Foreign Investors’ Selling Pressure on Vietnam’s Stock Market: FPT Feels the Heat

Vietnam’s stock market is witnessing an unprecedented level of selling pressure from foreign investors. In recent sessions, foreign investors have consistently sold off thousands of billions of VND worth of shares on the HoSE, and FPT, once a favorite among foreign investors, has not been spared from this massive sell-off, even finding itself among the top-sold stocks.

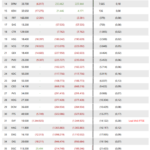

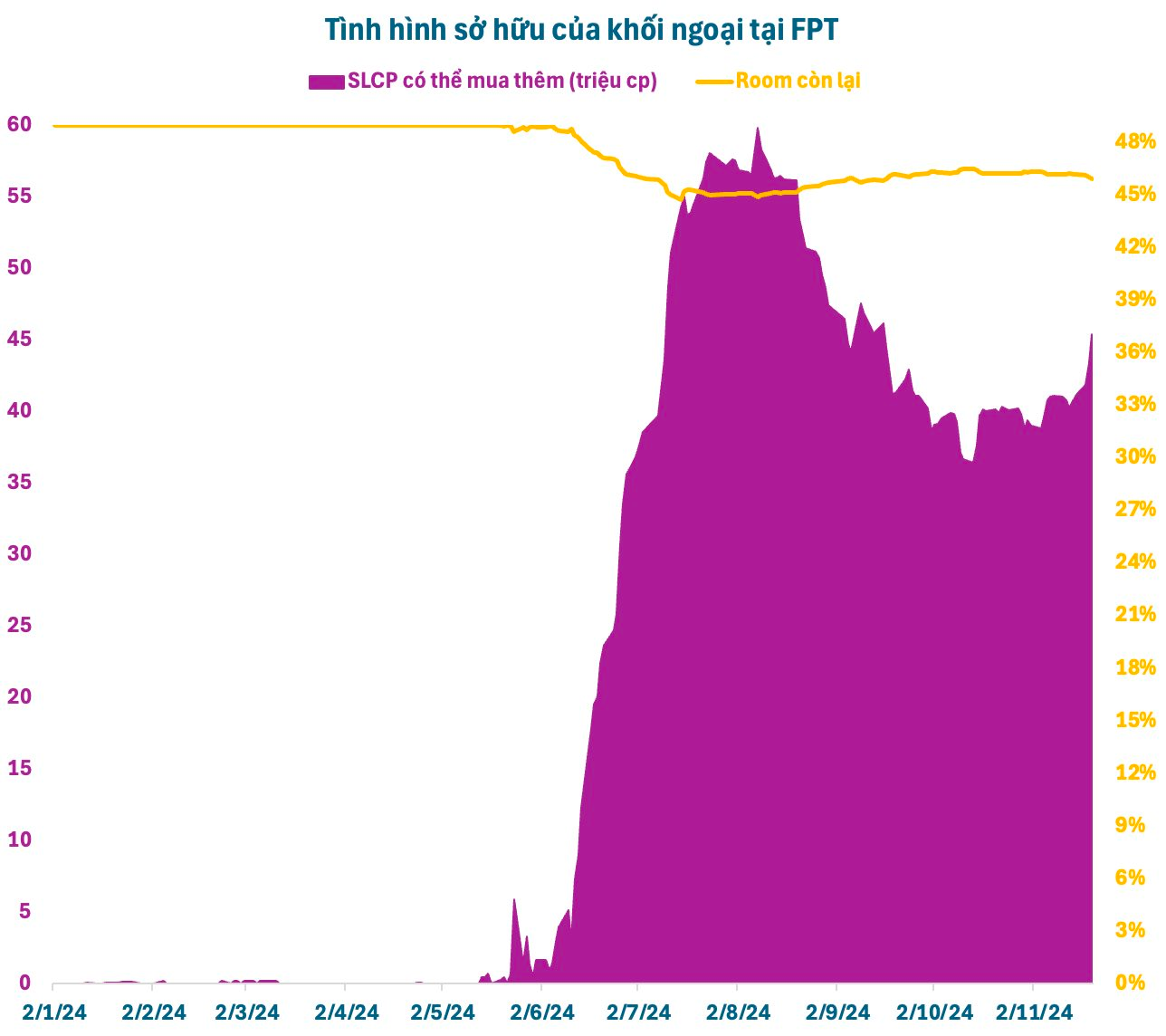

In just the first three trading sessions of this week, foreign investors sold approximately 4.2 million FPT shares, equivalent to a value of over 500 billion VND. This move has left more than 45 million FPT shares available for foreign ownership, or just over 3% of the total shares. As a result, foreign ownership in this technology stock has dropped below 46%, the lowest it has been in the past two months since mid-September.

With the room for foreign ownership now widened, it is easier for foreign investors to purchase FPT shares on the exchange instead of having to resort to off-exchange deals at prices significantly higher than the market price, as was the case a few years ago. However, it is challenging to predict when foreign investors will reverse course and start accumulating FPT shares again, especially given the current global trend of capital outflows from emerging and frontier markets, including Vietnam.

In fact, foreign investors have been aggressively selling FPT since May-June when the stock was on a tear, breaking record highs alongside the global tech trend. There was a period when more than 4% of the room was available for foreign ownership. The selling pressure showed some signs of abating, but it has recently intensified once more.

It is understandable that foreign investors would take profits as FPT has had a remarkable run and is still hovering near its all-time high. Since the beginning of the year, this technology stock has surged by nearly 60%, with the remarkable feat of surpassing its previous peak 35 times. With a market capitalization of nearly 195,000 billion VND (7.8 billion USD), FPT has become the largest private conglomerate on the Vietnamese stock market.

The stock’s strong performance has pushed FPT’s valuation to a record high. Assuming the technology conglomerate maintains its profit growth at around 20%, the forward P/E ratio for 2024 is estimated to be over 25 times, significantly higher than the VN-Index’s ratio of about 14 times. The expensive valuation, coupled with the uncertain prospect of breakthrough growth, makes FPT less appealing to foreign investors.

