Today’s market showed significant positivity, not just in the rising index but also in the balance and stronger bottom-fishing money flow. The shift from indiscriminate selling to price selection and consolidation indicates a notable change in investor psychology and risk assessment.

Today’s information landscape remains unchanged from yesterday and is not more favorable than last week. However, trading activities have stabilized considerably. This can only be attributed to a shift in supply and demand dynamics, with the primary driver being the acceptance of prices by market participants.

After continuous declines over several days, the slowdown in stock declines and low liquidity indicate that the most vulnerable stocks have been offloaded, leaving those willing to hold their positions. Investors who use their own money to hold onto their stocks, accepting losses, contribute to forming a bottom. The remaining participants, who hold cash, will need to decide if they are satisfied with the current discounted prices.

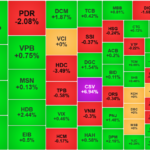

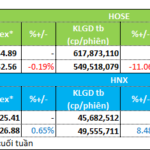

Bottom-fishing money flow was more evident today compared to yesterday, not only buying at red prices but also pushing prices up enthusiastically. Naturally, not all stocks received strong money flow, but the ability to maintain green prices is always a positive signal in this situation. If the cash holders don’t get their desired prices, they will eventually have to change their decision. If many participants and large funds make this change, the demand will strengthen, and the direction of prices will shift. Therefore, stocks that reverse with larger amplitudes and higher liquidity are preferable. The matched liquidity of the two exchanges today reached nearly VND 16,400 billion, which is not a high number but still positive, especially with the presence of active buying money flow creating liquidity.

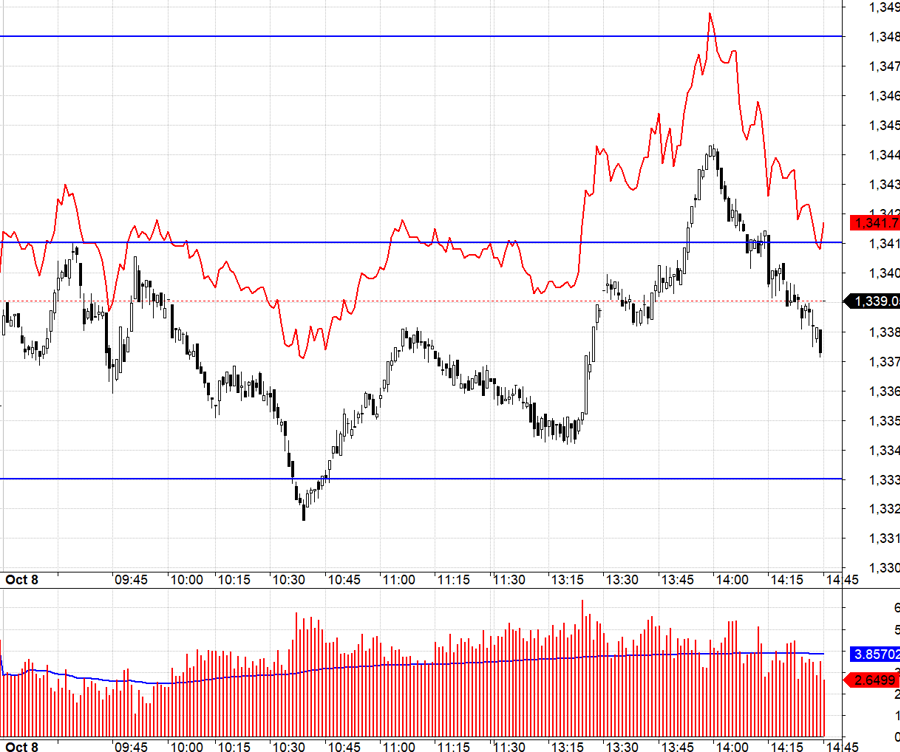

The back-and-forth price action and volatility during today’s session also reflect the ongoing supply and demand dispute, which has not yet tilted decisively in either direction. When prices rose in the afternoon, there was another wave of selling, which was not strong enough to reverse the upward trend but did curb the rise in many stocks. It is likely that in the coming sessions, the dispute will shift to the green price zone, and if there are any declines, they will be of narrower amplitude. Technically, consecutive sessions like this will send a consensus signal of bottom formation across various indicators.

I maintain the view that the market is undergoing a positive correction, and stocks are purchasable. There are still many opportunities to buy during the session, so it is essential to time your entries well to optimize your resources and avoid getting caught up in the excitement of high-speed trading.

Today, the derivatives market also witnessed a recovery in liquidity, with foreign investors going long for the first time after three sessions. Basis remains the most annoying factor; when VN30 declined intraday, F1 did not decrease proportionally, and when VN30 rose, the basis tended to widen. At the beginning of the session, VN30 formed two peaks at 1341.xx, a beautiful short entry point, but when VN30 fell to 1333.xx, F1 did not decrease much. When VN30 rebounded from 1333.xx, the basis widened again. Even in the final upward push, F1 did not maintain the basis to rise proportionally.

Today’s underlying market sent a clearer signal of supply and demand balance. However, there may still be a need for another supply test, as the current low selling volume requires pressure on the pillars to expand the index amplitude and create a strong psychological impression. The strategy remains to buy stocks, dynamically long/short derivatives, and prioritize long if there is pillar suppression.

VN30 closed today at 1339.05. The nearest resistance levels for tomorrow are 1341; 1348; 1356; 1366; 1369; 1376. Supports are at 1333; 1325; 1318.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, assessments, and investment opinions expressed herein belong to the individual investor, and VnEconomy respects the author’s views and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments and investment opinions.

What Are Proprietary Trading Firms Holding in Their Portfolios?

The proprietary trading segment has brought in a substantial profit of over 3.53 thousand billion VND for securities companies, despite a modest increase. What are the secret weapons in the portfolios of these securities firms, and how have they achieved this success? It’s time to delve into the strategies and uncover the key drivers behind these impressive results.

The Savvy Investor’s Bottom-fishing Expedition

The VN-Index pared losses, forming a Hammer candlestick pattern with above-average volume. This indicates a temporary reprieve from market risks as bottom-fishing funds entered the market, spurring a surge in trading volume. The Stochastic Oscillator, having exited oversold territory, continues to signal a buy. If this signal holds in the coming sessions, the short-term outlook may not be as pessimistic.

The Surprising Surge of Penny Stocks: A Market Phenomenon

Liquidity saw a significant improvement during the afternoon session; however, funds did not largely flow into the blue-chip stocks. It was the mid-cap and small-cap stocks that witnessed a surge as the liquidity in the mid-cap group increased by 37% compared to the previous day, while the small-cap group witnessed a remarkable 44% increase, leaving the VN30 with just a 14% gain.