The increase in DIG‘s ownership in DIC Hospitality came not long after this subsidiary changed its business model from an LLC to a JSC on July 1, 2024. Following the transition, DIC Hospitality’s charter capital remained at over VND 1,000 billion but decreased by VND 5,728 billion compared to before the conversion.

DIC Hospitality was established in January 2020, headquartered in Vung Tau city, Ba Ria – Vung Tau province. At that time, its charter capital was VND 230.5 billion, of which DIG held 99.957%, and Mr. Nguyen Hung Cuong – the current Chairman of DIG‘s Board of Directors – held 0.043%.

In 2020 and 2021, DIC Hospitality continuously increased its charter capital. By December 2021, the company’s charter capital had risen to over VND 1,000 billion, with DIG holding 78.302%, Mr. Cuong holding 0.01%, and the remaining 21.688% owned by Mr. Cao Van Vu.

Mr. Vu Thanh Binh, the brother-in-law of DIG‘s former Chairman, Nguyen Thien Tuan, has been the General Director and legal representative of DIC Hospitality since its inception.

In its 2023 annual report, DIG introduced DIC Hospitality as the operator of various projects, including the DIC Star Landmark Hotel, Cap Saint Jacques (CSJ) building, Thuy Tien apartment building, and DIC Star Vinh Phuc Hotel.

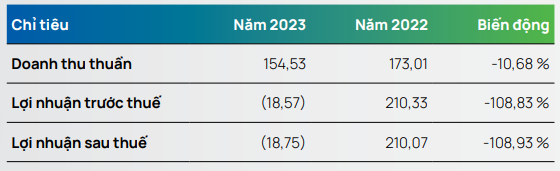

|

Business results of DIC Hospitality for the period of 2022-2023

Source: DIG

|

The change in DIC Hospitality’s business model and DIG‘s increased ownership were approved by DIG‘s Board of Directors in a resolution dated June 24, 2024, regarding the company’s financial investment plans for 2024.

According to this resolution, in addition to DIC Hospitality, DIG will also divest part of its capital from DIC Anh Em Enamel Tile Joint Stock Company and completely divest from Cao Su Phu Rieng – Kratie Rubber Joint Stock Company to interested investors. The divestment was to be completed before September 30, 2024, with payment made via bank transfer.

In early October 2024, DIG announced that it had completed the partial divestment from DIC Anh Em as per the June 2024 resolution. However, the company has not provided any updates regarding the capital transfer at Cao Su Phu Rieng – Kratie.

In terms of business performance, DIG reported a net profit of just over VND 16 billion in the first nine months of 2024, an 85% decrease compared to the same period last year, despite a 46% increase in revenue to VND 869 billion. This was mainly due to a significant drop in financial revenue, which fell by 75% to nearly VND 52 billion due to reduced income from investments.