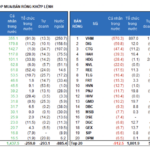

Vietnam’s stock market experienced significant volatility during the session on November 22. At the close, the VN-Index dipped slightly by 0.23 points to 1,228.1 points. Foreign investors unexpectedly turned net buyers, purchasing a net value of 31 billion VND worth of shares, ending a 30-session net selling streak.

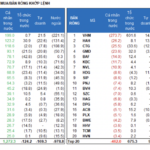

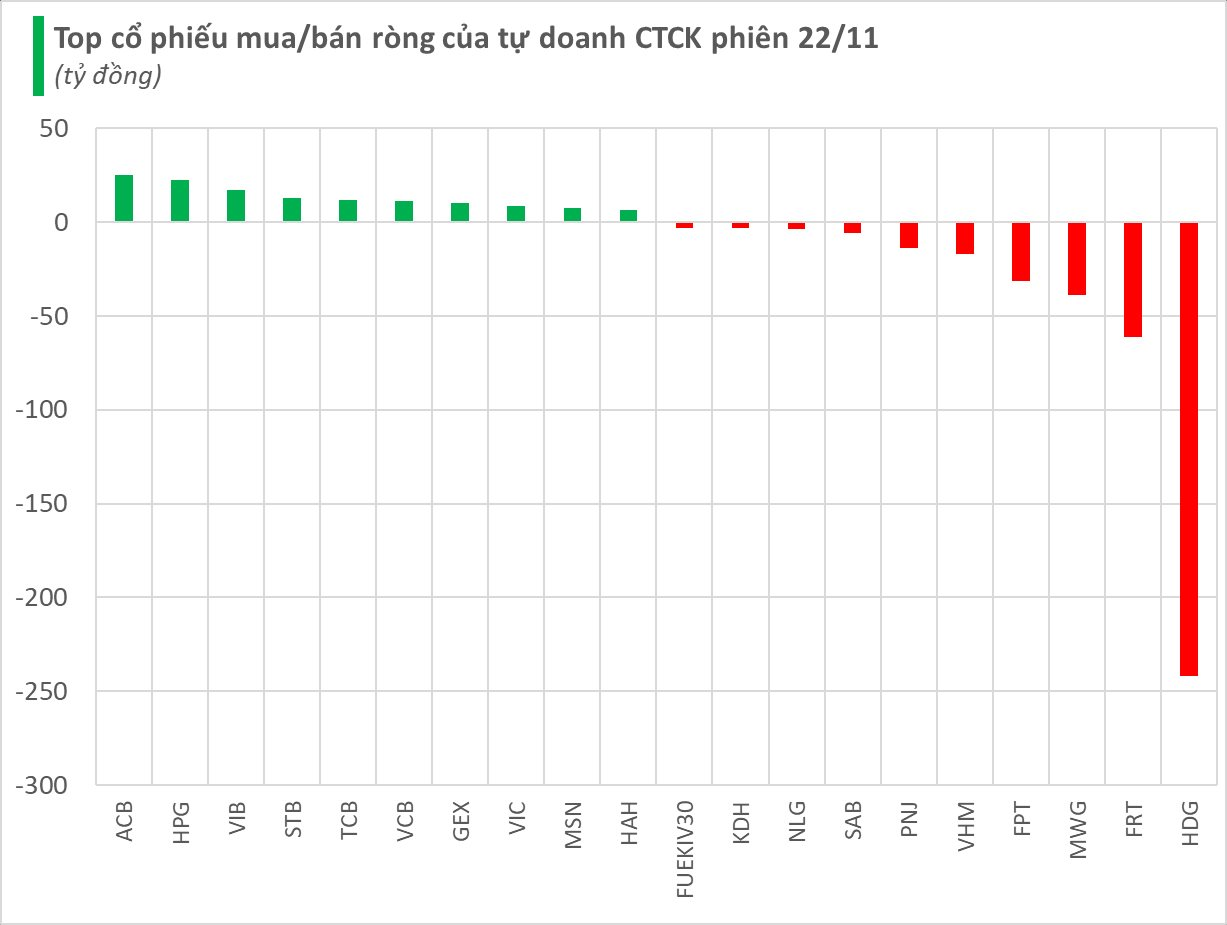

Brokerage firms’ proprietary trading activities continued with net selling of 182 billion VND across the market.

On the HoSE, brokerage firms’ proprietary trading activities resulted in net selling of 185 billion VND. While they net bought 68 billion VND on the matching order segment, they net sold 254 billion VND on the negotiated trading segment.

Specifically, brokerage firms net sold the most in HDG, offloading 242 billion VND worth of shares. FRT and MWG were also net sold, with values of 61 billion VND and 39 billion VND, respectively. Other stocks that witnessed net selling by brokerage firms included FPT, VHM, PNJ, and more.

In contrast, brokerage firms net bought 25 billion VND worth of ACB shares and 25 billion VND worth of HPG shares. VIB shares were also net purchased to the tune of 17 billion VND. Additionally, stocks like STB, TCB, VCB, and others were net bought during the November 22 session.

On the HNX, brokerage firms’ proprietary trading activities resulted in a net buy of 4 billion VND, with net purchases of PVS (3 billion VND) and VGS (2 billion VND). Conversely, KHS witnessed net selling of 1 billion VND.

On the UPCoM, brokerage firms’ proprietary trading activities resulted in a slight net sell. QNS experienced net selling of 1 billion VND, while ACV and FOX witnessed minor net buying.

The Savvy Investors: Seizing Opportunities in a Downturn

Domestic institutional investors today bought a net 729.7 billion VND, with a net purchase of 721.5 billion VND in matched orders. Individual investors also bought a net 873.8 billion VND.

The Cautious Sentiment Rises

The VN-Index staged a mild recovery, with a slight uptick in the session, but this was accompanied by a significant plunge in trading volume, falling below the 20-day average. This indicates that investor sentiment remains cautious following the recent downturn. The Stochastic Oscillator and MACD indicators continue to trend downward after issuing sell signals, suggesting that the short-term outlook remains bearish.