Illustration

Oil falls over 2% on weak Chinese demand

Oil prices fell over 2% in the final session of the week, logging their biggest weekly loss in a month, as investors worried about weaker Chinese demand and a potential slowdown in the pace of US interest rate cuts.

Brent crude futures settled at $71.04 per barrel, losing $1.52, or 2.09%, while WTI crude futures settled at $67.02 per barrel, down $1.68, or 2.45%.

For the week, Brent lost about 4% and WTI fell roughly 5%, their biggest weekly declines since mid-October.

Chinese refineries processed 4.6% less crude oil in October compared to a year earlier due to refinery maintenance and reduced runs at smaller, independent refineries, data from the National Bureau of Statistics showed.

The country’s industrial output growth slowed in October, and there are no signs of a let-up in weak demand in the property sector, raising concerns about the health of the world’s largest oil importer.

Goldman Sachs Research economists have slightly lowered their China growth forecast for 2025 following predictions of significant tax hikes under Trump.

Oil prices also fell this week as major forecasters predicted a slowdown in global demand growth. The International Energy Agency (IEA) expects global supply to exceed demand by over 1 million barrels per day in 2025 if OPEC+ maintains its current pace of production cuts.

Meanwhile, OPEC lowered its forecast for global oil demand growth this year and in 2025 due to weaker-than-expected economic data in China, India, and other regions.

US retail sales rose slightly more than expected in October, indicating a strong start to the fourth quarter. The data added to the debate among Fed policymakers about the pace and extent of interest rate cuts, as investors further lowered their predictions of a rate cut at the central bank’s December meeting.

Lower interest rates typically boost economic growth, supporting fuel demand.

Gold posts biggest weekly drop in over 3 years

Gold prices recorded their biggest weekly drop in over three years as expectations of fewer interest rate cuts by the Fed boosted the dollar, reducing the appeal of bullion.

Spot gold fell 0.1% to $2,565.49 per ounce. Prices fell over 4% for the week, touching their lowest since September 12 in the previous session. US gold futures for December settled down 0.1% at $2,570.10 per ounce.

The dollar posted its biggest weekly rise in over a month, making gold more expensive for buyers with other currencies.

Meanwhile, US Treasury yields continued to climb after data showed US retail sales rose slightly more than expected in October. Economists believe Trump’s tax plans will boost inflation, potentially slowing the Fed’s rate cut cycle.

Aluminum surges as China scraps export tax rebate

Aluminum prices surged after China said it would scrap export tax rebates, raising concerns that significant exports overseas could be curtailed.

Three-month aluminum on the London Metal Exchange rose around 8.5% to $2,730 per ton, closing up 5.6% at $2,658.50 a ton.

The Ministry of Finance announced it would remove export tax rebates for some steel and aluminum products, effective December 1.

China exports 4-6 million tons of semi-fabricated aluminum annually, accounting for about 7% of global supply.

Copper rose 0.2% to $9,006 a ton after hitting a three-month low in the previous session. China is not a major exporter of copper products.

Iron ore falls on concerns over Chinese real estate

Iron ore prices fell to their lowest in nearly two months and posted a weekly loss, pressured by a weak Chinese real estate sector, strong supply, and expectations of seasonal steel demand slowdown.

The January 2025 iron ore contract on the Dalian Commodity Exchange ended down 3.09% at 736 yuan ($101.80) per ton, the lowest since September 27. Prices fell 6.18% for the week.

In Singapore, the December iron ore contract fell 1.7% to $96.60 per ton, declining 4.18% for the week.

China’s new home prices fell the most in October since 2015, while real estate investment dropped 10.3% in the first ten months of 2024, indicating that Beijing’s support measures for the sector have had limited impact so far.

Construction activity is slowing down due to colder weather across China, affecting steel demand, with work slowing down or halting at sites in the northern regions.

However, in some southern regions, which are less affected by this weather, local contractors are speeding up projects to meet year-end deadlines.

