Esther Nguyễn, Founder of POPS Worldwide

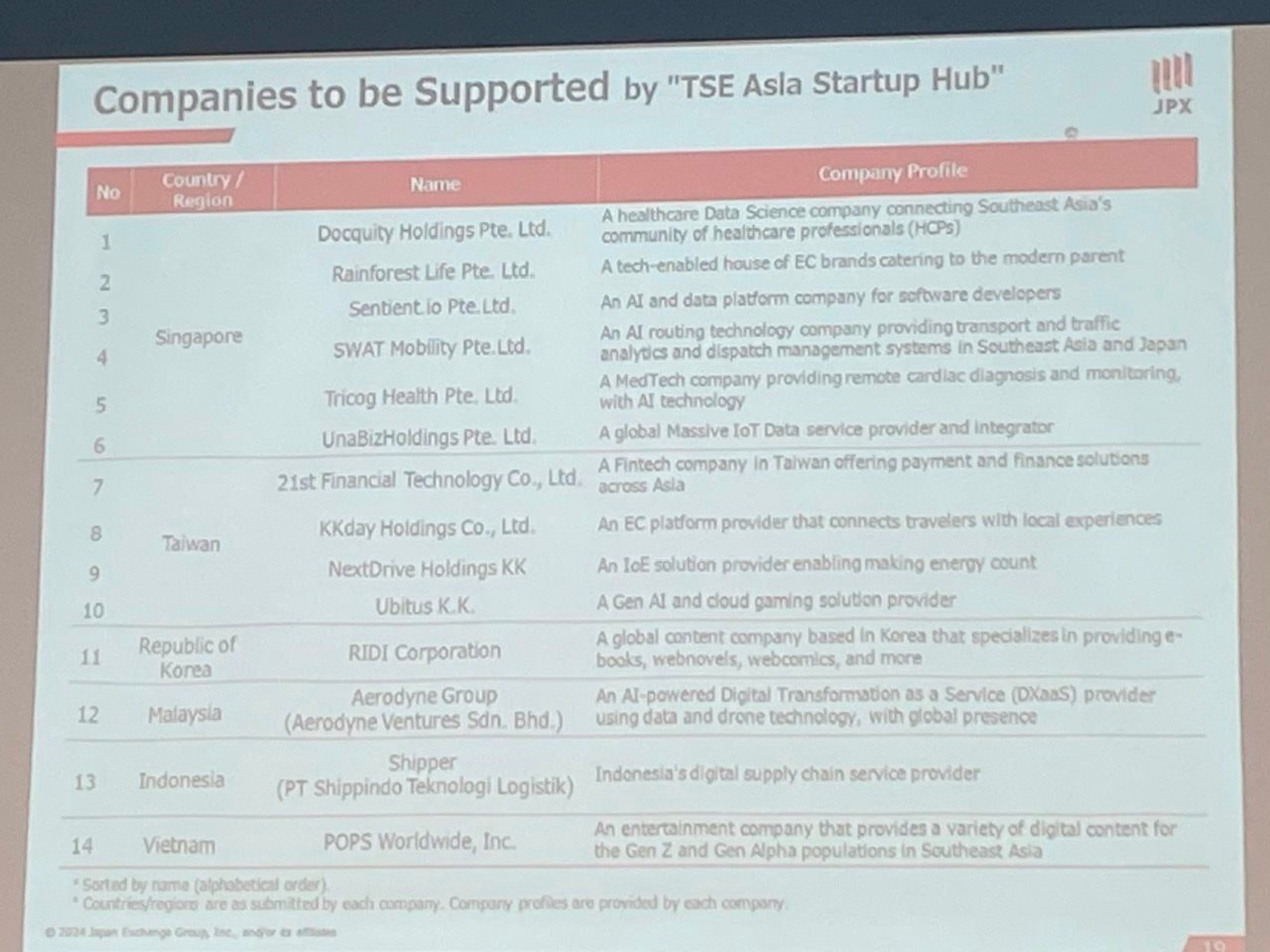

In March 2024, the Tokyo Stock Exchange (TSE) announced the names of 14 Asian startups that they would be supporting comprehensively to help them qualify for a future listing on the TSE. As the hub of Southeast Asian startups in the region, it’s no surprise that six startups from Singapore were chosen, followed by Taiwan (China) with four, and one each from South Korea, Malaysia, Indonesia, and Vietnam.

