Bids improved significantly in the afternoon session, but money did not flow heavily into the blue-chip group. Mid- and small-cap stocks were the real movers as mid-cap liquidity increased by 37% from yesterday, while small-caps surged 44% compared to the VN30’s modest 14% gain.

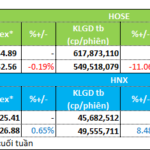

The market witnessed a brief profit-taking spell in the afternoon session, lasting for about the first 30 minutes, but subsequent positive buying pressure pushed prices higher. At its lowest point, the VN-Index still gained 2.7 points from the reference level and closed up 7.01 points (+0.56%). The breadth of the index remained strong with 209 gainers and 153 losers, indicating that most stocks only experienced profit-taking on the upside. By the end of the HoSE trading session, there were 244 gainers and 132 losers, reflecting a clear rebound in stock prices.

Mid- and small-cap stocks unexpectedly emerged as the strongest performers today. Out of the 244 stocks that closed in the green, 106 rose more than 1%, with only 6 coming from the VN30 index. Furthermore, the HoSE saw 11 stocks hitting the daily limit-up, including notable names such as CSV, HPX, DLG, HVN, and YEG.

Several mid- and small-cap stocks also joined the rally, with GMD climbing 4% on a turnover of 335.5 billion VND, PTB rising 3.87% with a matching volume of 17.1 billion, CMG gaining 2.92% on a turnover of 55.1 billion, EVF increasing by 2.8% with a turnover of 34 billion, and TCH advancing by 2.55% on a volume of 116.7 billion. Combined, the small-cap group posted a liquidity of 1,228.4 billion VND, a 44% increase from the previous day and the highest in the last five sessions. Midcaps also witnessed a 37% jump in liquidity, reaching 4,725.3 billion VND, the highest in the last three sessions.

Out of the 38 stocks on the HoSE that recorded a turnover of over 100 billion VND, 16 belonged to the VN30 basket. Naturally, mid- and penny stocks struggle to achieve top liquidity, but they outnumber large-caps when it comes to the number of stocks trading in the billions. Their low liquidity advantage is currently translating into price momentum as more money flows in.

Nonetheless, blue-chips remained the main driver of index gains today. Among the top 10 stocks contributing the most to the VN-Index’s advance, only HVN was outside the VN30 basket. This stock surged to its daily limit-up of 6.8% with the highest trading volume in two months, reaching 83.8 billion VND. Since the beginning of October, HVN has mostly traded sideways. Unfortunately, HVN’s market capitalization ranks only in the bottom quarter of the HoSE’s Top 25, limiting its impact.

The VN-Index climbed steadily for most of the afternoon session, thanks to broad-based gains in the VN30 basket. The impact could have been more pronounced if the large-caps had contributed more. VHM, however, slipped slightly from its morning highs, and VCB, TCB, BID, and GAS also witnessed minor declines. Among the top 10 stocks by market capitalization, only HPG posted a notable gain of 1.12%.

The sudden shift in money flow towards mid- and small-cap stocks is not surprising. This group underwent a significant correction during the recent downturn. Additionally, the limited money flow at this point is more suitable for smaller stocks with lower liquidity than for heavy-weighted blue-chips. If the market enters a T+ recovery phase, quick trades in smaller stocks with higher price volatility can lead to faster profits.

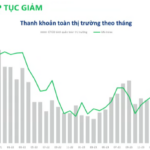

HoSE’s liquidity in the afternoon session increased by nearly 32% from the morning session, reaching 6,625 billion VND, equivalent to an absolute increase of 1,602 billion VND. In contrast, the VN30 basket’s absolute gain was only 663 billion VND. This is the clearest signal of increased money flow into mid- and small-cap stocks.

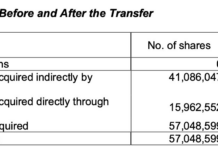

Foreign investors engaged in a large off-floor negotiated sale of VIB shares worth 5,540 billion VND in the afternoon session. However, the total net selling value for the whole HoSE trading session was 5,252 billion VND. In other words, excluding the VIB negotiated trade, foreign investors turned net buyers to the tune of approximately 288 billion VND. The most actively bought stocks were VPB (+275.7 billion), GMD (+172.4 billion), EIB (+63.7 billion), MWG (+60.6 billion), CTD (+38.1 billion), STB (+31.2 billion), TCB (+26.8 billion), and CSV (+22.2 billion). On the selling side, apart from VIB, we saw VHM (-95.1 billion), BID (-66.3 billion), MSN (-44.8 billion), HPG (-43.4 billion), SSI (-43.1 billion), VCB (-37.2 billion), and DXG (-22.8 billion).

“The Art of Persuasive Writing: Mastering the Science of Influence”

The VN-Index and HNX-Index both witnessed a decline, alongside a significant surge in trading volume during the morning session. This indicates a prevailing sense of pessimism among investors.

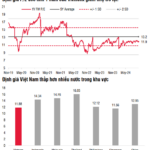

When Will the Market Correction Be Over?

Sharing his insights at the ‘Khớp lệnh’ program on November 4, 2024, expert Tran Hoang Son, Market Strategy Director at VPBank Securities Joint Stock Company (VPBankS), opined that the market needs to adjust to a more attractive level to lure mid to long-term investors.

SSI Research: Short-term Volatility Presents Buying Opportunities for Long-term Investors

“According to SSI Securities Corporation’s November 2024 strategy report, the SSI Research Center for Analysis and Investment Consulting believes that the market may fluctuate in the short term. However, this also presents an opportunity to buy potential stocks at reasonable prices to build a long-term investment portfolio.”