In Shanghai, steel rebar fell about 2.8%, hot-rolled coil dropped 2.2%, wire rod dipped 0.36%, and stainless steel declined nearly 0.5%.

Japanese rubber rises on weak JPY

Japanese rubber prices rose in the final session of the week, buoyed by a weak yen, but posted their third weekly loss in four on concerns about Chinese demand.

The April 2025 rubber contract on the Osaka Exchange closed up 6 yen, or 1.74%, at 350 yen ($2.24) per kg. The contract fell 4.71% for the week.

Shanghai’s January 2025 rubber contract closed down 0.65 yuan, or 0.37%, at 17,650 yuan ($2,441.62) per ton.

The US dollar rose for the fifth day against the yen, making yen-denominated assets cheaper for buyers with other currencies.

Coffee, sugar mixed

March 2025 arabica coffee futures closed up 0.039 cents, or 1.4%, at $2.833 per lb, moving towards the previous session’s 13-year high.

Dealers said the outlook for next year’s crop in Brazil had suffered some setbacks due to dry weather earlier in the year, with soil moisture still low despite recent rains.

Broker Sucden Financial said positive technical indicators affirmed that prices could continue to rise in the short term, although the pace of gains might slow.

January 2025 robusta coffee fell $4, or 0.1%, to $4,773 per ton.

March 2025 raw sugar closed up 0.1% at 21.58 cents per lb.

December white sugar fell $0.10 to $545.20 per ton.

Corn, wheat rise

Chicago corn futures rose on technical buying after four straight sessions of losses amid concerns about domestic demand if Trump’s administration is less supportive of the biofuels industry as expected.

CBOT December corn settled up 0.05 cents at $4.24 per bushel.

US wheat recovered after touching multi-month lows last week as the dollar strengthened over several days.

CBOT December soft red winter wheat rose 6-1/4 cents to $5.36-1/2 per bushel.

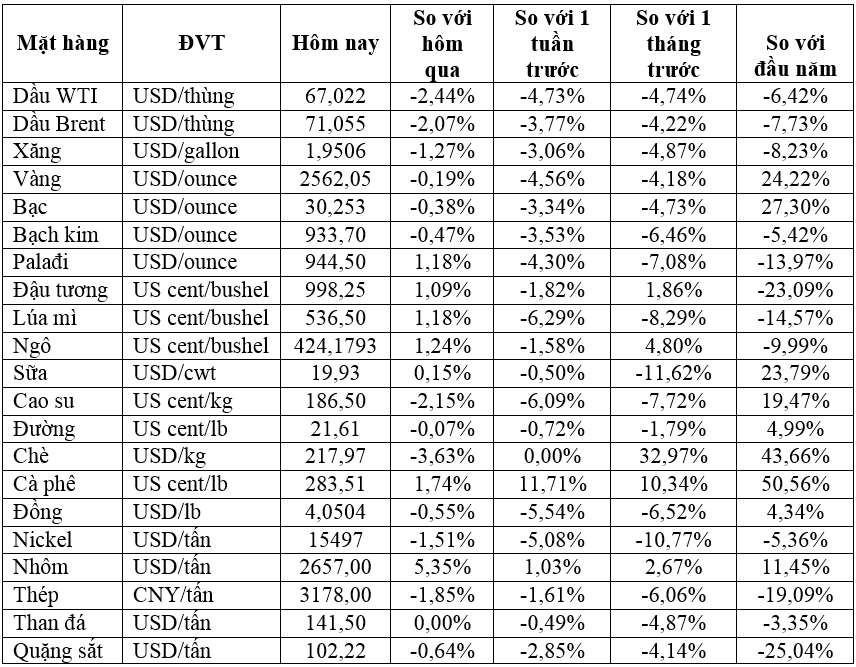

Prices of key commodities on November 16 morning

The Soaring Prices of Gas and Oil: RON 95 Surges Past 20,000 VND per Liter

Today (September 26th) saw a rise in domestic gasoline prices, with an increase of VND 680 to 750 per liter.