has become old and deteriorated, with some items in a state of disrepair. “Some visitors never returned after seeing the place; some complained about it being old, while others found it too expensive. I’m just following the prices of other apartments advertised online,” Ms. Giao stated.

Hanoi apartments establish new price levels. Photo: Hồng Khanh

|

Ms. Nguyễn Hằng, a resident of a condo in Bắc Từ Liêm district, Hanoi, stated that she had heard a lot about the “fever” in the condo market lately. However, from her observations, selling a home is not an easy task.

“There are a few investment apartments in my building that are now up for sale. I noticed one apartment that had been advertised from February 2024 to August 2024 without finding a buyer. Perhaps due to the prolonged unsold status, the owner decided to rent it out for 11 million VND/month in September,” she said.

Ms. Hằng shared that she purchased her apartment in 2018 for 24 million VND/m2, while the aforementioned apartment was advertised for sale at 60 million VND/m2 during the past year.

“Now, residents are even speculating that the price of apartments in this building will reach 80-100 million VND/m2. Brokers are always waiting in the lobby of the building. I’ve seen potential buyers come to view the apartments, but there don’t seem to be any new residents, mostly tenants,” Ms. Hằng shared.

Staying Calm and Rational in a Hot Market

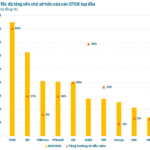

The Ministry of Construction’s report on housing and the real estate market in Q3/2024 indicated that condo prices continued to rise for both new and old projects, increasing by about 4-6% quarterly and 22-25% annually. Some areas even experienced localized increases of up to 35-40% compared to the previous quarter.

According to real estate experts, when condo prices continuously surge, a portion of buyers may experience FOMO (fear of missing out) and rush to purchase before prices climb further. However, as prices have escalated too rapidly, doubling or tripling in a short period, many buyers may also perceive the market as experiencing “price madness” and choose to wait for a decrease before committing.

Another factor contributing to the difficulty in selling apartments is the phenomenon of “price inflation.” Many homeowners tend to refer to the prices posted by brokers online as a benchmark for their properties.

Mr. Lê Công, director of a real estate agency in Hà Đông, stated that while Hanoi’s condo prices had indeed established new levels, many homeowners saw the high prices posted by brokers and assumed that their apartments had also appreciated significantly. In reality, while condo prices have increased, many of the prices advertised by brokers are intended to create a new price level and generate “artificial fever.” Therefore, in a heated market, both buyers and sellers need to remain calm and cautious.

Brokers often take advantage of the seller’s psychology, making them believe that the market is hot, leading to decisions to raise prices too high or reject genuine buyers. To avoid this situation, homeowners who intend to sell should refer to multiple information sources and research the actual value of their property.

According to Mr. Công, sellers should refer to the selling prices of apartments in the same building that have actually been sold, rather than those that are merely advertised. This helps owners set reasonable prices and avoid being influenced by price manipulation tactics.

For buyers, it is essential to thoroughly assess their genuine needs and conduct careful surveys before making a decision, avoiding being swept up in market psychology and falling into the trap of artificial prices, ultimately paying an excessive price compared to the actual value of the apartment.

According to a recent VietnamNet survey on home-buying plans, 40% of respondents suggested buying immediately. In contrast, 55% of readers said they would wait for real estate prices to drop, as they believe the current prices are unreasonable.

Hồng Khanh

“The Capital’s Property Boom: New and Old Apartments in Hanoi See a Surge in Prices, Rising by 22-25% Year-on-Year.”

The Ministry of Construction has reported a continued rise in apartment prices in Hanoi, with a year-on-year increase of 22-25% for both new and old projects. In contrast, Ho Chi Minh City witnessed a decrease in prices for certain projects.