The State Securities Commission (SSC) has recently issued Administrative Fine Decision No. 1187/QD-XPHC regarding penalties for violations committed by Petroleum Chemistry Joint Stock Company – Northern Region (coded PCN and traded on UPCoM).

According to the decision, Petroleum Chemistry DMC – Northern Region was fined VND 92.5 million for failing to disclose information that is required by law. Specifically, the company did not publish the following documents on the SSC’s disclosure system and the website of the Hanoi Stock Exchange (HNX): reports on corporate governance in 2019, 2020, and 2022, audited financial statements for 2020, 2021, and 2022, annual reports for 2020, 2021, and 2022, six-month corporate governance report for the first half of 2021, notification of signing the 2021 and 2022 audit contracts, and Decision No. 38/QD-HQT dated August 14, 2021, on the appointment of the deputy general director.

Illustrative image

Additionally, the company delayed the disclosure of several documents, including Resolution No. 15/NQ-DMCN dated January 6, 2020, on personnel matters (regarding the replacement of Mr. Nguyen Cong Dung by Mr. Nghiem Phu Son as the Chairman of the Board of Directors), the 2021 corporate governance report, and the six-month corporate governance reports for the first half of 2022 and 2023.

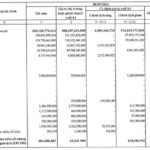

Petroleum Chemistry DMC – Northern Region was also fined VND 65 million for disclosing information with incomplete content as prescribed by law. Specifically, the company’s 2021 corporate governance report and 2022 semi-annual corporate governance report lacked certain information. According to the audited 2021 financial statements, the company had transactions with related parties involving its parent company, Construction Joint Stock Company 873 – Transportation Engineering Construction. However, the 2021 corporate governance report failed to disclose these transactions and provide information about independent members and non-executive members of the Board of Directors.

Furthermore, Petroleum Chemistry DMC – Northern Region was fined VND 125 million for violating regulations on transactions with shareholders. Specifically, as per the company’s audited 2022 financial statements, as of December 31, 2022, it had lent VND 1.25 billion to a shareholder, Construction Joint Stock Company 873 – Transportation Engineering Construction (which owns 49.21% of the company’s shares).

The total fine imposed on Petroleum Chemistry DMC – Northern Region for these violations amounts to VND 282.5 million.

Petroleum Chemistry Joint Stock Company – Northern Region, formerly known as Petroleum Chemistry One-Member Limited Liability Company DMC – Northern Region, was established on January 24, 2008. Its head office is located in Te Xuyen, Dinh Xuyen, Gia Lam, Hanoi.

The Foreign Sell-Off: Nearly $37 Million of Vietnamese Stocks Sold by Foreigners – What’s the Reason Behind this Massive Dump?

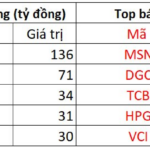

In the afternoon trading session, MSN stock witnessed intense selling pressure from foreign investors, resulting in a significant outflow of VND 169 billion.

The Foreign Sell-Off Continues: Blue-Chip Stock Dumps Over $10 Million Worth of Shares

The foreign transactions were less than enthusiastic, as they sold a net value of VND 384 billion across the market.

The Market Beat: A Rapid Decline, A Strong Surge in the Expiry of Derivatives

The VN-Index faced pressure throughout the morning session and the early minutes of the afternoon, dipping below 1,272 points. However, true to the nature of an expiration day for derivatives, the VN-Index staged a strong comeback, closing above 1,286 points. This impressive turnaround was largely driven by the banking, securities, and real estate sectors, which provided the much-needed boost to push the index higher.