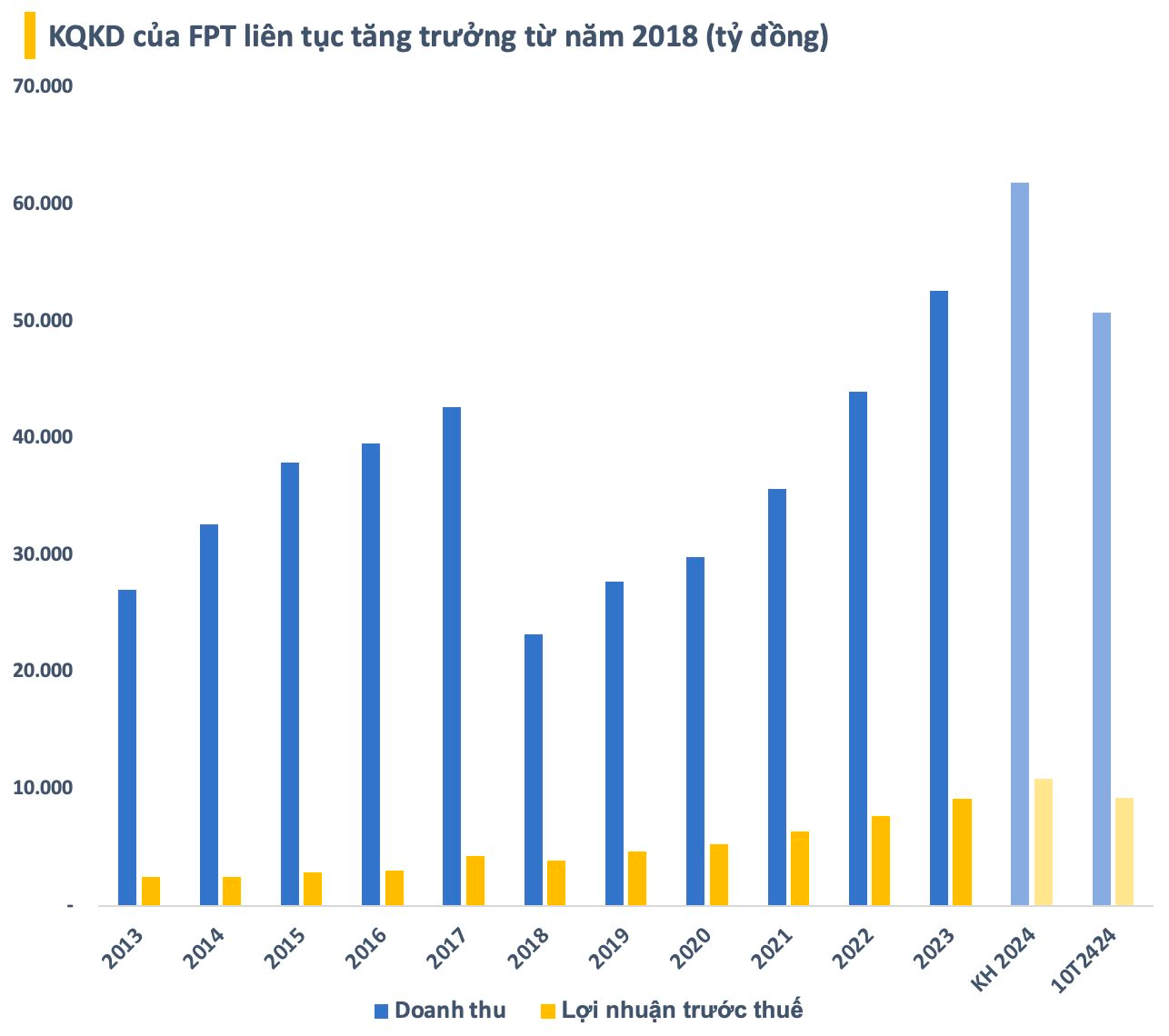

Nonetheless, FPT remains one of the top choices for foreign investors in Vietnam’s stock market due to the scarcity of technology stocks. Additionally, the company’s consistent growth of around 20% every month, quarter, and year over an extended period is a rarity in the market.

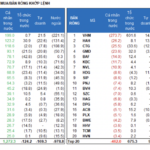

In the first ten months of the year, FPT recorded impressive results, with revenue reaching 50,796 billion VND and pre-tax profit amounting to 9,226 billion VND, representing increases of 19.6% and 20%, respectively, compared to the same period in 2023. After-tax profit attributable to the company’s shareholders and EPS stood at 6,566 billion VND and 4,494 VND per share, respectively, reflecting a growth of about 21% year-over-year.

For 2024, FPT has set ambitious business plans, targeting record-high revenue of 61,850 billion VND (~2.5 billion USD) and a pre-tax profit of 10,875 billion VND, indicating increases of approximately 18% compared to the actual results of 2023. With the achievements in the first ten months, the corporation has accomplished 82% of the revenue plan and 85% of the profit goal.