However, while all the countries on the list have had startups successfully IPO on the TSE, Vietnam has not had any representation yet. So, if POPS Worldwide can succeed, they will be trailblazers for Vietnamese businesses.

The journey for POPS Worldwide will undoubtedly be challenging, as being part of the “TSE Asia Startup Hub” does not guarantee a successful IPO on the TSE. They will be competing indirectly with fellow members of the program, such as the Korean unicorn Ridi, AI and drone startup Aerodyne Group from Malaysia, and Tricog Health from Singapore, as well as Japanese startups.

According to KR-Asia, since 1991, TSE has supported and encouraged 127 foreign companies to qualify for IPOs in Japan, but as of 2023, only six companies on that list have made it to the electronic board.

On another note, the reason TSE chose POPS Worldwide over VNG or Tiki—two Vietnamese companies with strong desires to go public overseas—is that POPS Worldwide comes closest to meeting the essential criteria for a successful TSE listing.

A foreign startup aiming to list on the TSE must meet the following critical requirements: at least 20% of sales revenue must come from the Japanese market, a market capitalization of over $350 million, and impressive growth rates and profit margins. Additionally, if the startup’s business and finances have a Japanese connection, it will gain extra points; for example, having a Japanese-language website, Japanese investors, or many Japanese partners.

If we consider the situation before 2024, POPS Worldwide has been operating in the Japanese market for several years, has a significant Japanese investor in TV Tokyo, and has numerous partners in the animation industry. “It took us three years to convince TV Tokyo to sign our first contract with them,” revealed Esther Nguyễn, founder of POPS Worldwide. “But after partnering with TV Tokyo, it became easier to persuade other partners. In addition to TV Tokyo, we are also working with several Japanese television stations, studios, and companies in the entertainment and media industries, such as Fuji Television, Nippon Animation, Toei Animation, Asahi TV, and the Doraemon and Pokemon brands.”

TV Tokyo invested in POPS Worldwide during its Series D funding round.

In 2020, POPS Worldwide joined forces with TV Tokyo to dub popular Japanese anime series like Naruto, Sergeant Keroro, and My Guardian Characters for distribution throughout Southeast Asia. TV Tokyo is a subsidiary of TV Tokyo Holdings Corporation, a leading Japanese broadcasting and media company listed on the TSE.

In 2022, TV Tokyo became the lead investor in POPS Worldwide’s Series D funding round. Prior to this, Esther Nguyễn had shared her intention to raise $50 million in the Series D round. Before 2022, POPS Worldwide had raised a total of $37 million, including a $30 million Series C round in 2019 led by Eastbridge Partners and Mirae Asset-Naver.

According to Esther Nguyễn, there is a lot of work ahead for POPS Worldwide after joining the “TSE Asia Startup Hub.” For instance, they need to expand their offices, recruit more personnel, and broaden their partner network.

“Many people have advised me to hire a senior Japanese finance professional because the financial and tax systems in Japan are different from those in Vietnam and Southeast Asia,” she said. “Without someone who understands the financial intricacies of the Japanese market, it will be challenging to operate smoothly and safely. One of POPS Worldwide’s unique features is the content created by KOLs/KOCs across Southeast Asia. However, the standards for content quality in this field are quite different in Japan compared to Southeast Asia, so we need time to adjust and find the right balance. Especially for content related to children, Japan has more detailed and stringent regulations than Southeast Asia.”

For Esther Nguyễn, expanding into the Japanese market is not an insurmountable challenge; it just requires perseverance and a step-by-step approach. Moreover, as the culture and lifestyle of Japanese people differ significantly from those in Southeast Asia, Vietnamese startups need to thoroughly understand the financial and business regulations and consumer habits of this market before considering entering it.

POPS Worldwide aims to list on the TSE by 2027.

