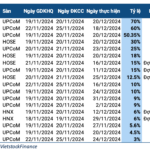

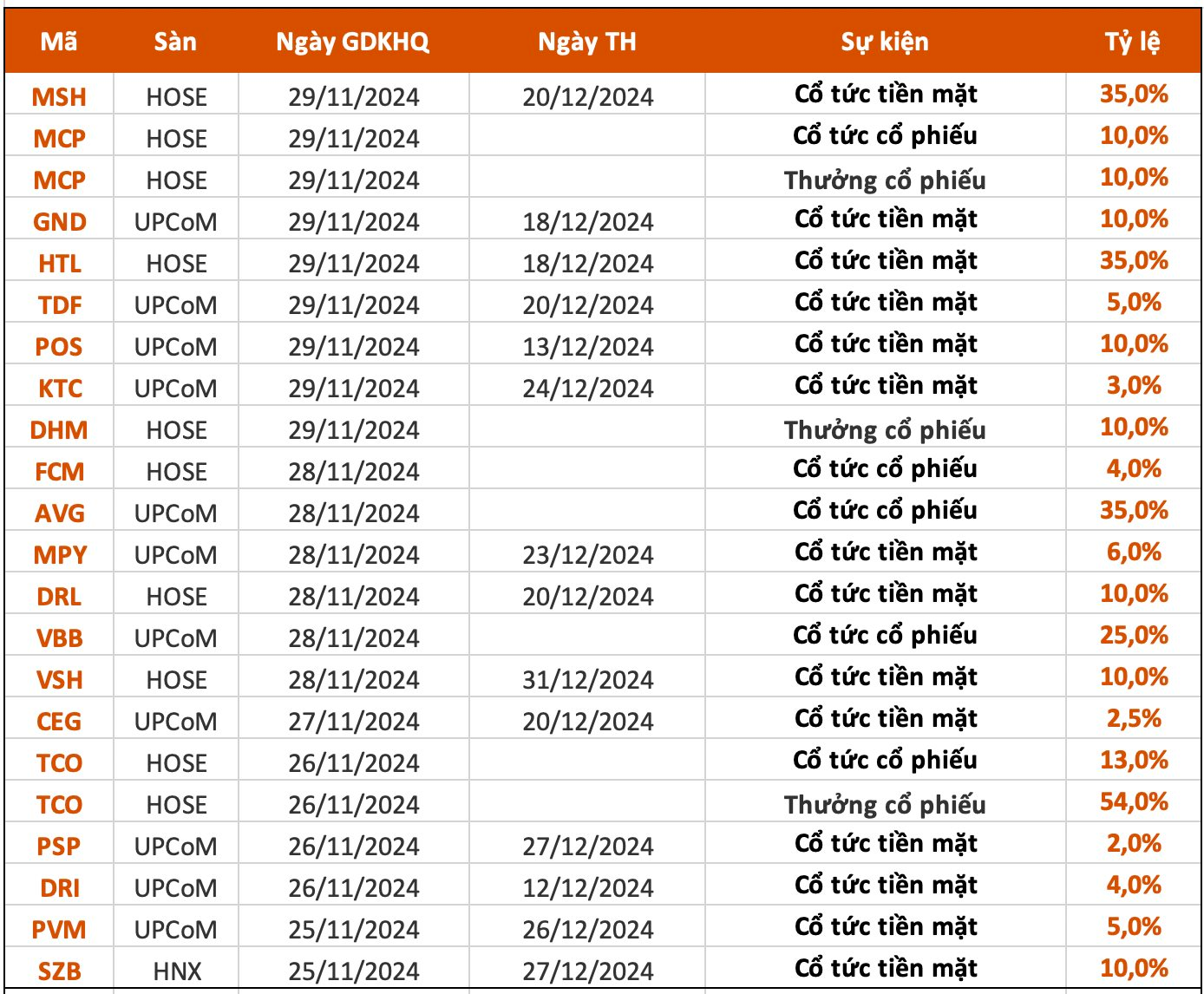

Among these, 14 businesses will pay out cash dividends this week, ranging from 2% to 35%. Additionally, three enterprises will distribute stock dividends, one will offer bonus shares, and two will provide a combination of both.

May Song Hong (MSH)

will finalize the list of shareholders for the 2024 interim cash dividend on Dec 2, with a rate of 35%. This means that for each share owned, shareholders will receive VND 3,500, and the expected payment date is Dec 20. With over 75 million shares in circulation, May Song Hong is expected to pay out a total of approximately VND 262.5 billion in this interim dividend.

Cong Ty Co Phan Ky Thuat va O to Truong Long (HTL)

announced that Dec 2 is the deadline for shareholders to register to receive a 35% cash dividend, or VND 3,500 per share. The payment date is set for Dec 18. With 12 million shares listed on the HoSE, the company is estimated to allocate VND 42 billion for this interim dividend.

This interim dividend follows the company’s decision to increase the dividend payout ratio for this year to 65%, or VND 6,500 per share. Previously, at the annual general meeting in May, the company approved a dividend plan for this year with a maximum ratio of 20%. This is the highest dividend payout since the company’s listing. Thus, the company may have at least one more payout to shareholders with a ratio of 30%.

Ngan Hang TMCP Viet Nam Thuong Tin (Vietbank – VBB)

announced that Nov 29 is the record date for shareholders to receive a 25% stock dividend. Accordingly, Vietbank will issue nearly 142.8 million new shares to pay dividends to shareholders. The source of the issuance is the undistributed profit reserve as of Dec 31, 2023.

After the issuance, the bank’s charter capital will increase by nearly VND 1,428 billion to VND 7,139 billion. Vietbank stated that the additional capital is expected to be used for investing in assets, supplementing its development and network expansion, ensuring compliance with safety ratios, and generating profits for the bank’s operations. The expected completion date is by the end of 2024.

CTCP Thuy Dien Vinh Son – Song Hinh (VSH)

announced that Nov 29 is the record date for the 2024 interim cash dividend. Previously, in October, VSH paid out more than VND 472 billion in the second tranche of 2023 dividends.

According to the announcement, Thuy Dien Vinh Son – Song Hinh will pay a cash dividend of 10% (equivalent to VND 1,000 per share). Thus, with over 236 million shares in circulation, VSH will distribute approximately VND 236 billion to shareholders. The payment date is set for Dec 31, 2024.

Among the shareholders, Cong Ty TNHH Nang Luong REE, a wholly-owned subsidiary of CTCP Co Dien Lanh (REE), holding over 124.2 million shares or 52.58%, will receive a corresponding amount of over VND 124.2 billion. Additionally, Tong Cong Ty Phat Dien 3 – CTCP (PGV), with over 72 million shares or 30.55%, will also receive over VND 72 billion in dividends from VSH.

A Rewarding Prelude: IDV’s Generous Interim Dividend of VND 1,500 per Share Ahead of the Annual General Meeting

The Vinh Phuc Infrastructure Development Joint Stock Company (VPID), listed on the Hanoi Stock Exchange as IDV, is preparing for its upcoming Annual General Meeting (AGM) scheduled for January 18, 2025, at its headquarters in Khai Quang Industrial Park, Vinh Yen, Vinh Phuc. Shareholders eligible to attend and vote at the meeting must be registered by December 16, 2024.

The Ultimate Dividend Stock: Unveiling the Company’s Record-Breaking Profits and Skyrocketing Stock Performance

In a move that followed an impressive Q3 2024, the company announced a dividend advance. With net profits tripling from the previous year’s quarter, the company is celebrating its highest earnings since its inception.