HDBank has once again proven its mettle by winning the Annual Report Awards for the sixth consecutive year in the Finance category. This achievement is a testament to the bank’s unwavering commitment to enhancing the quality of its disclosures and embracing international standards such as the ASEAN CG Scorecard.

Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission of Vietnam, presenting the Top 10 Best Corporate Governance Practices Enterprises award to HDBank

|

In the realm of corporate governance, HDBank was recognized among the Top 10 Best Corporate Governance Enterprises in the Large Cap group and also received the Best Annual General Meeting (AGM) Enterprise award for the second consecutive year. HDBank took the lead in organizing its AGM in a flexible manner, offering both online and in-person attendance options, thus maximizing convenience and ensuring shareholders’ rights. This achievement holds even greater significance as the assessment criteria for corporate governance were elevated in 2024, aligning with the latest OECD standards, with a 40% weightage given to international practices.

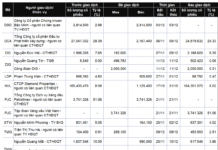

As of Q3 2024, HDBank demonstrated robust and sustainable performance:

• Pre-tax profit: VND 12,655 billion, a 46.6% increase year-on-year

• Total assets: VND 629 trillion, a 23.9% surge

• Total capital mobilization: VND 559 trillion, a 24.8% hike

• Credit balance: VND 412 trillion, a 16.6% growth

• Efficiency ratios: ROE at 26.7%, ROA at 2.2%, and NPL ratio maintained at a low 1.46%

In parallel with its business operations, HDBank has been a pioneer in community and environmental initiatives. During the first nine months of 2024, the bank undertook numerous meaningful social welfare activities, including donating health insurance cards to the underprivileged, building charity houses, supporting underprivileged students, responding to the Prime Minister’s call to eradicate temporary and dilapidated housing nationwide, and offering a VND 12,000 billion credit package to customers affected by Typhoon Yagi. The bank also actively contributed to relief efforts for flood-affected communities in the northern provinces.

The Vietnam Listed Companies Awards (VLCA) 2024, a prestigious annual event organized by HoSE, HNX, and the Investment Review newspaper, attracted over 500 listed companies. According to the organizers, HDBank demonstrated excellence in risk management disclosures, assessment and control of non-performing loans, and efficient capital utilization among financial institutions.

The three accolades received at VLCA 2024 are a testament to HDBank’s unwavering commitment to transparency, adherence to advanced governance practices, and the promotion of sustainable Environmental, Social, and Governance (ESG) development, thereby creating value for shareholders, customers, and the community.

“Banks Reap the Benefits as Savings Account Interest Rates Rise”

With an increasing number of banks offering attractive interest rates on savings accounts, the battle for idle funds is heating up. In today’s market, which banks are offering interest rates above 6% per annum on deposits? It’s time to explore the options and make your money work harder.

Profiting from the Economic Recovery

The banking sector is poised to reach new heights in 2024, with expectations of soaring profits. This optimistic outlook is underpinned by the sustained growth in credit and a notable easing of bad debt pressures, thanks to the economy’s robust recovery trajectory.