VNG Lacks Japanese Investors, and Tiki Faces Business Challenges

In recent years, VNG and Tiki, rather than POPS Worldwide, have been the two Vietnamese startups most eager to go public.

After successfully listing on the Ho Chi Minh City Stock Exchange (HOSE), VNG chose the SPAC method to qualify for an IPO on a US stock exchange, specifically NASDAQ, in 2024. However, they later withdrew their application, citing that “these years are not the right time to IPO on NASDAQ.”

As for Tiki, they have also made moves indicating their determination to list on the Singapore or US stock exchange, such as registering a legal entity in Singapore. Still, in 2024, this e-commerce platform has not announced any concrete actions demonstrating their pursuit of this dream.

Considering the essential criteria for listing on the TSE mentioned earlier, it’s not surprising that VNG and Tiki were not chosen. In addition to not operating in the Japanese market, they also lack many other critical requirements.

In August 2023, VNG submitted a filing to the US Securities and Exchange Commission (SEC) as a preparatory step for an IPO on NASDAQ. This filing revealed the expected shareholder structure of the company controlling VNG after the IPO, which included prominent corporations such as Tencent, Ant Group, and GIC, the investment fund of the Singapore government. Notably, none of the major shareholders of VNG were from Japan.

Over the past decade, VNG has expanded its business overseas to Southeast Asian countries, Taiwan, and Hong Kong (China) and acquired startups across Asia, but none of these ventures have involved Japan.

On the other hand, Tiki does have Japanese investors. In its early stages, Tiki received capital support from CyberAgent Ventures Inc. in 2012. The following year, the Sumitomo Group also decided to invest in Tiki, acquiring approximately 30% of the company’s shares, while CyberAgent Ventures’ stake decreased from 22% to 15%. However, Japanese investors only participated in the Series A and B rounds, and from Series C to E, they were no longer involved. Tiki’s Series E funding round in 2021 was led by the global insurance group AIA, with other investors including UBS AG (London branch), Mirae Asset-Naver Asia, and Taiwan Mobile Co. In total, Tiki has raised $258 million.

Moreover, despite operating solely in the Vietnamese market, Tiki has struggled to maintain its leading position over time. From being a top player alongside Lazada in the first half of the 2010s, Tiki is now falling behind Shopee, TikTok Shop, and the soon-to-enter Temu.

The latest data from Metric shows that the Shopee platform continues to dominate the Vietnamese e-commerce market in the first half of 2024, with revenue of VND 53,740 billion, capturing 67.9% market share. TikTok Shop follows with VND 18,360 billion and a 23.2% market share, while Lazada and Tiki trail with VND 6,030 billion (7.6%) and VND 997.06 billion (1.3%), respectively.

When Will the Vietnamese IB Market Bounce Back?

The Vietnamese IB market was once likened to a land of opportunity, but it has become stagnant in recent years due to various reasons. However, according to Mr. Nguyen Van Quang, Head of Investment Banking at NH Vietnam Securities Company (NHSV), it remains a market with strong long-term potential and could bounce back to life if Vietnam’s stock market is successfully upgraded.

“Effective IR: How Companies Can Sustain Their Allure Post-IPO”

Investor Relations (IR) is about providing transparent and timely information, empowering investors to make informed decisions about their investments in a company and take timely action (buy/sell/hold). It is about giving investors the full picture, both good and bad, to enable them to make astute choices.

Unlocking the Potential of Vietnam’s IB Market: A Challenge Worth Taking

“The Vietnamese IB market holds immense potential, but unlocking this power is a challenging journey. This is according to Tran Nhat Huy, Director of Investment Banking at Shinhan Securities Vietnam (SSV). He shared that while the market holds great promise, there is a long way to go to truly awaken its inner strength.”

“Refinery Petrochemical BSR Files for HOSE Listing”

With a focus on gearing up for new breakthroughs and fulfilling commitments to shareholders at the 2024 Annual General Meeting, Binh Son Refinery and Petrochemical Joint Stock Company (BSR) has accelerated its efforts to complete the final steps of transferring its listing from the UPCoM to the Ho Chi Minh Stock Exchange (HOSE).