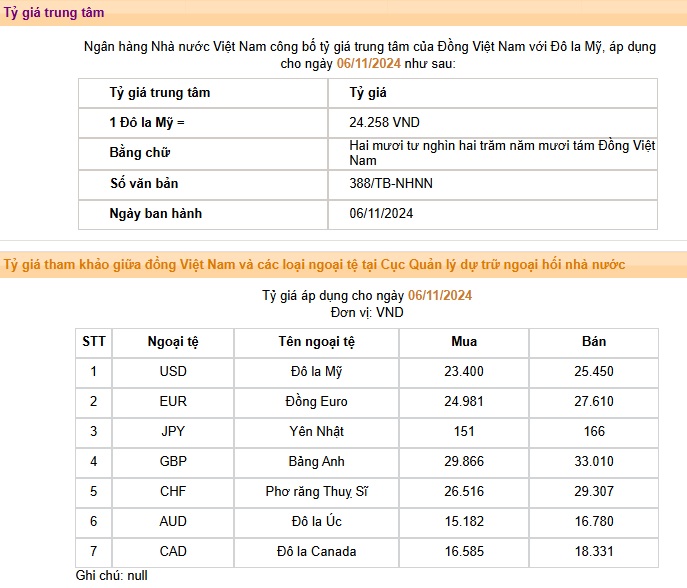

On the morning of November 6, 2024, the State Bank of Vietnam (SBV) announced the central exchange rate of the Vietnamese Dong to the US Dollar at 24,258 VND/USD, an increase of 10 Dong compared to the previous day.

Source: SBV

|

The reference exchange rate at the SBV’s trading center was 23,400 – 25,450 VND/USD for buying and selling, respectively.

Commercial banks, such as Vietcombank and VietinBank, also saw an increase in their buying and selling rates, with Vietcombank reaching 25,140 – 25,470 VND/USD and VietinBank at 25,218 – 25,470 VND/USD.

Globally, the USD-Index stood at 104.83, an increase compared to the previous day’s 103.84.

|

USD-Index surges past the 104 threshold

Source: VietstockFinance

|

Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets, and Securities Services at HSBC Vietnam, assessed that the US presidential election results would lead to different scenarios regarding trade policies, which would subsequently impact the global economy and Vietnam specifically.

In the event of a Donald Trump victory, there could be an implementation of trade policies that increase the use of tariff barriers on countries trading with the US. In this context, Vietnam may benefit from attracting foreign investment as manufacturing companies shift their supply chains or expand their operations in the country. However, Vietnam’s exports to the US market would face risks due to America’s trade protectionist policies. Statistics show that the US is Vietnam’s largest export market, with a total export value of more than 88 billion USD in the first nine months of 2024, a 26% increase compared to the same period last year.

The Vietnamese Dong has been under depreciation pressure as the US Dollar strengthened since the beginning of October. The trend of the US Dollar’s movement in the global market is unpredictable as it depends on the US election results.

“However, the USD/VND exchange rate is expected to remain stable in the last months of the year, thanks to favorable fundamental factors, including a large trade surplus and foreign investment disbursement, which reached 20.81 billion USD and 17.3 billion USD, respectively, in the first nine months. Additionally, the SBV always proactively intervenes in the foreign exchange market when necessary to ensure its stable operation and avoid negative impacts on other macroeconomic objectives, such as economic growth and inflation,” said Mr. Khoa.

Mr. Khoa cited the example of the SBV providing Dong liquidity on November 4 to meet the sudden surge in Dong usage demand, which usually occurs at the beginning of each month in the interbank market. The SBV’s open market operation did not significantly affect the foreign exchange market, while the tools currently used by the SBV to intervene in the exchange rate are the issuance of short-term bills and the readiness to sell foreign currency at the rate of 25,450. The SBV uses both the open market and bill issuance channels simultaneously to support liquidity and narrow the interest rate gap between the VND and USD to reduce pressure on the exchange rate. The shortage only occurs in the short term, while the market’s liquidity is expected to remain stable.

Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets, and Securities Services, HSBC Vietnam

|

Previously, in its recently published November strategy report, Shinhan Securities (SSV) assessed that exchange rate and interest rate impacts would be more pronounced if Donald Trump returned to the White House.

“Trump trades,” or bets on a Trump victory, have caused the USD-Index to rise rapidly in recent times. Investors who believe in “Trump trades” think that his policies will strengthen the USD and increase American inflation.

By the end of October, the VND had depreciated by more than 4% against the USD. The USD-Index also increased from 100 at the end of September to 104 at the end of October. In addition to concerns about geopolitical risks in the Middle East, the USD-Index surged due to the anticipation of the US presidential election results.

Investors believe that Donald Trump will become president again in the upcoming term, and his policies will lead to higher inflation. With high inflation, the US Federal Reserve (Fed) will slow down its interest rate cuts, contrary to the market’s expectations in September 2024. Moreover, Donald Trump’s policies may also affect America’s trading partners and strengthen the USD against other currencies.

Phu Hung Securities (PHS) also shared a similar opinion in its latest macro report, stating that 60% of the US Dollar’s increase in October was related to bets on Donald Trump’s victory in the November 5 election.

Cat Lam

“VIB Bank Contributes Over $129,000 in Taxes for 2023, Finalizing an Additional $383,000 Payment for 2022-2023”

As per the Large Enterprise Tax Department’s document dated November 11, 2024, Vietnam International Commercial Joint Stock Bank (HOSE: VIB) has completed paying additional taxes of 8.5 billion VND for the years 2022 and 2023, bringing the total tax payment for 2023 to 3,102 billion VND.

“VinFast Secures Backing from Vingroup and Chairman Pham Nhat Vuong to Fortify its War Chest and Accelerate its Ascent.”

On November 12, 2024, Vingroup and Mr. Pham Nhat Vuong announced a financial support package for VinFast. As part of this, Vingroup plans to provide VinFast with new loans of up to VND 35,000 billion by the end of 2026. In addition, Mr. Pham Nhat Vuong has committed to personally sponsoring VinFast with VND 50,000 billion. Furthermore, Vingroup will invest in VinFast Vietnam by converting the existing loan of approximately VND 80,000 billion into preferred shares, which will be eligible for dividends.