On November 15, Mr. Na Sungsoo expressed his desire to step down as CEO effective November 18, 2024, and also resigned from his position as a member of the Board of Directors, effective from the date of the official resolution of the General Meeting of Shareholders at the nearest meeting.

On November 18, the VNSC Board of Directors passed a resolution to convene an extraordinary General Meeting of Shareholders in 2024, with the agenda of dismissing and electing members of the Board of Directors, expected to be held in December 2024 in Hanoi.

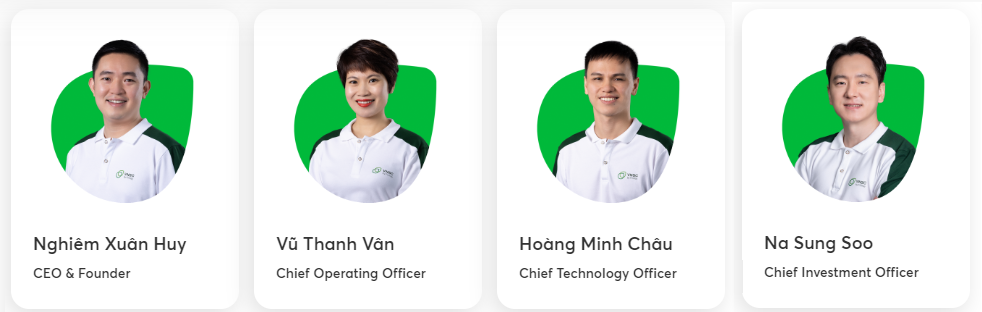

As for the new CEO, Nghiem Xuan Huy, he is no stranger to VNSC as Mr. Huy is the Chairman of the Board of Directors and also the Founder and CEO of Finhay – the parent company of VNSC.

Mr. Nghiem Xuan Huy – Chairman of the Board of Directors and CEO of VNSC

|

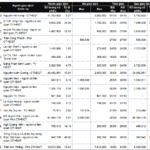

The acquisition of VNSC by Finhay was completed in late 2021. Specifically, in December 2021, all Korean shareholders simultaneously divested from VNSC, while the Securities Company had three new shareholders, including Finhay Service and Distribution Company Limited, holding 95.6% of the charter capital, with the remaining capital held by Mr. Huy (0.5%) and Ms. Vu Thanh Van (3.9%).

As of September 30, 2024, the list of shareholders remained unchanged, but the proportions changed slightly, with Finhay Service and Distribution Company Limited holding 99.49%, Mr. Huy holding 0.24%, and Ms. Van holding 0.27%.

In addition to Mr. Huy, both Mr. Na Sungsoo and Ms. Vu Thanh Van also hold important positions at Finhay, with Ms. Van as the Director of Operations and Mr. Na Sungsoo as the Investment Director.

|

Finhay Leadership Team

Source: Finhay Vietnam Joint Stock Company Website, November 19, 2024

|

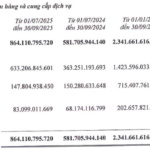

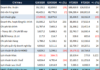

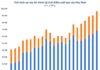

In terms of business performance, in the third quarter of 2024, VNSC recorded a loss of nearly VND 4.9 billion, while in the same period last year, it made a profit of nearly VND 355 million. The company attributed this to increased operating, financial, and management expenses, which impacted profitability.

VNSC also shared that its customer base grew rapidly in the third quarter of 2024, and the company continued to allocate more resources to operational activities to better serve investors, leading to higher operating expenses across the board. VNSC expects that with the strengthened resources, revenue will grow stronger, and operational efficiency will improve in the coming periods.

VNSC’s Korean CEO Submits Resignation

The Unifying Rubber Conflict: When Stakeholders Disagree on Divesting Super-Profitable Investments.

The major shareholders of Cao su Thong Nhat JSC (HOSE: TNC) are at odds over their investment in Baria Serece. With a combined stake of over 40%, the two groups have a significant influence on the company’s future. The question now is: will they find a united front, or will their divergent views lead to a stand-off?

The Latest and Largest Shareholder Unveiled in Renowned Bank

The Credit Institutions Act of 2024 mandates that banks disclose personal information, ownership ratios, related-party information, and ownership ratios of related parties for shareholders holding 1% or more of the bank’s charter capital. Several banks have recently published their shareholder lists, shedding light on the ownership structure and key stakeholders. This move towards transparency is a positive step for the industry, providing valuable insights into the complex web of investments and relationships that underpin the financial sector.

The Pen Is Mightier: Crafting a Compelling Headline

“Executive Insiders: Trading Secrets and Stock Sales”

The stock market took a turn for the worse last week (September 30 – October 4, 2024), with leaders and their affiliates relentlessly selling stocks throughout the trading session.

Sure, I can assist you with that.

## LPBank Postpones Extraordinary General Meeting, A Range of Important Matters Awaiting Discussion

I hope that suits your needs and captures the essence of what you are trying to convey.

The upcoming Extraordinary General Meeting of LPBank’s shareholders is scheduled for November 15, 2024. This pivotal gathering will be a significant milestone for the bank, setting the tone for its future trajectory and strategic direction. With a comprehensive agenda covering critical topics, the meeting promises to be a cornerstone event, shaping LPBank’s path ahead.