According to experts, Vietnam is asserting its position as an attractive destination for global investment capital – Photo: VGP/Anh Le

This is the assessment of many experts at the Vietnam Investment Forum 2025 (Vietnam Investment Forum 2025), which took place on November 8 in Ho Chi Minh City.

Sharing at the forum, Mr. Nguyen Ba Hung, Chief Economist of ADB Bank, assessed that in 2024, two prominent growth drivers are FDI capital continuing to maintain a positive trend and rapid export growth. Meanwhile, in 2025, the general trend of the world market is cooling down, so the export growth prospect in 2025 may not be as high as the result of 2024, this expert expects the “lever for growth in 2025 is public investment to boost domestic consumption and domestic investment.”

Sharing the same view, Mr. Nguyen Tu Anh, Director of the Center for Information, Analysis and Economic Forecast (Central Economic Committee), said that in 2025, it is expected that the factor that will lead the growth is investment demand, partly from state investment and the other part is expected to improve private investment along with economic recovery.

At the forum, the speakers analyzed the domestic and international macroeconomic variables in 2025, made forecasts about monetary and fiscal policies, their impacts on the business and investment environment, analyzed factors affecting the trend of global investment capital transfer and investment in Vietnam.

The common view of the speakers is that with the combination of economic growth and macro stability, infrastructure investment policies and strong administrative procedure reform, Vietnam is asserting its position as an attractive destination for global investment capital. Enterprises and investors need to seize these opportunities to build sustainable and effective development strategies in the next period.

There will be many pilot resolutions to immediately solve urgent problems

Sharing the view that the opportunity of the Vietnamese economy in the coming year will come from the improvement of internal strength, Mr. Phan Duc Hieu, a permanent member of the National Assembly’s Economic Committee, said that institutional reform along with new investment decisions will be the two key factors opening up optimistic expectations for the coming years.

Regarding institutional reform, Mr. Phan Duc Hieu said that the National Assembly is expected to consider many pilot resolutions to immediately solve urgent problems, which are not sufficient to build into laws, such as the pilot resolution to solve commercial housing problems.

As for public investment decisions, Mr. Phan Duc Hieu emphasized the policy of investing in the North-South high-speed railway. At the same time, he expected the socio-economic efficiency from the development of this high-speed railway system, which will be a driving force to create new economic spaces, rearrange residential areas, and create new socio-economic development momentum.

Unlocking India’s Rice Exports: Exploring the Impact

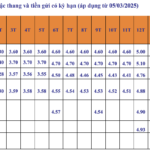

The Indian government’s decision to lift the ban on common rice exports has resulted in a $24/ton decrease in Vietnam’s rice export prices in October 2024 compared to the previous month. However, as of now, Vietnam’s 5% broken rice remains more expensive than that of Thailand by $16/ton and India by $46/ton.

The Great ETF Snub: Vietnam Left Out in the Cold Despite Southeast Asia’s Allure

Week 04-08/11/2024 saw a significant wave of capital outflows across multiple Asian markets, with Vietnam recording a notable foreign net withdrawal of up to $144 million, equivalent to VND 3,600 billion. Among this, ETFs withdrew $9.2 million, contributing to the overall outflow. This period marked a notable shift in investment trends, highlighting the dynamic nature of global financial landscapes and the intricate interconnectedness of international markets.

The Golden Scam: Uncovering a Risky Venture Gone Awry

“Seeing that gold prices in Cambodia were lower than in Vietnam, Pham and Luyen pooled together $570,000 to purchase over 6kg of gold. They intended to bring it back to Vietnam to sell for a profit. However, their scheme was uncovered by authorities, who promptly arrested them.”