Binh Hoa Packaging JSC (stock code SVI) has announced an upcoming extraordinary general meeting scheduled for December 18, 2024. A notable agenda item pertains to the relocation of its factory from Bien Hoa Industrial Park 1 to Loc An – Binh Son Industrial Park. The company is also expanding its Binh Duong factory.

According to the Department of Planning and Investment of Dong Nai province, the relocation is in line with the project “Converting Bien Hoa Industrial Park 1 into an Urban-Commercial-Service Area and Improving the Environment.”

Established in 1963 as Bien Hoa Industrial Zone, and later renamed Bien Hoa Industrial Park 1 after 1975, it is considered Vietnam’s first industrial park, spanning 324 hectares in An Binh ward, Bien Hoa city. Presently, the industrial park is home to 107 businesses with 26,000 employees.

Over its 50 years of operation, it has been a hotspot for environmental pollution, directly affecting the Dong Nai river, the primary water source for 20 million residents in the Southern Key Economic Region.

SVI is among the businesses mandated to relocate before December 2025. The total investment for this relocation project amounts to VND 1,175 billion, planned for the 2024-2026 period.

SVI is one of the top five packaging suppliers in Southern Vietnam, serving prominent clients such as Unilever, Pepsico, Nestle, and Vinacafe.

A turning point for SVI occurred in December 2020 when TCG Solutions Pte. Ltd, a subsidiary of Thai Containers Group Co., Ltd, and an affiliate of SCG Group (Thailand), successfully acquired 12.1 million SVI shares, holding 94.11% of its charter capital. The transaction value was reported to be nearly VND 2,100 billion.

In 2023, SVI’s post-tax profit surpassed VND 132 billion, a nearly 14% increase compared to the previous year. EPS rose from VND 9,086 to VND 10,319. The company’s gross profit margin also improved to 17.34% in 2023 from 14.2% in 2022.

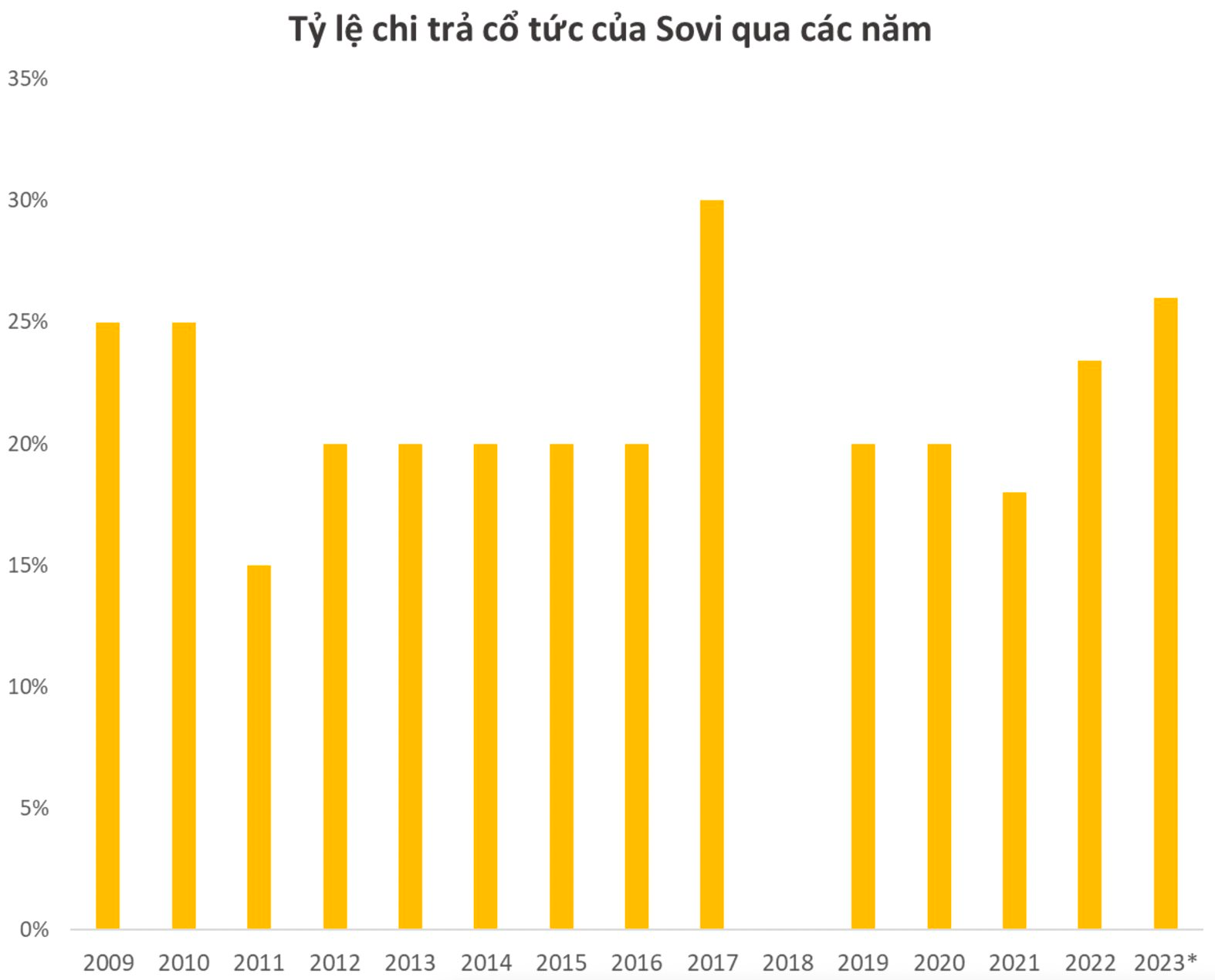

Given these positive results, SVI proposed a 2023 cash dividend of 26% (VND 2,600/share) to its shareholders. With over 12.8 million shares in circulation, the company will distribute more than VND 33 billion in dividends. This is the highest dividend ratio since 2018 and the second-highest since its market listing in 2017 (30% cash dividend in 2017).

SVI has consistently paid dividends in cash annually. SCG Group, as the majority shareholder, will receive over VND 31 billion in dividends. In June 2023, SVI also paid dividends for 2022 at a rate of 23.4%, resulting in SCG receiving over VND 28 billion. In total, the Thai group has earned hundreds of billions in dividends since its investment in SVI.

Earlier this year, SVI agreed to relieve Mr. Nguyen Quy Thinh from his role as an Independent Member of the Board of Directors and appointed Mr. Piyapong Jriyasetapong in his place.

The Ultimate Guide to Dividend Dates: Maximizing Your Cash Payouts with Up to 35% Dividend Yields, and a Bank’s Imminent Record Date.

For the 14 enterprises that paid cash dividends, the highest rate was an impressive 35%, with the lowest being a still-respectable 2%.

A Rewarding Prelude: IDV’s Generous Interim Dividend of VND 1,500 per Share Ahead of the Annual General Meeting

The Vinh Phuc Infrastructure Development Joint Stock Company (VPID), listed on the Hanoi Stock Exchange as IDV, is preparing for its upcoming Annual General Meeting (AGM) scheduled for January 18, 2025, at its headquarters in Khai Quang Industrial Park, Vinh Yen, Vinh Phuc. Shareholders eligible to attend and vote at the meeting must be registered by December 16, 2024.

The Electric Revolution: VinFast Speeds Ahead with a Massive Order of 2,200 Electric Cars for a New Taxi Venture.

For the first nine months of the year, the company’s net profit stood at over 19 billion VND, a remarkable 211% surge compared to the same period last year, surpassing the full-year profit target.