The IT Services segment in overseas markets continued its impressive growth, recording revenue of 25,516 billion VND in the first ten months – officially surpassing the 1-billion-USD mark and representing a 29% increase. This surge was driven by robust growth across all four markets, with the Japanese and APAC markets maintaining high growth rates of 31% (equivalent to 37% growth in Japanese Yen) and 38%, respectively. The value of new orders secured in foreign markets reached 26,924 billion VND, a 15% increase.

According to ShinhanSec, the outlook for technology companies is promising, as profits remain robust due to the booming demand for AI, automation, and cloud platforms. TPS’s recent report also presents a positive outlook for FPT, citing factors such as the global and domestic economic recovery, the development of the semiconductor industry, and the trends of digital transformation and digitalization, which are expected to boost the IT and education sectors.

The Optimistic Outlook: Can We Expect a Positive Shift?

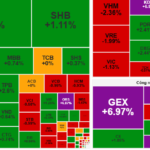

The VN-Index surged amidst a recent spate of losses, indicating a strong rebound. Accompanying this rise was a surge in trading volume, surpassing the 20-day average, signifying a return of liquidity to the market. The Stochastic Oscillator, a key technical indicator, has now entered oversold territory and is signaling a buy. Should this indicator continue to climb, we can expect a further positive shift in market sentiment.